22

REGIONAL REPORT: NORTH AFRICA

international

construction

december 2013

Mixed region

Expected to carry up to 10 million passengers a year, the 350

km rail line will link the country’s economic center, Casablanca,

with one of the major cities in the north, Tangier. The project is

estimated to cost US$ 4 billion and is scheduled to start running

in 2015.

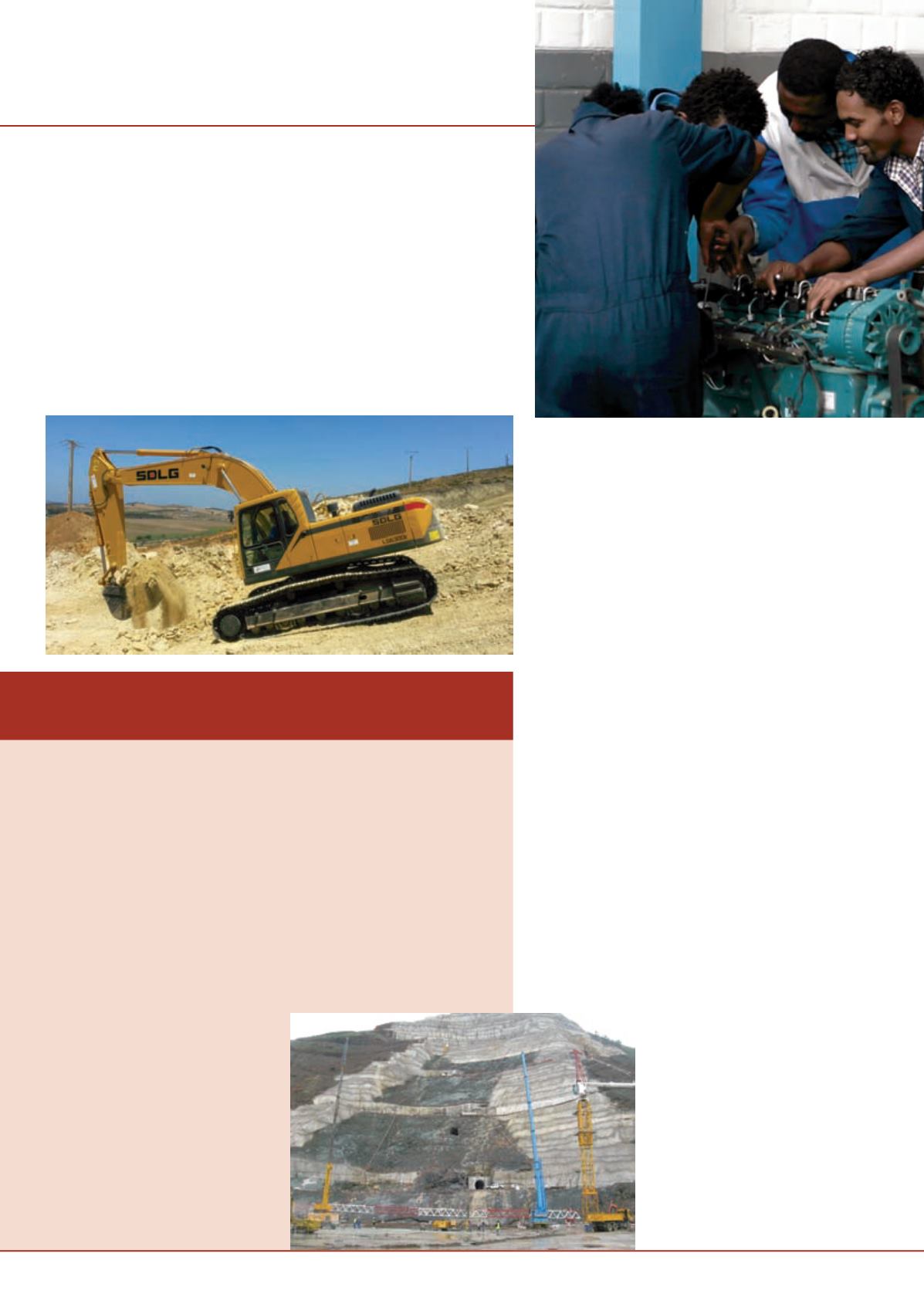

Two, 29 tonne class SDLG LG6300 excavators – the first two

excavators from the manufacturer to arrive in Morocco – are

being used by Chinese contractor COVEQ on the project.

The LG6300 ihas a wide chassis for increased stability and

reinforced X-shaped lower brackets on the extended crawler.

SDLG said this configuration allows the unit to adapt well

to different working conditions while offering lower fuel

consumption and higher performance.

Liebherr also produces especially robust machines targeted at

S

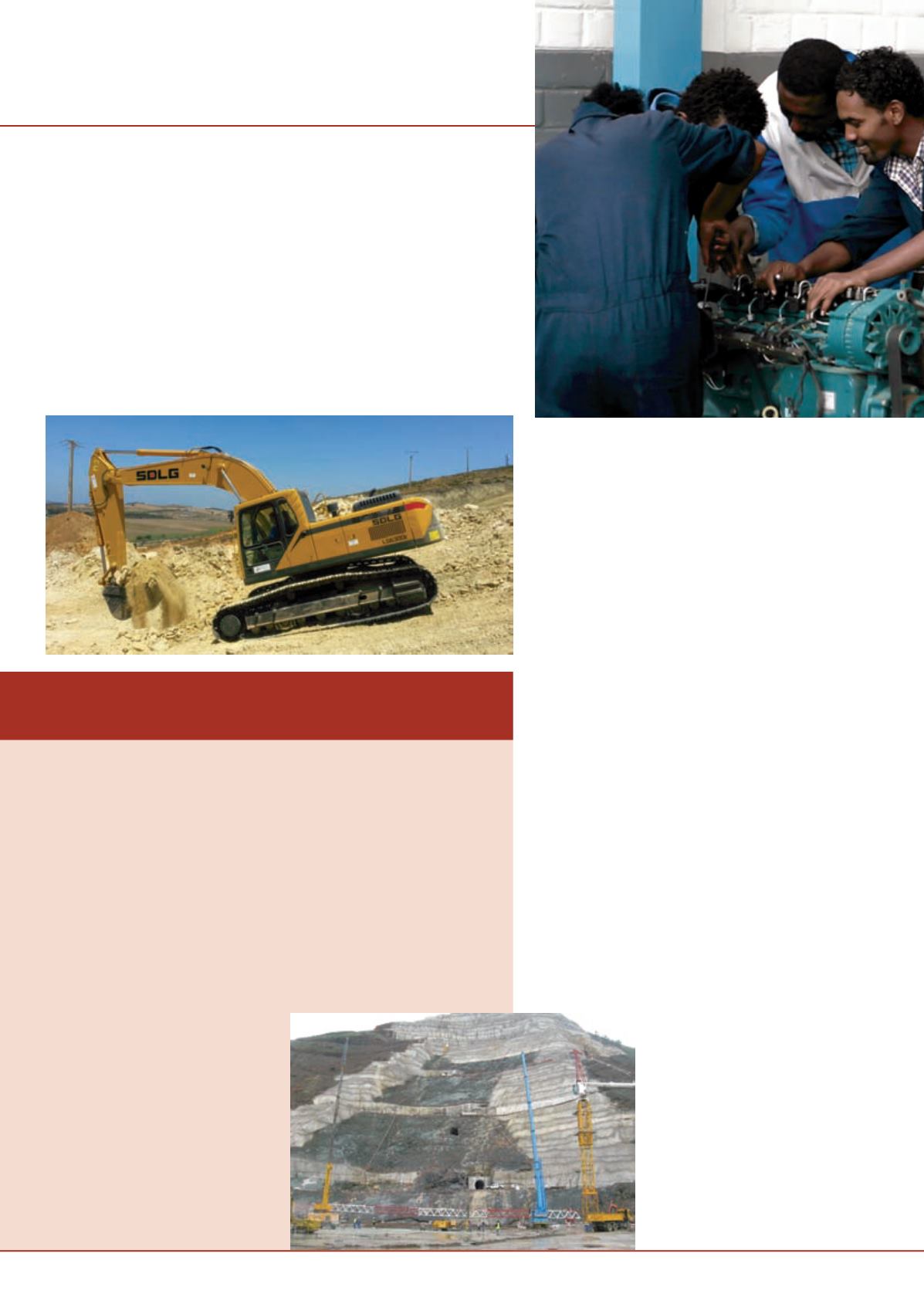

ix years ago, French contractor Razel-Bec used two of its Potain 12 tonne capacity

MD 345 cranes to support construction of Algeria’s Koudiat Acerdoune dam, where it

worked 24/7 to help the project meet its deadline and budget targets.

When it won a contract to build the new

€

175 million (US$ 236 million) Tabellout Dam for

the Algerian government, it selected the same pair of cranes from its fleet, giving both an

inspection and overhaul before sending them off.

The new Tabellout dam is being built at Jijel, close to the northeastern town of Sétif, 350 km

from Algiers and 30 km from the coast. Also selected to work on the project was a 16 tonne

capacity MD 365, supplied by international rental company Arcomet, and an 18 tonne capacity

MD 175, also from Razel-Bec’s own fleet, which will construct the headrace tunnel feeding the

dam’s turbines.

Jacky Legras, crane fleet manager at Razel-Bec, said, “Support is available whenever we

need it, whether it’s advice on configuring a crane or guidance on parts and service. One

call to a Manitowoc [owner of the Potain brand] contact centre and we have a crane expert

to handle all of our service and technical

needs.”

The cranes are providing general lifting

and concrete pouring duties on the project.

Some 1 million m

3

of concrete will be used

in the dam, which is being built from roller

compacted concrete (RCC). Once complete,

the dam will be 120 m high and 400 m

across, while thickness will range from

100 m at ground level to 8 m at the crest.

Construction will take 45 months and once

complete, the project will provide34 million

m

3

of drinking water and 88 million m

3

of

water for agricultural use a year.

Building on experience

Algerian dam project uses familiar equipment

this region, including the new 50 tonne class R 956 and 60 tonne

class R 960 excavators – both sporting EU Stage IIIA / US Tier

3-compliant diesel engines.

The R 960, for example, is equipped with a reinforced

undercarriage featuring crawler-track components from the next

size larger excavator. In conjunction with a heavier counterweight,

this is improves stability, allowing the use of a larger bucket.

Meanwhile, the steelwork on the R 956’s upper carriage has also

been improved for extended service life.

Simplified maintenance and high productivity are also key to

the design of Caterpillar’s new 320D Series 2 Excavator for the

African, Middle East and CIS markets.

The main features of this 22 tonne class machine include a

powerful hydraulic system, durable main structures and a refined

operator station.

In addition, its 104 kW Tier 2 emissions-compliant engine

has been designed to be a reliable performer in areas where fuel

quality can be poor. A new filtration system uses a primary fuel

filter / water separator and a secondary fuel filter to ensure clean

fuel throughout the system.

Active market

Looking at the region as a whole, Gaby Rhayem, regional director

for Doosan Construction Equipment in Middle East and Africa,

said the North African market was still very active.

“The biggest opportunities are in Algeria, while the Moroccan

market has been strong. Tunisia is recovering slowly from political

instability, and we are seeing more opportunities in Libya,” he

said.

However, Mr Rhayem also highlighted customs rules as one of

the challenges of doing business in the region. “In North Africa

the customs rules are very difficult and vary greatly,” he said.

“They can change at any time making business difficult as is the

case at the moment.”

Challenges

But other, arguably more detrimental

challenges also exist. For instance, North

African countries did not rank too

favourably in Transparency International’s

2013 Global Corruption Barometer,

where a score of one means not at all

corrupt and five means extremely corrupt.

Egypt scored an average of 3.6, Libya

3.25, Algeria 3.51, Morocco 3.54, Tunisia

3.08, Sudan 3.84 and Nigeria 3.25.

Allegations and proven instances of

Machines from

Volvo CE’s

Chinese joint

venture SDLG

are helping

to construct

Morocco’s first

high-speed rail

line.