15

MARCH 2014

ACT

BUSINESS NEWS

AUTHOR:

CHRIS SLEIGHT

is

one of the world’s most

internationally renowned

construction business writers,

with specialist expertise in

financial markets and stock

market analysis. He is editor

of KHL’s market-leading

International Construction

and

is a regular contributor to

ACT’

s sister publication,

International Cranes

and Specialized

Transport

.

Chris Sleight

reports that the

reduction in the

Fed’s quantitative

easing program is

having an impact

on the stock

markets, albeit

by a roundabout

route.

R

egular readers of

this column will

have seen plenty

of warnings over the last few

months that the rally can’t go

on forever. As has been seen

over the last year or so, the

lack of other safe havens has

seen the Dow scale previously

unimaginable heights, most

recently breaking through

16,500 points in mid-January.

And while markets cannot

defy gravity forever, the other

cliché to employ is that bulls

don’t die of old age. In other

words, stocks won’t always

rise, but something needs to

happen to make them fall.

QE impact?

That catalyst arrived in late

January in the shape of the

Fed’s reduction in quantitative

easing (QE). The so-called

tapering announced just

before Christmas will see the

amount of money the central

bank creates to buy up assets

like government bonds fall

from the previous level of

$85 billion a month to zero,

probably by the end of this

year.

Although it is an American

policy by the United States

Federal Reserve, the impact

of tapering is largely being

felt outside the country. The

winding-down of QE means

yields are rising for the type

of securities the Fed was

spending money on. This

makes them more attractive,

so investors are taking their

money out of higher risk

emerging markets in favour of

these safer US instruments.

To do this they have

effectively sold emerging

market currencies, which has

driven those lower.

The response in countries

like Brazil, India and

Turkey has been to hike-up

interest rates to defend their

currencies, in some cases

very sharply. The Turkish

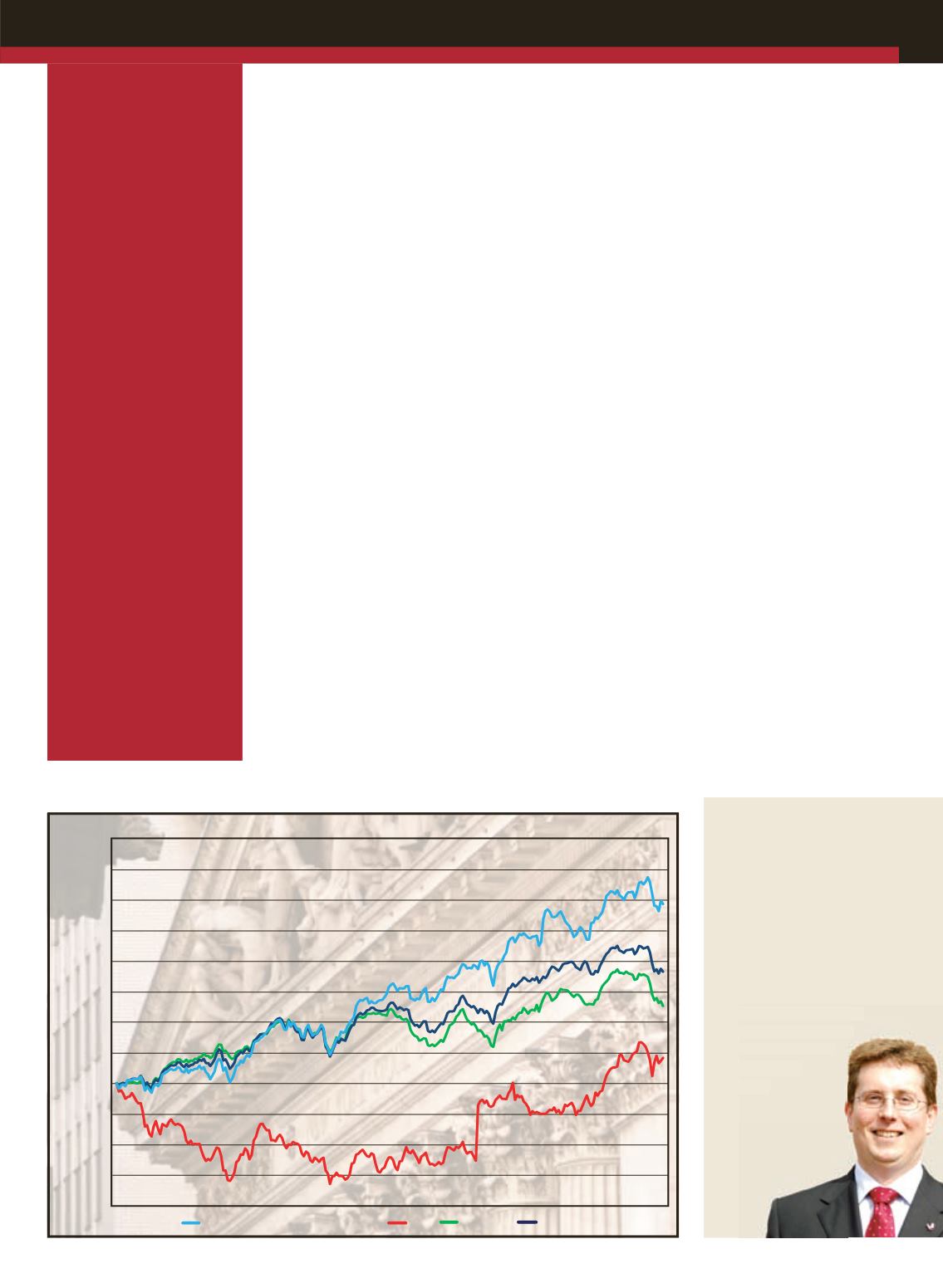

ACT Heavy Equipment Index (HEI)

DOW

NASDAQ

S&P 500

40%

35%

30%

25%

20%

15%

10%

5%

0%

5%

-10%

-15%

-20%

% change

52 weeks to February 2014

Central Bank, for example,

put its overnight lending rate

up from 7.75 percent to 12.5

percent at the end of January.

Higher interest rates of

course mean less borrowing

and higher debt costs for

businesses, so therefore less

economic growth in these

countries.

Consequences

The consequent threat to

global economic growth

pushed stock markets around

the world lower in late

January and early February,

and the major U.S. indicators

– the Dow, S&P 500 and

NASDAQ – were among those

that fell.

So while QE tapering may

not have a direct impact on

the American economy, the

way the world is tied together

through trade these days

means there could be an

impact down the line from

weaker export markets.

■

ACT’

s Heavy Equipment Index

(HEI) tracks the performance

of eight of America’s most

significant, publicly-traded

construction equipment

manufacturers – Astec

Industries, Caterpillar, CNH,

Deere & Company, Joy Global,

Manitowoc and Terex.

Tapering affects

stock markets