BUSINESS HIGHLIGHTS

BRAZIL

Votorantim suspends

US$ 4 billion+ IPO

Brazil’s largest cement producer pulls out of

cement stock market float amid pricing concerns

V

otorantim has postponed a US$ 4 billion+ initial public offering

(IPO) of a stake in its cement business, Votorantim Cimentos, citing

concerns about pricing, new regulations and weakening market

conditions.

The listing of the unit on both the Bolsa de Valores in São Paulo, Brazil and

the New York Stock Exchange has been suspended after bids came in below

the planned BRL 16.00 to BRL 19.00 (US$ 7.80 to US$ 9.26) per share

price range.

Other factors weighing on the IPO included a general stock-market

deterioration amid a slow-down in Brazil’s economic growth and a proposed

new regulation in Brazil that could see royalties on mining and quarrying

increased from 2% to 4% of total revenues, which Votorantim said would

affect its business.

Votorantim Cimentos had revenues of BRL 9.48 billion (US$ 4.71 billion)

last year and net profits of BRL 1.64 billion (US$ 815 million).

AUSTRIA

Alpine collapse

Contractor Alpine Bau has gone

into voluntary insolvency with net

debts of € 625 million (US$ 815

million). It said the decision was a

result of delays in a programme of

divestments and the deterioration in

the its trading position since the first

quarter of 2012.

Alpine is majority-owned by

Spain’s FCC, The parent company

has made a € 289 million (US$

375 million) provision in its 2013

accounts for Alpine’s insolvency.

SOUTH AFRICA

Asset sale

Contractor Murray & Roberts has

sold the majority of its construction

products businesses for ZAR 1.33

billion (US$ 132 million). Asphalt

producer Much Asphalt was

bought by private equity company

Capitalworks, while Ocon Brick,

Technicrete and Rocla, which make

bricks and concrete products, were

sold to a private equity consortium

that included Capitalworks. Murray

& Robertsis still looking for a buyer

for Hall Longmore, which makes

steel pipes.

FRANCE

Services sale

Spie is to acquire Hochtief’s Service

Solutions business for € 250 million

(US$ 326 million). Spie beat

several rival offers for the business,

including a bid from YIT. The

transaction is due to close at the end

of this year, and will be retroactively

effective from 1 January 2013.

QATAR

Metro contracts

A consortium comprising Porr, SBG

and HBK won a € 1.89 billion (US$

2.45 billion) contract to build the

16.6 km Green Line of the Doha

metro. Vinci leads the consortium

awarded the €1.5 billion (US$ 2

billion) contract for the 13.8 km

southern red line, and Impregilo

leads the consortium for the € 1.7

billion (US$ 2.2 billion) contract for

the 13 km northern red line.

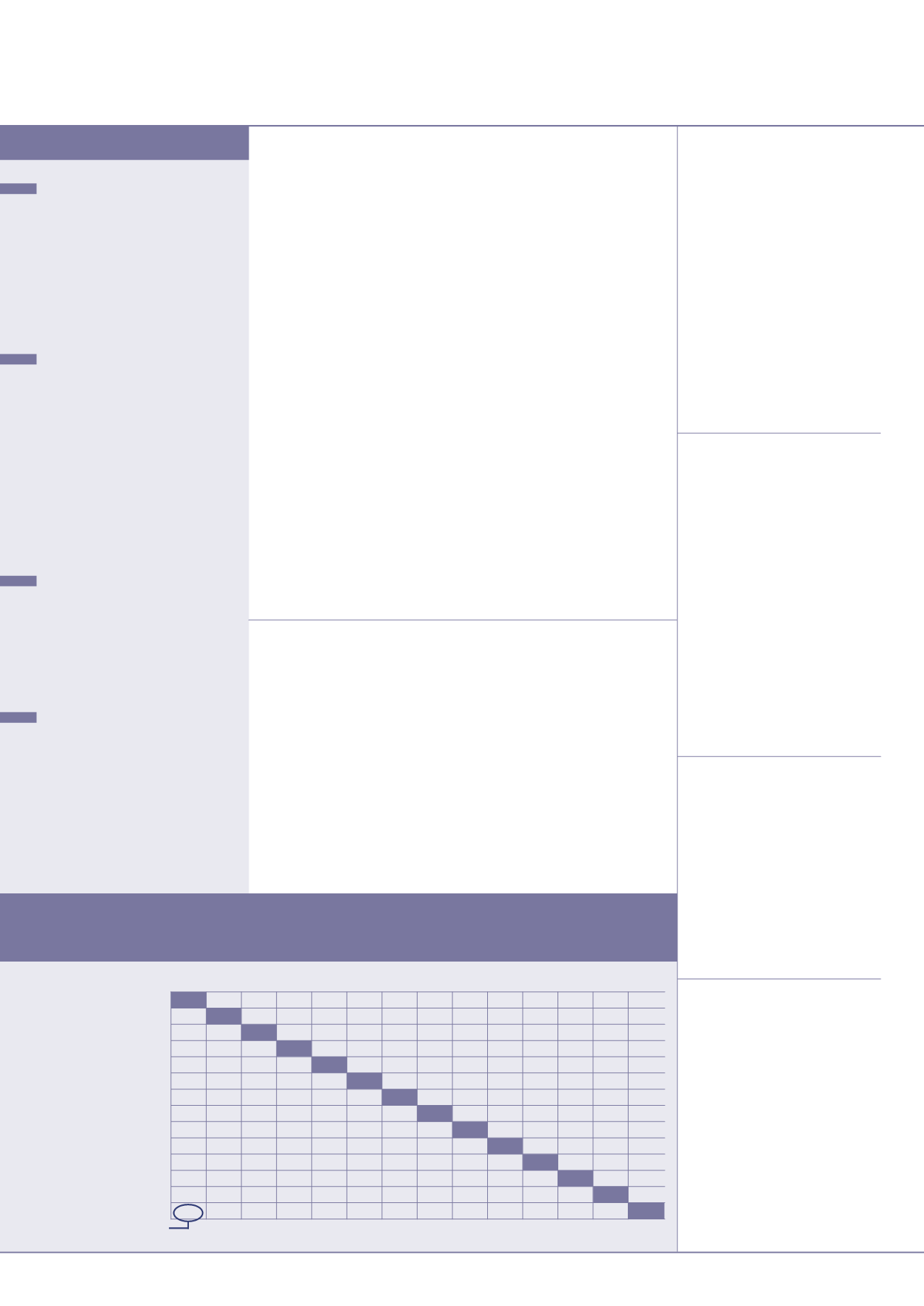

VALUE OF 1:

SYMBOL AU$

BRL

UK£ CNY

€

INR

YEN MXN RUR SAR

ZAR KRW CHF

US$

Australian Dollar

AU$

0.48 0.665 6.36 0.789 55.6

100

12.58 32.0

3.87

9.24

1137 0.965 1.031

Brazilian Real

BRL

2.07

0.321 3.07 0.381 26.8

48.5

6.07

15.4

1.87

4.46

549 0.466 0.498

British Pound

UK£

1.50

3.12

9.6

1.19

83.6

151

18.9

48.1

5.81

13.9

1710 1.45

1.55

Chinese Yuan

CNY

0.157 0.326 0.105

0.124 8.74

15.8

1.98

5.03 0.608 1.452

179 0.152 0.162

Euro

€

1.27

2.63

0.84

8.07

70.5

127

15.9

40.6

4.90 11.71 1442 1.22

1.31

Indian Rupee

INR

0.018 0.037 0.012 0.114 0.014

1.8

0.226 0.576 0.0696 0.166 20.5 0.0174 0.0186

Japanese Yen

YEN

0.010 0.021 0.007 0.063 0.008 0.553

0.1253 0.319 0.0385 0.0920 11.3 0.0096 0.0103

Mexican Peso

MXN

0.080 0.165 0.053 0.506 0.063 4.42

7.98

2.54 0.307 0.734

90

0.077 0.0820

Russian Ruble

RUR

0.031 0.065 0.021 0.199 0.025 1.74

3.14 0.393

0.121 0.289 35.5 0.0302 0.0322

Saudi Riyal

SAR

0.259 0.536 0.172 1.645 0.204 14.373 25.973 3.253 8.275

2.39

294 0.250 0.267

South African Rand ZAR

0.108 0.224 0.072 0.689 0.085 6.016 10.871 1.362 3.463 0.419

123 0.104 0.112

South Korean Won KRW

0.0009 0.0018 0.0006 0.0056 0.0007 0.0489 0.0883 0.0111 0.0281 0.0034 0.0081

0.00085 0.0009

Swiss Franc

CHF

1.04

2.15

0.69

6.59

0.82 57.59 104.06 13.03 33.15 4.01

9.57

1178

1.068

US Dollar

US$

0.97

2.01 0.645 6.17 0.765 53.9

97.4

12.2 31.03 3.75

8.96 1102.9 0.936

For example US$ 1 = AU$ 0.97

Exchange rates: June 2013

FINLAND

Metso has announced

a demerger plan that will see the

company’s pulp, paper and power

divisions separated from its automation

and mining & construction divisions.

The mining, construction and

automation company will retain the

Metso name, while the pulp, paper and

power business will be named Valmet.

SOUTH AFRICA

Sandro Scherf, CEO

of South African aggregates processing

equipment supplier Pilot Crushtec, has

fully acquired the company through

a management buy-out (MBO). The

company supplies mobile and semi-

mobile, crushing, screening, recycling,

sand washing and material handling

equipment through a combination of

equipment it manufactures itself and

the distribution of other companies’

machines.

ITALY

Salini and Impregilo have

approved the terms of their merger,

creating a new listed company known

as Salini Impregilo that is targeting

consolidated revenues of

€

7.4 billion

(US$ 9.7 billion) by 2016. The merger

will be effective from the start of 2014.

AUSTRALIA

Lend Lease plans to

restructure its Australian operations

and has warned of reduced profits this

year. The company’s four Australian

construction businesses – Abigroup,

Baulderstone, Project Management

& Construction and Infrastructure

Services – will be merged into three,

with individual focuses on building,

engineering and infrastructure.

international

construction

july-august 2013

BUSINESS NEWS

10

NORTH AMERICA

Lafarge’s US$ 700 million gypsum sale

Cement producer Lafarge has

continued to dispose of non-core

businesses with the sale of US$ 700

million worth of gypsum plants

to an affiliate of private equity

company Lone Star Funds.

Lafarge North America’s gypsum

division manufactures gypsum

wallboards and joint compounds

throughout a network of plants in

the US and Canada. In 2012, these

operations had sales of US$ 310

million.

Lafarge said its latest round of

asset sales completed the group’s

refocusing on its core businesses –

cement, aggregates and ready-mixed

concrete. In 2011 it sold the other

parts of its global gypsum business

in three separate transactions for

total proceeds of € 1.55 billion

(US$ 2.02 billion).