>

17

september 2013

international

construction

ECONOMIC OUTLOOK

Back to growth

Back to growth

US construction is seeing a strong rebound, but the public sector remains a weak link.

Scott Hazelton

reports.

T

he US economy has grown at less than

+2% for the third consecutive quarter,

and many of the factors that will shape the

near term, such as the reduction of the Federal

Reserve’s bond purchases or the impact of the

federal government sequester, are not easy to

predict. Even so, fundamentals for solid growth

are in place for 2014 and 2015 - both consumer

and business spending have increased in spite of

these conditions and will continue to do so.

Arguably, the most important event in recent

months was the 10-year Treasury bond yield

rising from 2.0% in late May to about 2.9% at

the time of this writing. Near-term growth in

the housing sector has been affected by higher

mortgage rates as a result. However, a lean supply

of housing, positive builders’ sentiment, and

continued rising prices should help the long-

term recovery of the sector.

Perhaps the biggest near-term uncertainty for

financial markets is when the Fed starts winding

down its US$ 85 billion per month asset-

purchasing program (QE3). While Fed officials

are eager to end bond buying, labour market data

is mixed and inflation is still running below the

Fed’s +2% target.

A “tapering” is likely in December, but even

so, the Fed will continue to purchase bonds for

another couple of quarters and keep interest rates

low at least until unemployment reaches 6.5%,

probably in late 2015. As such, the impact on

economic growth will probably be imperceptible.

The other policy uncertainty centres around

federal government spending and the sequester.

While the impact of the sequester was far less

than what was anticipated at the beginning of

this year, the third-quarter of 2013 is also the end

of the federal government’s fiscal year, meaning

that there are likely to be more cuts before

September. Assuming that the sequester lasts

through the end of the calendar year, that implies

a drag on growth from government spending in

the second half of 2013.

Housing sector

The impact of Fed tapering is being felt in the

housing sector, and the recent 100-basis-point

(1 percentage point) jump in mortgage rates

will slow the recovery. Higher rates have already

caused a sharp drop in the demand for mortgage

credit.

Housing starts which had been rebounding in

the early part of this year, now hover just under

a 900,000-unit annual rate. But the recovery

in home sales and construction will ultimately

continue since inventories are lean and demand

for housing exceeds supply. Homebuilder

sentiment remains high, and housing affordability

is still historically favourable.

An analysis of the underlying demand for

housing also suggests a resumption of this

growth: new households forming (1.1 million

units per year by IHS Global Insight’s estimate),

replacement demand (250,000 units/year),

and second-home demand (50,000 units/year).

Home prices will continue to rise faster than

inflation until at least the end of 2014. While

housing starts will number just under 1 million

in 2013, the market will improve, supporting

1.2 million starts in 2014 and nearly 1.6 million

units in 2015 and 2016.

Fixed investment has been another bright spot

of late, with most gains coming from housing

and equipment and intellectual property (a new

category, largely software).

On the non-residential side, the construction

market continues to suffer from excess inventory,

weak demand and undisciplined fiscal policy.

While the outlook is improved, employment and

income growth are still lagging for this point in a

recovery and it will still take some time for excess

space to be absorbed.

Commercial construction

The outlook for commercial construction as a

whole is positive, although it is expected to be

muted over the next few quarters, as businesses

remain cautious with long-term investment

spending.

Spending growth has been more moderate

in 2013 than in 2012 with expected growth of

+6.9%. Commercial spending will get a boost in

2014 and 2015 as the residential sector continues

to surge, falling back to a more normal pattern of

growth afterwards.

Office construction growth has faltered as

employment gains have been moderate, and

focused on part-time workers as Obamacare

costs discourage full-time employees. Growth

in 2013 will be +8.7%, down from +12.8%

in 2012. Even 2014 will see a slow start, with

growth improving over the year. Even so, IHS

Global Insight does not see a return to peak

office construction spending until very late in

the forecast.

Lodging construction will grow +15.7% in

2013, the best of all the commercial categories.

Spending will still be about a third of the peak

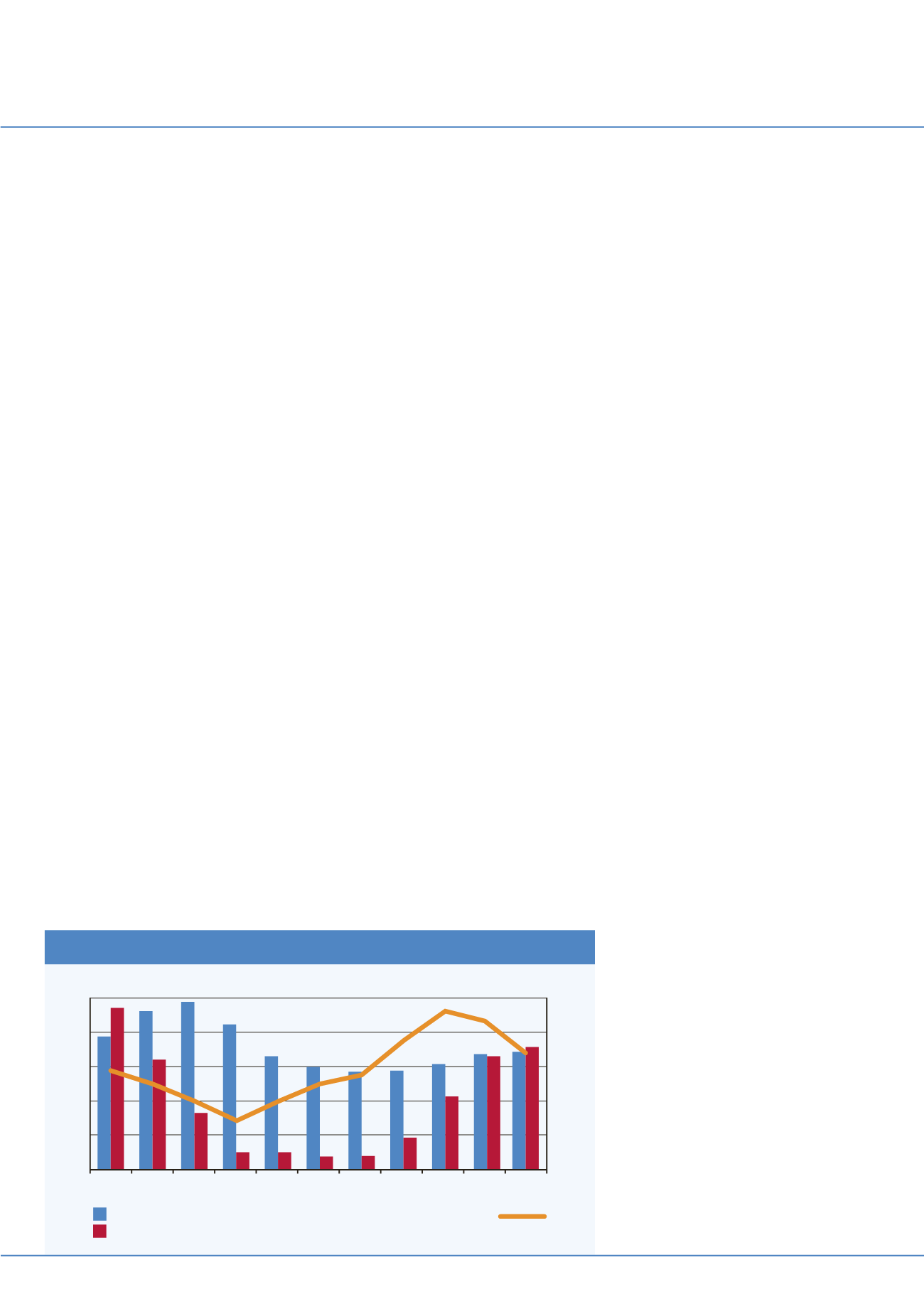

The trend for residential and non-residential construction

600

520

440

360

280

200

20

10

0

-10

-20

-30

Billion 2005 dollars

Percentage change

2006 2007 2008 2009 2010 2011 2012 2013 2014

2016

2015

Residential

Non-residential

Total growth

Perhaps the biggest near-

term uncertainty for financial

markets is when the Fed starts

winding down its US$ 85 billion

per month asset-purchasing

program (QE3).