11

NEWS

MARCH 2014

ACT

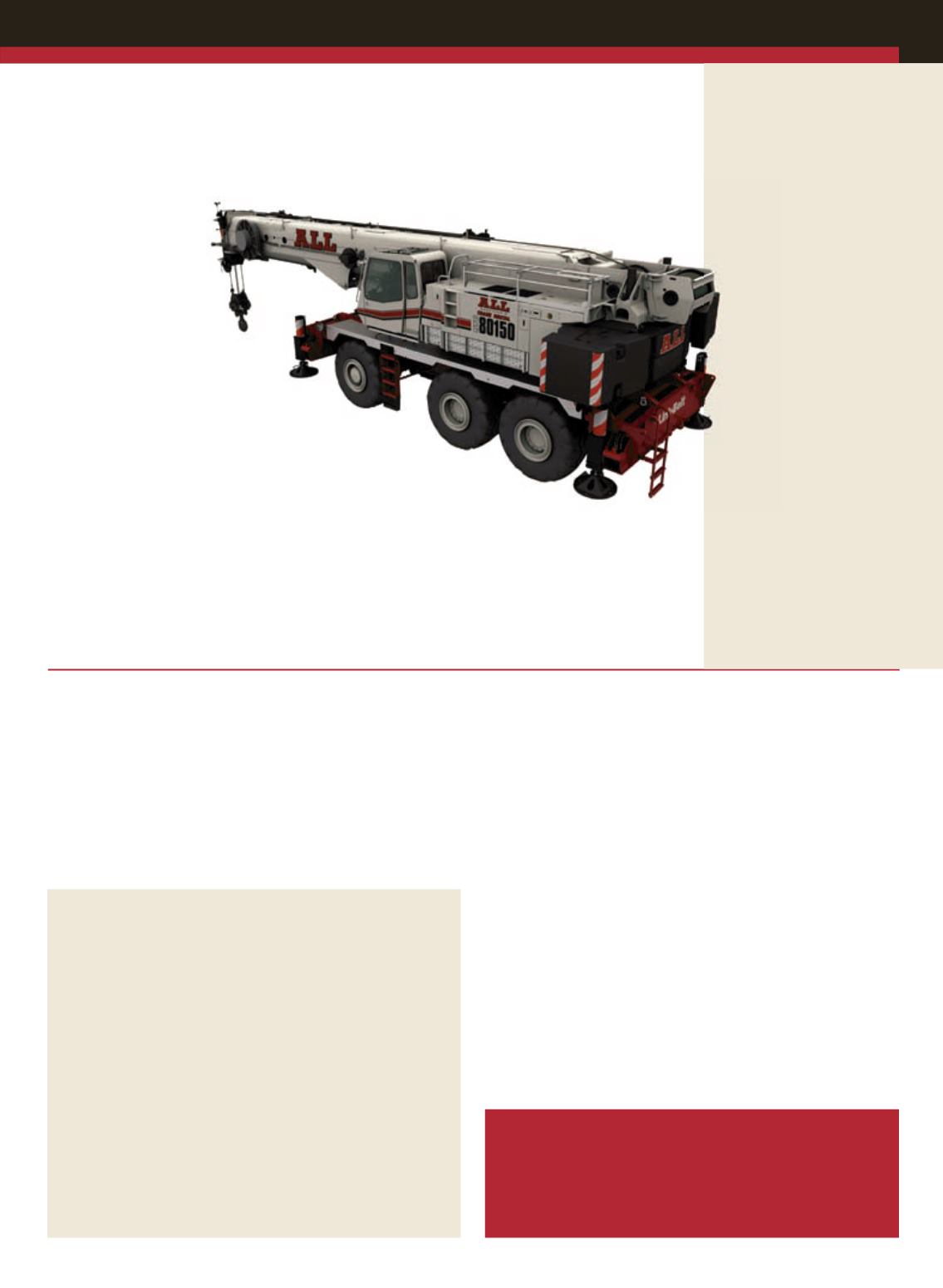

All Erection places 30

crane order with Link-Belt

All Erection and

Crane Rental Corp.

will add 30 new Link-

Belt cranes to its fleet

in 2014. Included in

the package are four

new 150-ton capacity

RTC-80150 Series II

rough terrain cranes. Notable

features include its 195 foot,

six-section boom and three-

axle carrier.

Also included in the order

are three HTC-8690 telescopic

truck cranes, eight 218 HSL

lattice boom crawler cranes,

six 238 HSL lattice boom

crawler cranes, two TCC-750

telescopic crawler cranes and

seven TCC-1100 telescopic

crawler cranes.

“The decision to purchase

the new RTC-80150 was, in

part, because our customers’

appetites continue to grow

All Erection will add 30 new

Link-Belt cranes to its fleet in

2014, including four of the new

150-ton capacity RTC-80150

Series II.

for long-reach, high-capacity

RTs for their jobsites,” said

Michael Liptak, president, All

Erection and Crane Rental.

“We like this unit for both

of these features, but are

very impressed with how it

transports. This machine can

break down in less than an

hour and reduces transport

costs by keeping a low overall

height while also maintaining

a main unit transport weight

under 100,000 pounds.”

■

■

Manitowoc has completed

the sale of its 50 percent

interest in Chinese truck crane

manufacturing joint venture

Manitowoc Dong Yue Heavy

Machinery Co., Ltd. The buyer

is Manitowoc’s partner in the

venture, Tai’an Taishan Heavy

Industry Investment Co., Ltd.

Glen Tellock, Manitowoc

chairman/CEO, said, “The

sale of our joint venture

interest is consistent

with our strategy to better

align resources across

Manitowoc’s crane segment

and to maximize financial

performance.”

■

National Interstate Corp.

celebrates its 25th anniversary

serving the insurance industry

in 2014. Established in 1989,

National Interstate provides an

array of commercial insurance

products including traditional

insurance and alternative risk

transfer options primarily

targeting companies in the

transportation industry.

HIGHLIGHTS

Cranes sales down at Terex Corp.

Sales at Terex Cranes in 2013

were down on the previous

year. For the crane segment,

sales were $1.93 billion, down

3 percent from $1.99 billion

in 2012. It was a similar story

in the final quarter where net

sales were $480 million, down

6 percent compared with $511

million in the fourth quarter

of 2012.

“Our Cranes segment failed

to realize the growth that we

had anticipated entering 2013.

While new product launches

did provide some growth,

markets such as Australia,

Europe and Latin America

were more challenging than

anticipated,” said Ron DeFeo,

Terex chairman and CEO.

“Overall, 2013 was a good

year and I am pleased with the

improvements and progress

underway at Terex,” DeFeo

said on the performance of

Terex Corporation as a whole.

“This past year was a tale of

two halves, with the second

half of the year significantly

stronger than the first half.

Our performance in the

second half was fuelled by

the continued strength of

our Aerial Work Platforms

(AWP) segment and a

Assistant Editor

American Cranes & Transport

has a job opening in the editorial

department. Industry journalists interested in applying for the

job of Assistant Editor should send a resume and cover letter to

.

Revenues up in 2013 for

Manitowoc Cranes

For the full year 2013, Manitowoc Cranes revenue was up 3.3

percent, to $2.5 billion on the $2.4 billion figure for 2012.

Operating earnings increased $48.3 million, or 28.3 percent, and

the operating margin was up 170 basis points to 8.7 percent for

2013, the company reported.

In the most recent quarter, however, while orders were up, crane

sales were down. Fourth-quarter 2013 orders, at $707 million,

were 30 percent higher than the fourth quarter of 2012. Order

backlog for cranes was $574 million on December 31, 2013, a

decrease of $182 million from the same point in 2012.

Fourth-quarter 2013 net sales were $704.8 million, down 7.9

percent from $764.9 million in the fourth quarter of 2012. Looking

ahead, in 2014 Manitowoc forecasts crane revenue to show modest

top-line growth and the operating margin to be a high single-digit

percentage.

turnaround in our Materials

Handling & Port Solutions

(MHPS) segment. Our focus

throughout the year on

strengthening margins and

driving financial efficiency

helped deliver a strong close

to the year.”

As for the outlook for 2014

DeFeo said, “We see some

signs of improvement in many

parts of the world although

this is tempered with some

continued market uncertainty,

particularly in developing

markets. Overall, we believe

that the global economy will

be stronger in 2014, but still

modest when viewed against

historic demand levels.”

■