48

REGIONALREPORT JAPAN

IRNAPRIL-MAY 2015

For decades it was an

economic powerhousewhose

ideas led - and changed - the

world. But how is Japan, and

its rental industry, really

faring in 2015?

T

he first people to approachwith the question

are the Japan ConstructionMachinery Rental

Association (JCRA). It’s an established body,

founded in 1974, and now represents 980 rental

companies and 26 manufacturers across more than

3,000 locations in the world’s 10th biggest country.

Four out of every five Japanese rental companies

count themselves among itsmembership.

More than a quarter of those rental companies -

258 in total - took part in the association’s Industry

Survey for 2015. Conducted during the final months

of last year, it askedJCRAmembers to ratehow their

business had fared during the year across a number

of key indicators, and to offer ideas on how it might

look at the samepoint in 2015.

In some respects the picture was positive, with a

clear majority saying business had either increased

or slightly increased - a figure of 62% in terms of

revenue and 55% for grossmargin. The percentages

who thought it had stayed roughly the same were

22% and 26% respectively. Using either measure,

fewer than 20%believed that businesswas down.

Forecast

Move on to the forecast for this year, however, and

thesituationstarted to lookdifferent. The “increase”

camp had almost halved, to 35% for revenue and

33% for gross margin, and the “down” respondents

surpassed 25% in both cases. Indeed, the figure

viewing their gross margins with pessimism went

through the 30%barrier.

So while the picture at the end of 2014 looked

reasonable, the perception for the market the

following year is that it would be “flat”, with more

than 35% feeling theywould have little to celebrate

in either revenue or gross margin by the end of

December 2015.

With the first quarter of 2015 now behind us, has

themarket behaved how the JCRAmembers though

itwould?

Easternpromise?

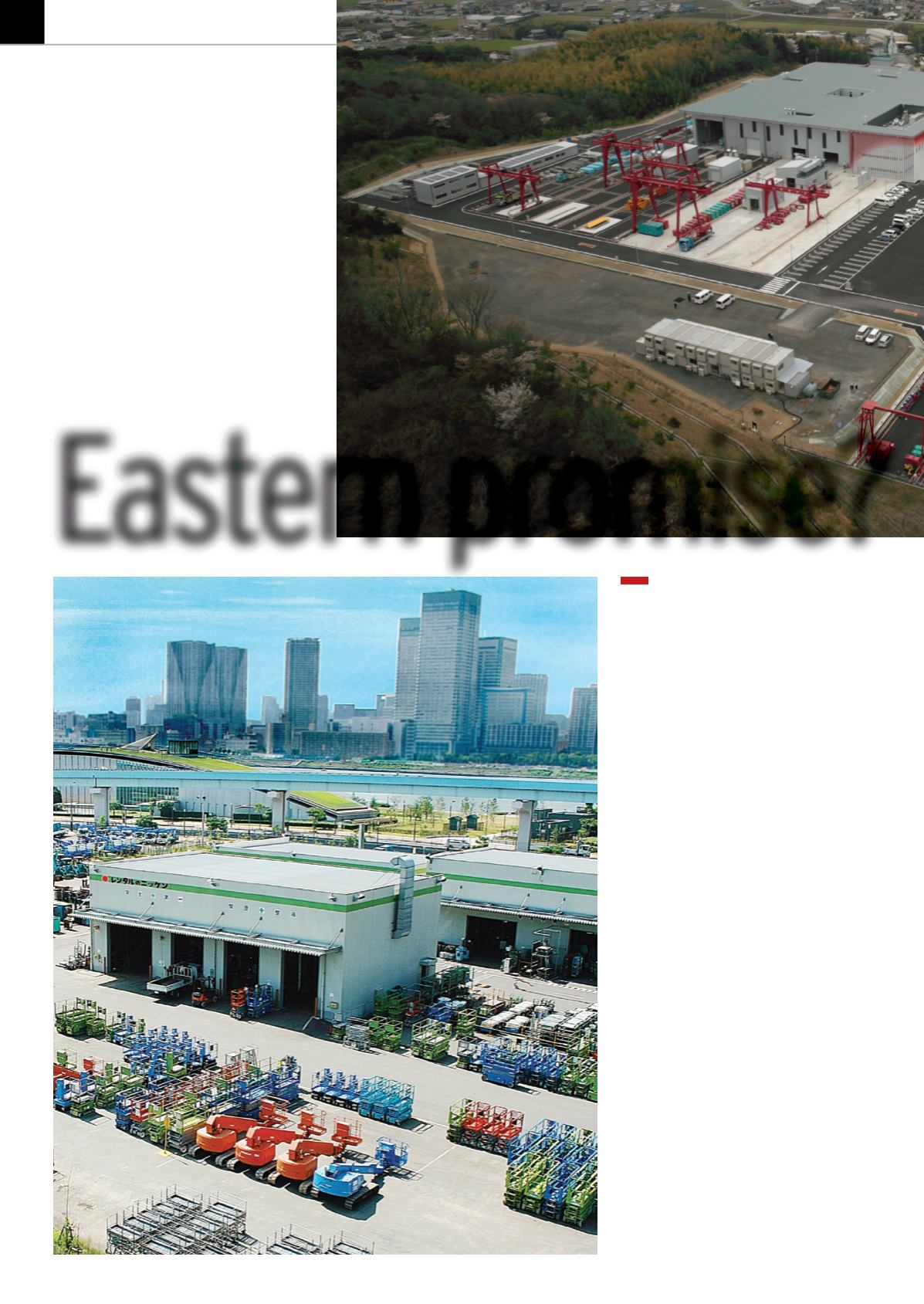

Aktio’sMie Inabe Techno Park branch

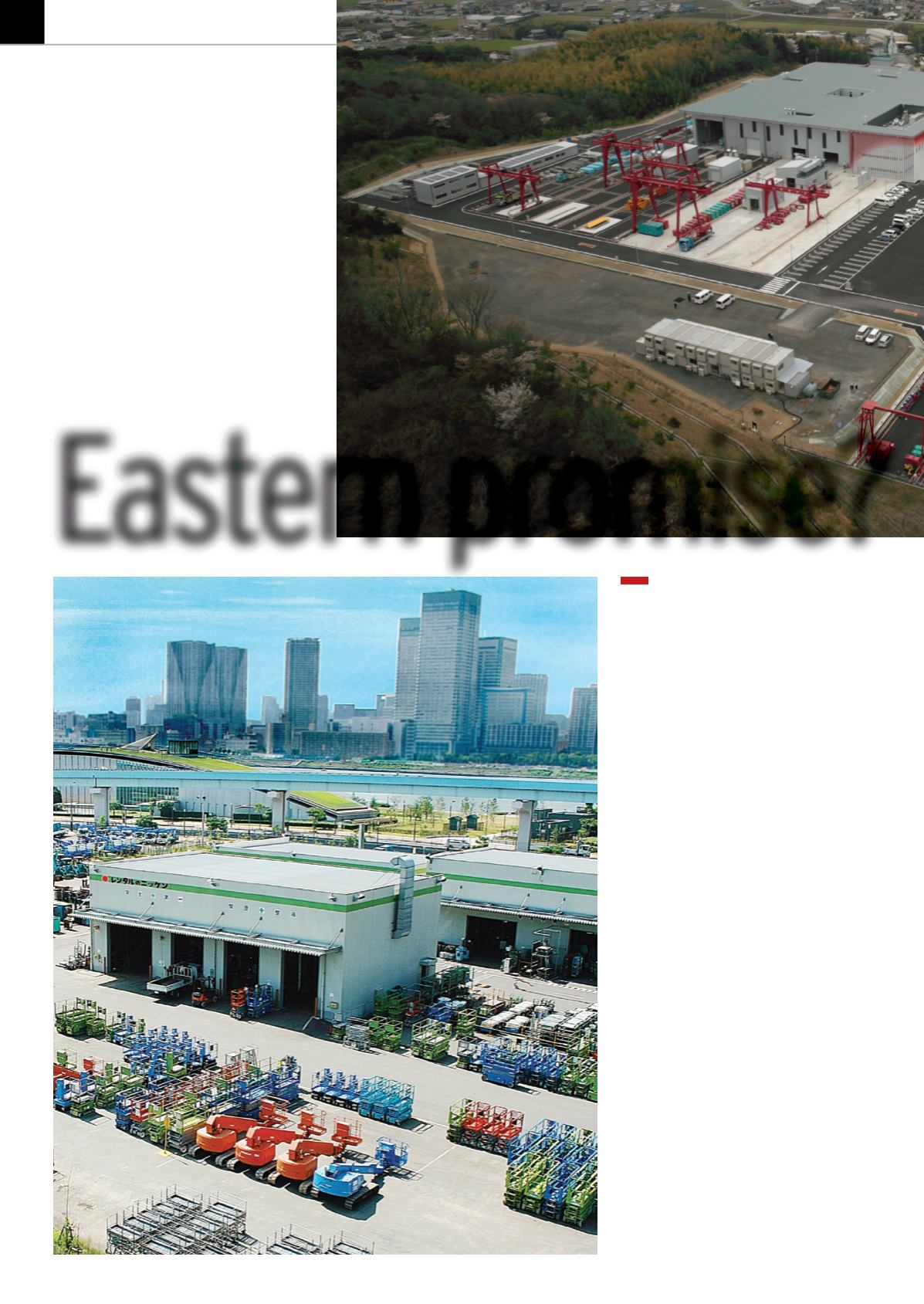

Nikken’smaintenance facilities and branch in Tokyo