T

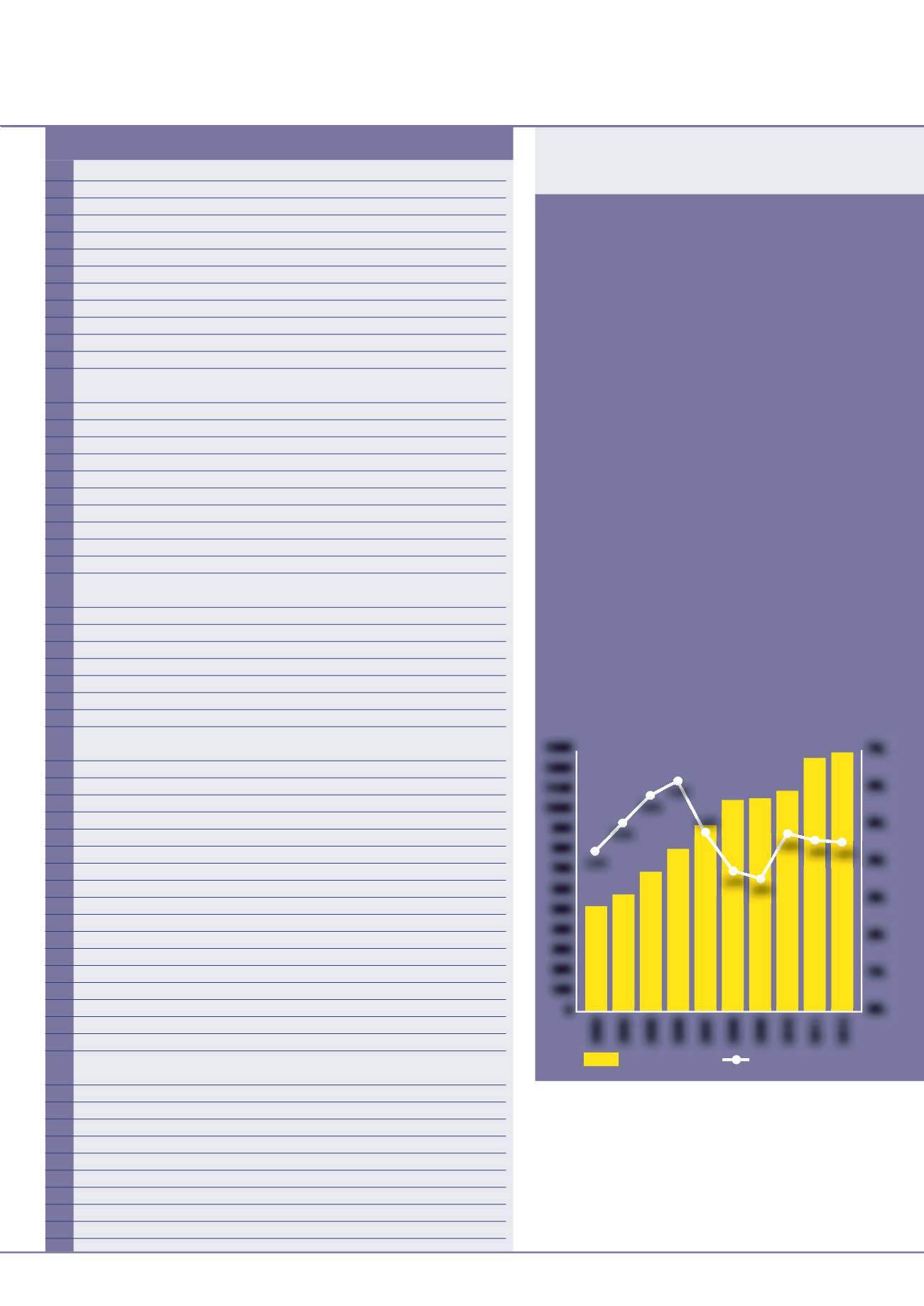

he 2013 league table of global contractors is based on

revenues achieved in 2012. These came to US$ 1,530 billion

for the whole group, another record total.

The graph illustrates the revenues and profitability trend for the

Top 100 going back a decade, and it is striking to note that there

have always been annual turnover rises, even in the years of global

recession. This year’s total for the top 100 came to US$ 1,292

billion, a +4% increase.

Although revenues have always improved, profitability in the

industry has been more sensitive to the changing economic

climate. The Top 100’s margin peaked in 2006 at 6.2% operating

profit. This was followed by a steep decline, driven first by the

downturn in the US residential market and then the global recession

that followed it. There was an improvement in 2010, as reported in

the 2011 edition of the Top 200 study, but since then profits have

flattened out. In 2012, the industry achieved an average margin of

4.4%, down 0.1 percentage points from 2011.

This fall in profitability and the relatively subdued +4% rise in

revenues for the top 100 suggests business conditions are still

tough for this group of companies, which could be indicative of the

whole industry. With global construction output somewhere around

the US$ 7,500 billion mark, the top 100 represent about 17% of

activity.

This statistic also reflects the fragmented nature of the global

construction market. It is difficult to think of another sector where

the top 100 companies have as little as a 17% market share and

the top 200 claim about 20%. Indeed, the global number 1, CSCEC

had revenues last year equivalent to only about 1.1% of global

construction output. There are not many other businesses in the

world where you could be market leader with a 1.1% share.

Global challenges

Industry profitability still weak

Sales Company

Country 2012 Change

Website

(US$ million)

1300

1200

1100

1000

900

800

700

600

500

400

300

200

100

0

7%

6%

5%

4%

3%

2%

1%

0%

Sales (US$ Billions)

Operating Margin

2003

520

2004

2005

>

2006

927

2007

2009

1096

1242 1291

2011

2012

2010

1048

2008

19

july-august 2013

international

construction

NEWS REPORT

The global top 200

* = estimate

4.3%

5.2%

5.8%

6.2%

4.8%

3.7%

579

695

807

3.6%

4.8% 4.5% 4.4%

1054

55

6751

China Gezhouba

China

50

5

56

6347

Emcor Group

US

66

10

57

6287

VolkerWessels

Netherlands 55

2

58

6266

Laing O’Rourke

UK

57

1

59

6224

Toda

Japan

69

10

60

6150

Kinden

Japan

64

4

61

6048

YIT

Finland

61

62

6001

PCL Construction Group

*

Canada

73

11

63

5816

Petrofac

UK

63

64

5812

Andrade Gutierrez

Brazil

46

18

65

5746

Enka

Turkey

75

10

66

5607

Kandenko

Japan

68

2

67

5542

Guangsha Construction

China

72

5

Group

*

68

5485

Chicago Bridge & Iron

US

80

12

69

5420

Spie

France

65

4

70

5343

Carillion

UK

54

16

71

5179

Obrascon Huarte Lain

Spain

52

19

72

4996

Chiyoda

Japan

113

41

73

4981

Aveng

South Africa 77

4

74

4945

Penta-Ocean Construction

Japan

87

13

75

4943

Misawa Homes Holdings

Japan

76

1

76

4822

Nippo

Japan

78

2

77

4820

Pulte Group

US

88

11

78

4674

Orascom Construction

Egypt

71

7

Industries

79

4644

Sacyr Vallehermoso

Spain

70

9

80

4623

Maeda Corporation

Japan

90

10

81

4575

Clark Construction

*

US

86

5

82

4385

Babcock International

UK

79

3

83

4381

Fayat Group

France

83

84

4354

D R Horton

US

98

14

85

4313

Murray & Roberts

South Africa 85

86

4292

Sumitomo Mitsui

Japan

89

3

Construction

87

4245

Brookfield Multiplex

Australia

120

33

88

4129

Alpine Bau

Austria

74

14

89

4111

Tutor Perini

US

95

6

90

4086

Lennar

US

118

28

91

3960

Boskalis Westminster

Netherlands 91

92

3782

Whiting-Turner Contracting

US

92

93

3754

Fujita

Japan

108

15

94

3639

Nexity

France

100

6

95

3624

PanaHome

Japan

96

1

96

3616

ICA

Mexico

104

8

97

3598

Ed Züblin

Germany

94

3

98

3542

McDermott International

US

103

5

99

3525

Jaiprakash Associates

India

116

17

100

3460

Walsh Group

US

102

2

101

3415

Foster Wheeler

US

81

20

102

3409

Tecnicas Reunidas

Spain

97

5

103

3386

Barratt Developments

UK

111

8

104

3371

Lotte Engineering &

South Korea 105

1

Construction

105

3366

Camargo Corrêa

*

Brazil

93

12

106

3313

Veidekke

Norway

114

8

107

3300

Black & Veatch

US

150

43

108

3270

Arcadis

Netherlands 132

24

109

3265

Kumagai Gumi

Japan

112

3

110

3199

Jan De Nul

Belgium

125

15

111

3189

NVR

US

135

24

112

3174

MRV

Brazil

184

72

113

3171

Nishimatsu Corporation

Japan

109

4

Most noticeable towards the top end of the rankings are the

large Japanese groups. Sekisui House. Kajima, Obayashi, Taisei

and Shimizu have all moved up since the 2012 league table and

now sit within the top 20.

Indeed, this trend for the large Japanese companies is reflected all

the way through this year’s top 200. Only two of the 32 Japanese

companies ranked in this year’s league table have lost places since

the 2012 league table was published, while an impressive 27 have