Usedequipmentaddsvalue

57

ROUSESERVICES

IRNAPRIL-MAY 2015

Withnearly 100 years of industry

experience, RouseServices offers

business intelligencebackedby

constantlyupdatedaggregation

of equipment values and rental

metrics. RouseAppraisals values

approximately $30billion (€27.9

billion) of equipment, tracksmore

than 21,500makes andmodels,

andanalysesmore than$7.5billion

(€7billion) of retail, auction, and

trade-in sales of usedequipment

annually. RouseSales supports

client sales of over $425million

(€395million) inusedequipment

through the retail channel

annually. RouseAnalytics provides

monthly comparisons of pricing

and keyperformancemetrics to

localmarket industrybenchmarks

and tracks inexcess of $500

million (€465million) of revenue

monthlywith52 clients across

more than80markets.

■

Formore informationgo to

Definitions:

Rouse Forced LiquidationValue

Index

Theaverageauction (Forced

LiquidationValue) recoveries

expressedasapercentageof Original

Equipment Cost.

Forced LiquidationValue (FLV) The

estimatedgrossamount expressed

in termsofmoney that equipment

will typically realiseat aproperly

conductedpublicauctionwhen the

seller is compelled to sell asof a

specificdatewithinanapproximately

onemonthperiod.

RouseRate Index

Achieved rental rates relative to

January2011 (whenRouseAnalytics

started tracking ratedata) for a

basket of commonly rented items.

Physical Utilisation

Thepercentageof fleet costwhich is

on-rent duringagivenperiod. Aunit

is “on-rent” if it isat a jobsiteearning

rental revenue.

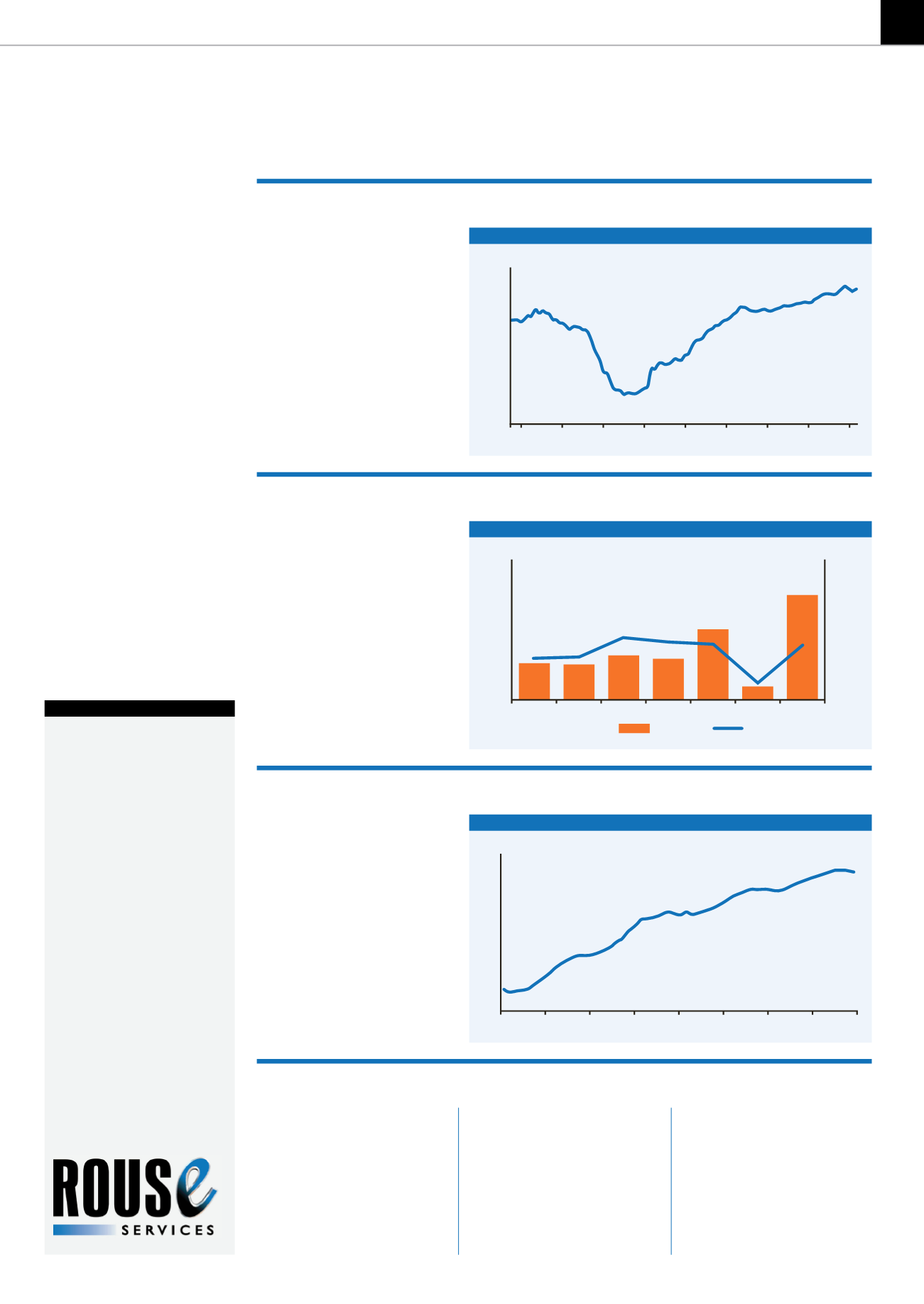

The February Rouse Value Index (RVI)

for used equipment prices increased

to 46.4, up0.5% from January values.

This is 7.2% higher than the prior

peak period of 43.3, in April 2007, and

56.5% higher than previous trough of

29.7, in June 2009. The RVI measures

the average Orderly Liquidation

Values for benchmark models across

14major rental category indices on a

monthly basis.

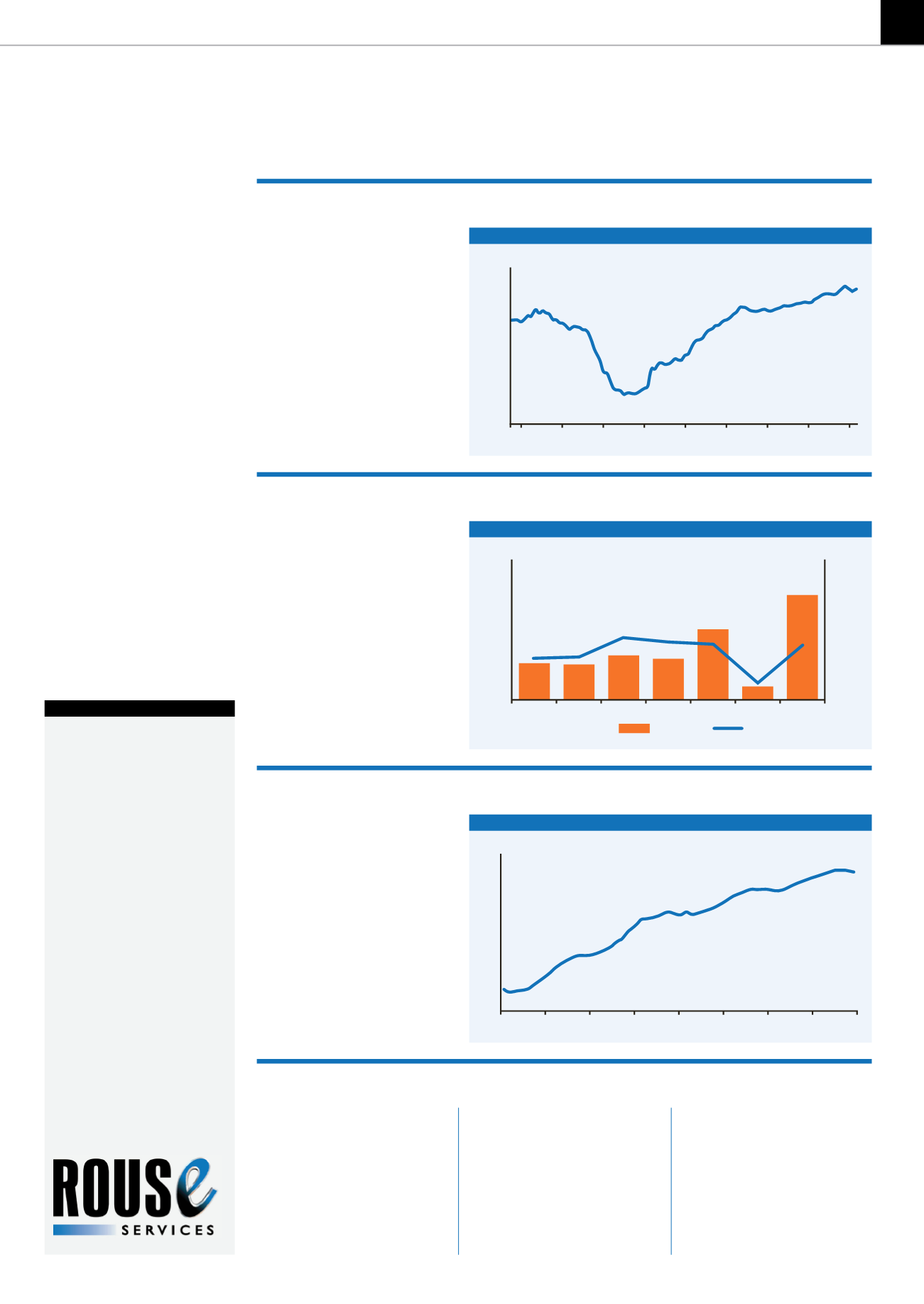

February auction sales of rental and

construction equipment tracked by

Rouse averaged 2.4% lower than

January Forced Liquidation Values

(FLV). Rouse recorded 6,067 units

that sold at 20 separate auction sales

conductedacrossNorthAmerica. The

units represented a combined FLV

(as of 31 January) of $200.8 million

(€186.8million) and generated $203.6

million (€189.4 million) of gross

auctionproceeds.

During December, achieved rental

rates as measured by the Rouse Rate

Index decreased 0.3% on average for

the rental companies participating in

the Rouse Analytics Rental Metrics

Benchmark Service. Rates are up

3.1% relative to December 2013 and

up 25.9% relative to January 2011.

December physical utilisation is down

7.9% fromNovember.

ROUSERATE INDEX: JAN2011-DEC2014

1.30

1.25

1.20

1.15

1.10

1.05

1.00

0.95

1.26

Jan

2011

Jan

2012

Jan

2013

Jan

2014

July

2014

Jan

2015

July

2011

July

2012

July

2013

ROUSEVALUE INDEX (RVI)

OLV (%OFCOST)

50.0

45.0

40.0

35.0

30.0

25.0

2007 2008

43.3

29.7

46.4

2009 2010 2011

2012 2013 2014 2015

AUCTIONVOLUMEANDRECOVERYRATE

VOLUME ($MILLIONS)

VOLUME ($MILLIONS)

SALEPRICE/FLV

RECOVERYRATE

240

180

120

60

0

110%

105%

100%

95%

90%

AUG

SEPT

OCT

NOV

DEC

JAN

FEB

RouseServices

shares its findings

on the state of the

US rental market

during thewinter

of 2014-15

FebruaryRouseValue Index up0.5%

Auction sales results down onJanuary

December drop in achieved rental rates

43.6