34

access

INTERNATIONAL

NOVEMBER-DECEMBER 2013

ITALY

a problem investing in new equipment.

“The Italian market for the first half of next

year will be flat, in the second part something

will change, but I’m not sure if that will be a

positive or negative change.”While Mr Marti

was half joking, his response demonstrates the

uncertainty of the Italian market, thanks to the

difficult economic and political situation.

One of the main issues for end users and

There has been staunch criticism of Italy’s new training laws for powered access equipment. Gerhard

Hillebrand, founding member and representative of IPAF in Italy, explains why. “Over the last four years,

new Health and Safety rules governing the safe use of MEWPs and of any other potentially-dangerous

machinery have radically changed the training requirements of the industry in Italy.

It ended in the State/Regions Agreement of 22 February 2012, seeing stringent regional accreditation of

instructors, training companies and regulations. Operators, rental companies and equipment owners face

tough sanctions if they fail to comply. The drafting of the regulation by the Ministry of Labour, in which IPAF

was involved, has been modified several times due to the pressure from politically-driven trade lobbies and

public entities. Health and safety, including training, inspection and surveillance of working equipment, is

now mandated by a constitutional Act to autonomous regions and the provinces of Trento and Bolzano. It

allows them to issue individual regional laws and regulations which must refer to the existing state/regions

terms governing public class room education.

It is for this reason that serious inconsistencies have emerged. Regional parameters have been set

without adequate practical training competence. This is to the detriment of many private existing training

centres set up, for example, by manufacturers, distributors and rental companies. Despite providing

adequate technical training recognised in most industrialised nations, they are not now being accepted

in Italy and are struggling to achieve approval. Without a licence certificate from the individual region, no

company is authorised to deliver training. So, the accreditation process in 21 differently ruled Italian regions

and two autonomous provinces is long, complex and expensive.”

NEW LAW CRITICISM

President of CTE, Lorenzo Cipriani, says there

will be developments across the manufacturer’s

range. “In fact we are working on working heights

from 20 to 32 m, and we are also developing our

industrial High Range over 61 m.

“The features that will become important in

the future for us will be the most efficient use

of materials to allow increased capacity, long

outreach and safety in using the machines.

“We have introduced new improvements

primarily for the International market. The most

important improvements were the increased

capacity in the basket, electronic systems with

high performance, installations on different

models of trucks for special export markets.”

CTE TO EXPAND RANGE

rental companies is the lack of available credit

from banks which have been loath to lend

money.The feeling among manufacturers is

that users want to invest in machines, and

therefore they could be selling more.

Export mission

In reaction to the economy in Italy, domestic

manufacturers have been relying on export

markets. At Co.me.t the domestic market

accounted for 60% of sales before the crisis.

That figure has now reduced to 30%. “We were

looking to export more anyway, but the crises

made that faster.”

At CTE, its export market has increased to

80% over the last five years, with the largest

buyer being Europe. “We are well placed

thanks to our branches in France and in

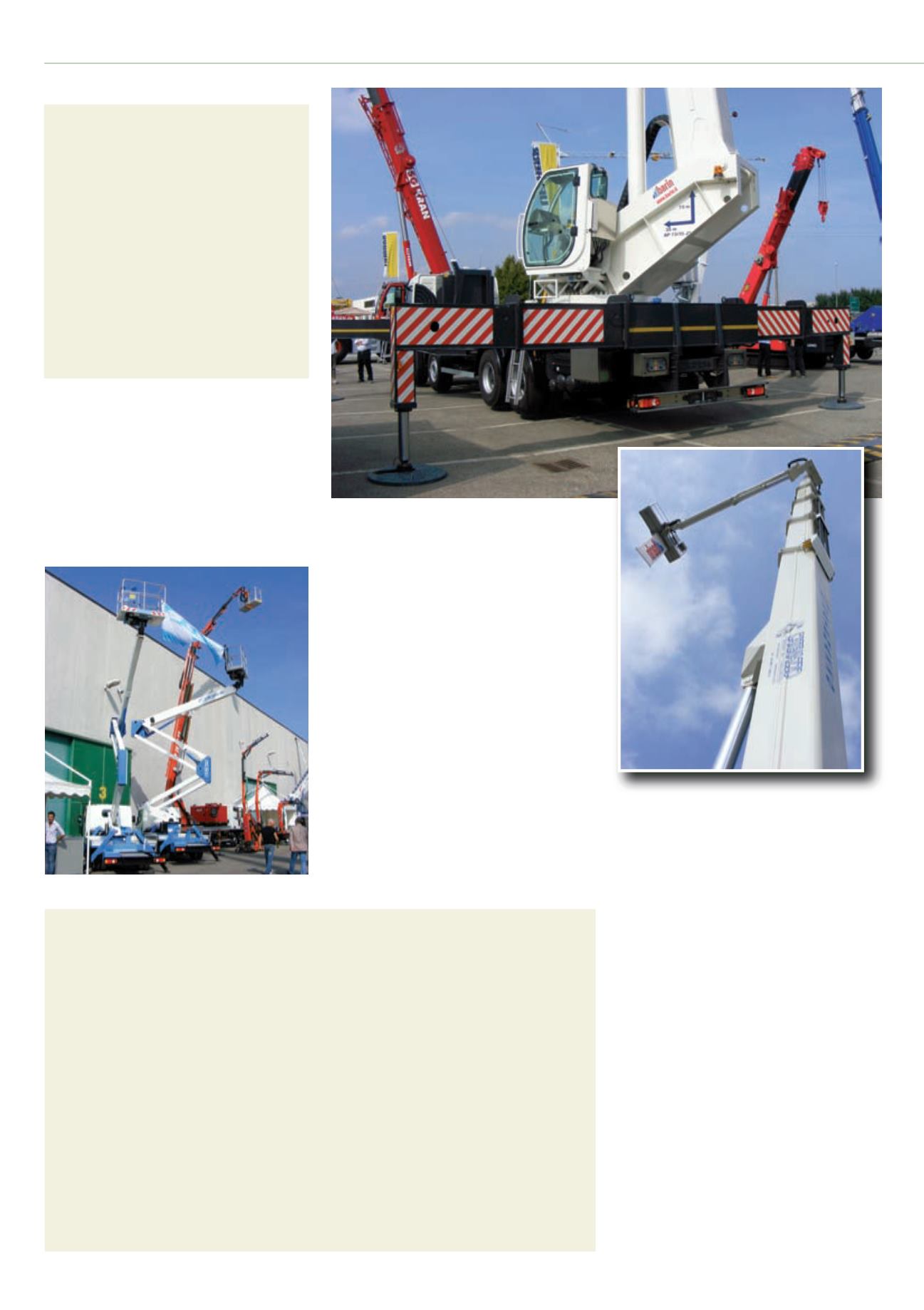

Barin’s new

73 m truck

mount on

display at the

GIS show.

Socage’s articulated DA325

boom on show in Italy.

England.We are also active in Eastern Europe

thanks to an efficient dealer network. But our

internationalisation has advanced to other

countries, like the Far and Middle East and

South America,” explains Mr Cipriani.

Vincenzo Andressa, Alimak Hec’s managing

director for Italy, and president for IPAF Italy,

agrees the construction market has completely

stopped, and outlines three reasons why the

market is so tough, particularly for his type of

product.

“Number one: we do not have new

infrastructure and building in public or

private, including residential. Number two:

refurbishment has also stopped and, number

three: we have a big problem with the

government.

“All companies have a bad cash situation,

so the volume of sales has stopped. If there is

anything left then it is rental, but even this is

very small. And if you do rent something, then

the questions is, ‘will you get the money for it?’

So, many companies are in administration or

liquidation.

“If you do have a chance to sell then you

have to be very careful. Better not to sell, than

sell and not get any money.”

AI