35

DECEMBER 2014

ACT

FINANCE

INDUSTRY FOCUS

Lee

and

Terry Resnick

present a case study on how

proactive estate and succession planning can drive a family

business into and beyond the next generation.

C

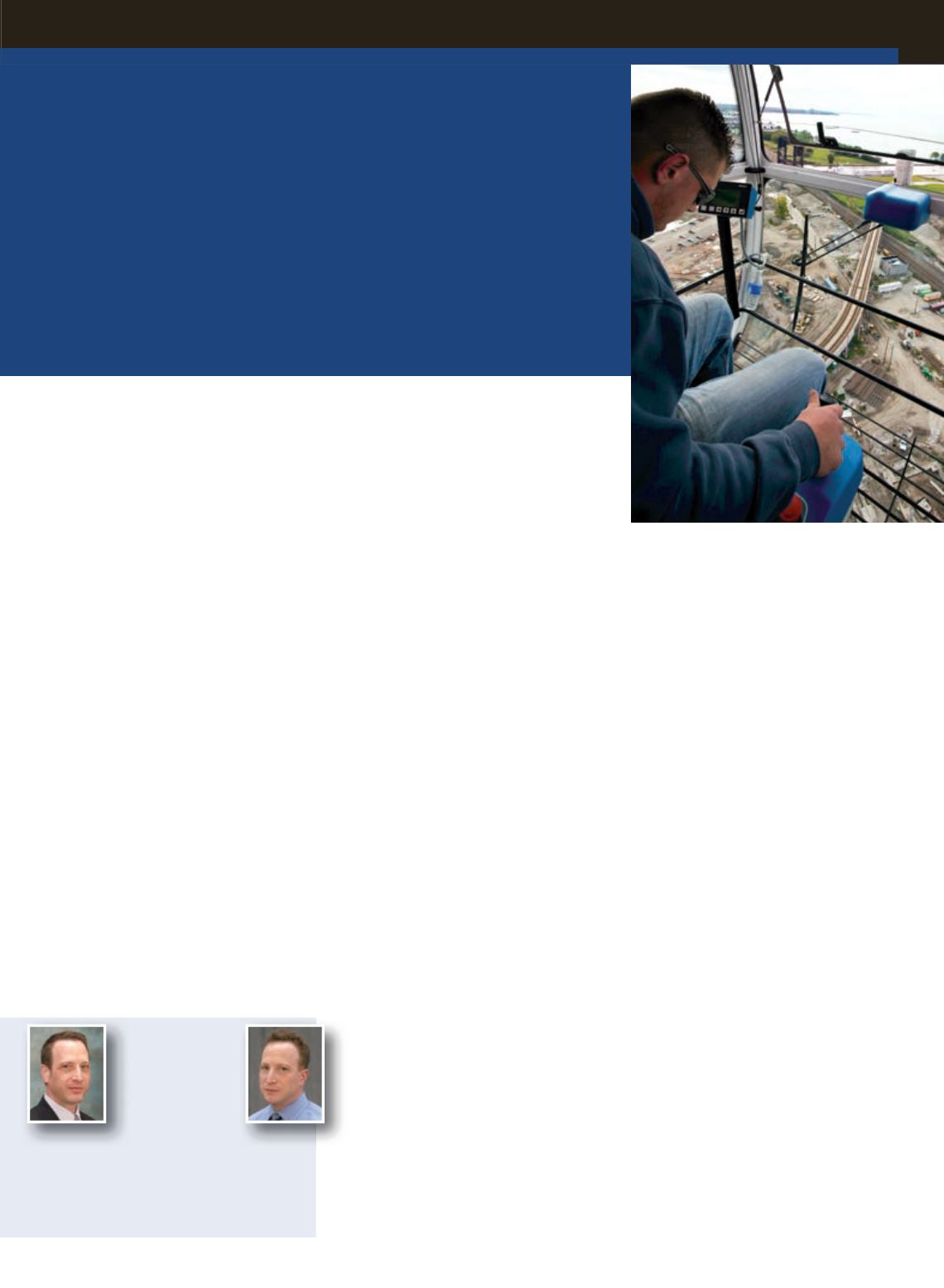

ranes and rigginghavebeen the

lifebloodof theMayweather

family for twogenerations.

Well respected in the industry, this

familyhasno intentionof ever ceasing

operations. Startingwith two employees

in1966,MayweatherCrane&Rigging*

has 90 employees andannual revenues

that exceed$50million. Theirhardwork

haspaidoff and theMayweathers enjoya

comfortable lifestyle.

RayMayweather, 65, is still intricately

involvedwith the companyandowns 100

percent ofMayweatherCrane&Rigging.

Hiswife, Rachel, phasedout of the

business in1968when theyhad the first

of their three children. Two sons,Nathan

andAdam, are involved in theday-to-day

operations andhaveworked theirwayup

tomanagement levelwith thehopesof

oneday takingover the familybusiness.

Their sisterLauren, althoughvery close to

herbrothers, never showedmuch interest

in the familybusiness, andwhile she still

lives in the same town, is involved ina

careerunrelated to thebusiness.

TheMayweathers are a classic example

of a familybusiness that tooka chance,

worked incrediblyhardandmade their

company successful. It isof theutmost

importance to theMayweathers that

MayweatherCrane&Rigging continues

forNathanandAdamand, if possible,

THEAUTHORS

LEE

and

TERRY

RESNICK

are

partners inResnick

Associates,

an estate,

succession and lif

e insurance advisory

and implementation firm.

This articlewas

adapted f

rom a presentation they gave at

the SC&RAAnnual Conf

erence inApril 2014

.

*

Nameswere changed to protect privacy

futuregenerationsofMayweathers.

Unfortunately,when it comes toa crane

and riggingbusiness, intentions aren’t

whatmakes thesegoals anddreams

happen. Proactive estate and succession

planningare thekeys todrivinga family

business intoandbeyond thenext

generation.Actions speak louder then

intentions, and insufficient or improper

planning, combinedwithhefty federal

estate taxes, speak louder thananything.

Witha twoout of three failure rateof

first generation familybusinessesmaking

it toa secondgeneration, theMayweathers

will find that successfully transferring

theirbusiness to their sonsNathanand

Adam couldbe abig challenge.

MayweatherCrane&Rigging isdoing

well.What challengeswill this family

facewhen it comes to transitioning their

company?

1.DoRayandRachel transfer the

business, one-third each to each child

(althoughonly twoof three are active in

thebusiness)?

2. Inaddition to their company,

Ray’s andRachel’s estate ismadeupof

additional non-business assets. Theyare

facedwitha corresponding federal estate

thatwill bemillionsof dollars (due and

payableninemonths after the second

deathofRayandRachel).

3. There are threekey employees that are

absolutelyvital to theday-to-day success

ofMayweatherCrane&Rigging.What

assurancesdoNathanandAdamhave that

thesekey employeeswill stayonceRay

exits thebusiness?

These are just a fewof thevery common,

yet oftenoverlooked challenges for a

successful crane and rigging company.

If these areas arenot addressed through

quality estate and successionplanning,

then theMayweather familywill be almost

assuredof losing the company.Conversely,

if properplanning is implementedand

reviewedannually, theyhave averygood

chanceof seeing theirbusiness continue

successfully formanymoreyears.

ISSUENUMBER1

:

Fromour experiences,

unless it is averyunique situation,we

generally recommend that only children

that are activelyworking in the company

receivebusiness interests ina familyheld

crane and rigging concern. Typically, the

crane and rigging companyand related

assets comprise70percent ormore

of abusinessowner’s estate. If there is

one childworking in the company that

ultimatelygets a70percent distributionof

the estate assets,without properplanning,

thatmeans if there are threeother children

theywill receive10percent each. Properly

structured life insurance is thekeyasset

in equalizing the inheritance for children

of crane and rigging companyowners.

There isnootherplanning technique

that allows the immediate creationof

wealth. But there’s a caveat: The correct

acquisitionand implementationof life

insurance for estateandbusinessplanning

isoften complexand sophisticated.As

with legal andaccounting/valuationwork,

it is critical that thispart of theplanning is

handledby experienced specialists. There

are countless storiesof businessowners

having life insuranceonly to seepremiums

unexpectedly skyrocket, implosionof

policies, and the like.

ISSUENUMBER2

:

Insufficient liquidity,

when it isneededmost, hasbeena

constant indestroying familybusinesses.

As stated earlier, the federal estate tax,

with current rates at 40percent, isdue

Succession

planning 101

Proper estate and

succession planning

can be the difference

between a company

surviving or not.

>

36