17

OCTOBER 2014

ACT

BUSINESSNEWS

AUTHOR:

CHRISSLEIGHT

is

one of theworld’smost

internationally renowned

construction businesswriters,

with specialist expertise in

financial markets and stock

market analysis. He is editor

of KHL’smarket-leading

International Construction

and

is a regular contributor to

ACT’

s sister publication,

International Cranes

and Specialized

Transport

.

After a promising

rally the heavy

equipment sector

showed some frailty

over the summer.

Chris Sleight

reports.

F

ormost of this year

theheavy equipment

sector has beenon

a growthpath. Itmayhave

missedout on the broader

market rally in2013, but 2014

has seen shareprices in the

sector rise at about the same

rate as thewell-watchmarket

indicators like theDow, S&P

500 andNASDAQ.

This summer saw the

markets suffer somethingof

awobble, asBancoEspirito

Santo, amajor Portuguese

bank, needed a rescue in

Europe, while tensions rose

in theMiddleEast and the

relationshipbetweenRussia

and theWest souredover the

Ukraine.

All these concerns prompted

markets todiveduring July,

although therewas something

of a recovery towards the end

ofAugust. Interestingly,many

of the tensions that caused

thedownturn remained, and

themarkets recoveredon

the basis that investors had

becomemore comfortable

with them.

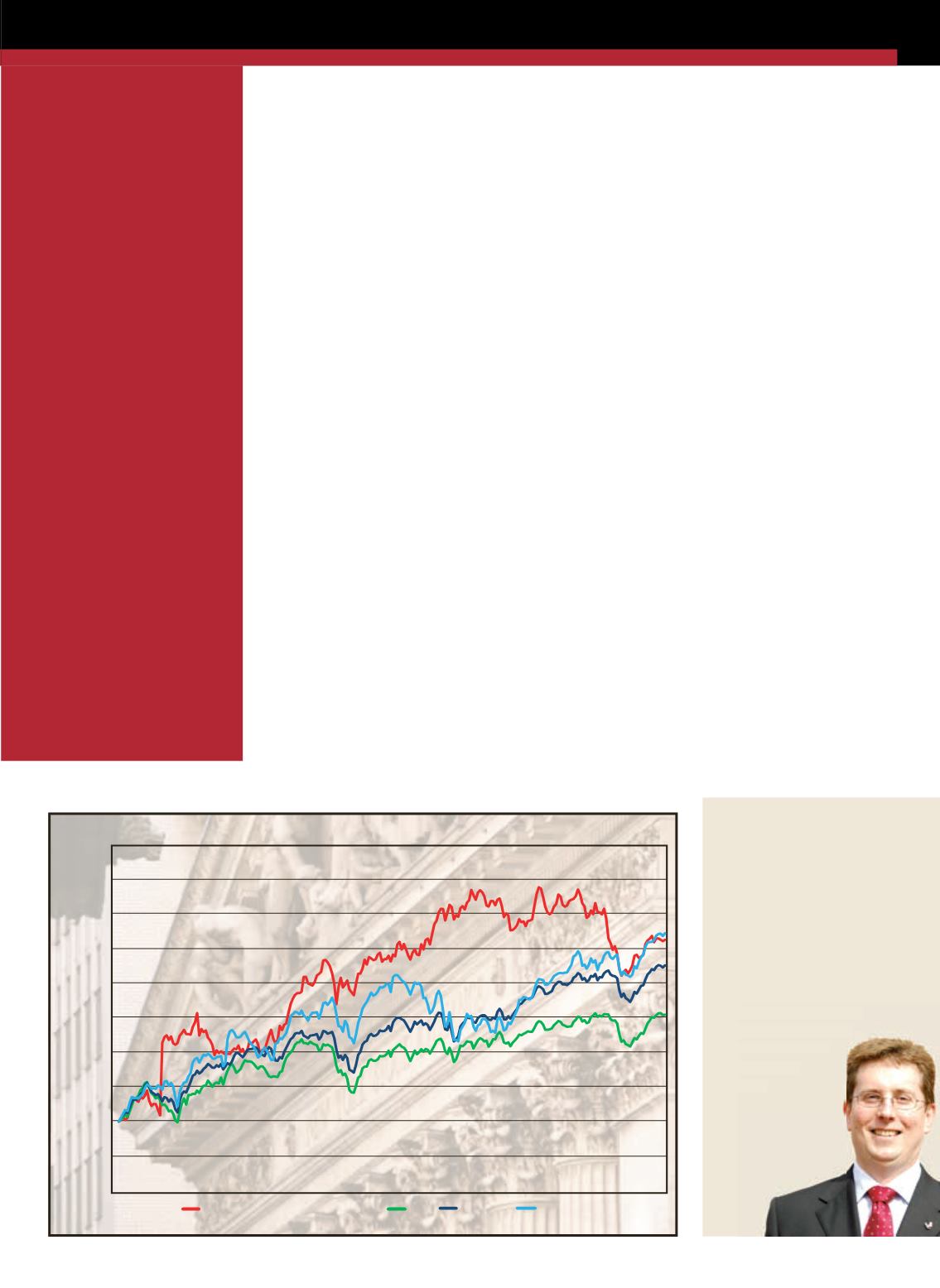

As thismonth’s graph

shows, theheavy equipment

manufacturing sector, as

measuredby the

ACT

Heavy

Equipment Index (HEI) took

a sharper plunge than the

broadmarket indicators, and

didnot recover aswell.

Whereas the likes of the

Dow, S&P500 andNASDAQ

lost atworst about 5percent

of their value, the

ACT

HEI

was down a good10percent,

and arguablymore like 13

percent, dependingonwhich

start point you chose.

Losing ground

And following thedip, the

major indicators had regained

their lost groundby early

September and somehad

movedpast their previous

highs.

ACT Heavy Equipment Index (HEI)

DOW

NASDAQ

S&P500

40%

35%

30%

25%

20%

15%

10%

5%

0%

-5%

-10%

% change

52weeks to September 2014

However, the

ACT

HEI

remained a good5percent

behind its peak earlier in the

summer.

Onewayof looking at it is

that the

ACT

HEI is doing

about half ofwhat it should

do as an indicator of cyclical

stocks. It is falling steeply

when themarkets are bad, but

it is failing tobounce back

anddemonstratemarket-

beating growthwhen things

take a turn for the better.

This demonstrates that

while there is confidence in

themarkets, there are still a

lot of jitters among investors

about the robustness of the

economic recovery.

Major geopolictical events

in theMiddleEast orwith

Russiawill always have an

impact, but in times ofmore

convincing economic growth

theywouldhave less of an

impact or be shrugged-off

faster.

■

ACT’

s Heavy Equipment Index

(HEI) tracks the performance

of eight of America’smost

significant, publicly-traded

construction equipment

manufacturers – Astec

Industries, Caterpillar, CNH,

Deere & Company, Joy Global,

Manitowoc and Terex.

Market wobbles,

investors jittery