21

Mixed region

REGIONAL REPORT: NORTH AFRICA

december 2013

international

construction

>

Political instability

continues to overshadow

many of the region’s

economies, but North

Africa’s construction

markets are fopen for

business.

Helen Wright

reports.

T

here are some countries in

North Africa that represent good

opportunities for the construction

industry, with international manufacturers

and contractors alike targeting expansion

in countries such as Algeria, Morocco and

Tunisia.

But the picture is far from perfect in the

region, with power vacuums and conflicts

disrupting markets in Libya and Egypt.

However, that is not to say that the entire

construction sectors in these countries have ground to a halt – in

fact there are clear signs of activity and investment despite the

instability.

In Libya, for instance, a € 963 million (US$ 1.3 billion)

contract to construct the first 400 km section of a 1,700 km

coastal motorway was this year awarded to a consortium led by

Italian contractor Salini Impregilo. The new motorway will run

across Libya from the Tunisian border to the Egyptian border.

Development bank loans are also bolstering infrastructure

investment in the region. The Islamic Development Bank (IDB),

for example, has committed to a string of loans in the past 12

months, including US$ 200 million in support of Tunisia’s

Rades-C combined cycle power project, and US$ 109 million for

irrigation and drainage pumping stations in Egypt.

In Mali, the IDB has also pledged US$ 250 million to support

reconstruction in the wake of conflict across the country. This

came on top of funding of over € 240 million (US$ 308 million)

from the African Development Bank (AfDB), plus a € 56 million

(US$ 72 million) AfDB loan for a drinking water supply project.

In fact, the AfDB and Made in Africa Foundation have

launched an infrastructure fund for the continent as a whole that

aims to raise up to US$ 500 million by the first half of 2014.

The target is to plug some of the US$ 93 billion of investment a

year that the AfDB estimates is needed to 2020 to close Africa’s

infrastructure deficit.

Manufacturers

Meanwhile, construction equipment manufacturers are eyeing

the region’s prospects closely. SMT Nigeria, the national dealer

for Volvo Construction Equipment, Volvo Trucks and Volvo

Penta, opened its new Volvo Service Centre in the capital Abuja in

October, for example – the dealer’s fourth branch in the country.

Part of SMT Nigeria’s efforts to improve its sales and aftersales

service in the country, the 20,000 m

2

facility features a 10 bay

workshop, inspection pit and parts store.

CEO of SMT Group Jérôme Barioz said, “Nigeria is a very

important market for the group. Abuja is one of the continent’s

fastest growing cities and Nigeria as a whole has huge potential.”

Meanwhile in Morocco, machines supplied by Volvo CE’s

Chinese joint venture SDLG are helping on the construction of

the country’s first high-speed rail line.

Mixed region

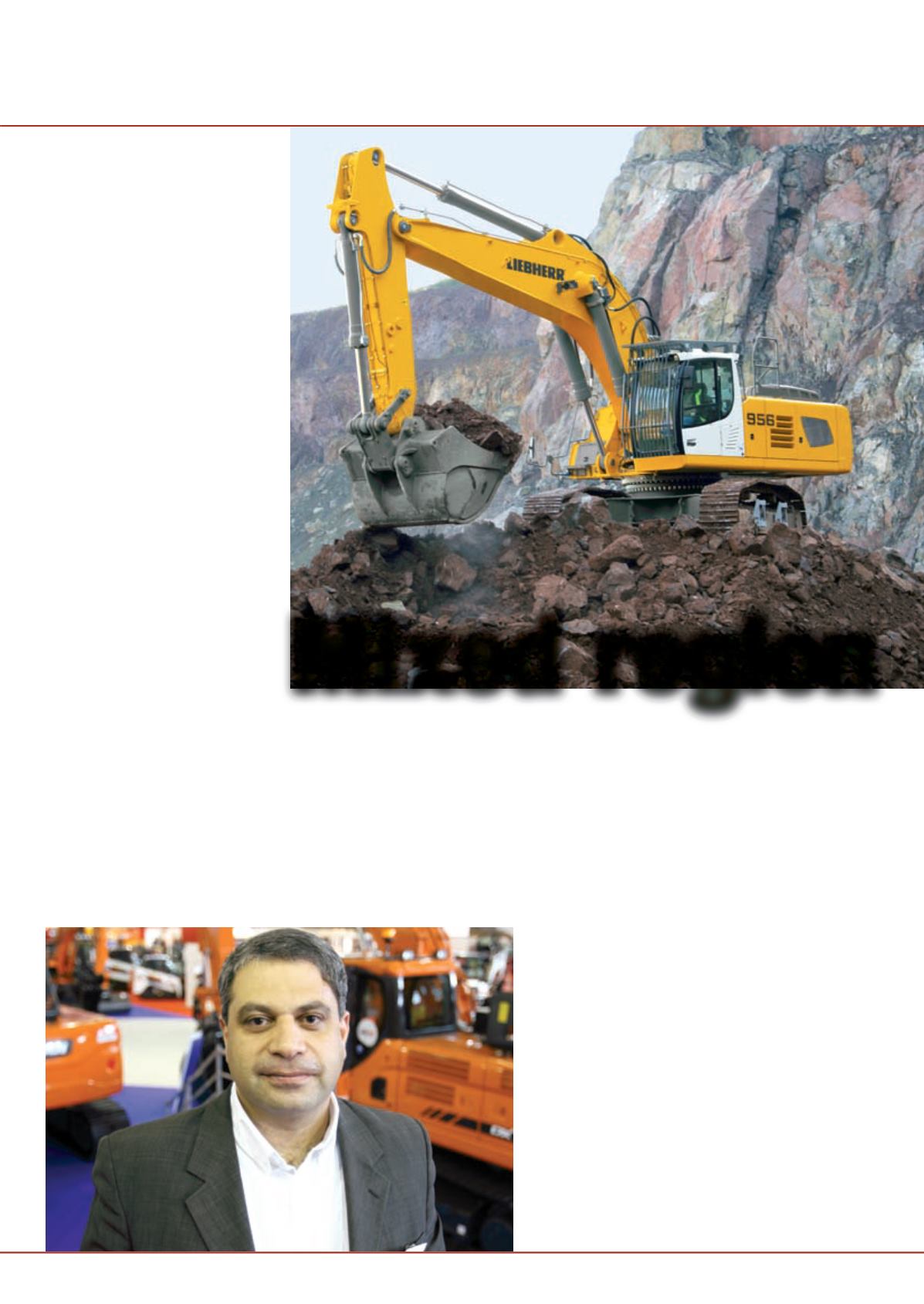

Liebherr introduced the 50 tonne

class R 956 excavator (pictured) and

60 tonne class R 960 for the North

African market.

Gaby Rhayem,

regional director

for Doosan

Construction

Equipment in

Middle East and

Africa, said the

North African

market as a

whole was still

very active.