>

27

july-august 2013

international

construction

ECONOMIC OUTLOOK

Strong momentum

Strong momentum

The need for new transport networks to close the huge infrastructure gap Southern Africa is driving

investment in the region’s construction markets.

Scott Hazelton

reports.

E

conomic growth in sub-Saharan Africa

should average at least +5% this year and

in 2014 – the best performance since the

global downturn began in 2008, and second only

to Asia for the best regional growth in the world.

South Africa, due to its strong trade links to the

Eurozone, is an outlier in the region’s high growth

momentum, but in total 11 of the world’s fastest

growing economies during the next five years

will be African, according to the International

Monetary Fund (IMF).

Investors are responding to the opportunity with

strong inflows to the continent, especially south of

the Sahara, while the African Development Bank

(AfDB) is readying an ambitious infrastructure

bond program to boost African economies.

The proposed programme aims to raise up to

US$ 40 billion for infrastructure development,

with about half of the amount to be drawn from

the considerable reserves now held by central

banks around the continent.

If it works as expected, the programme will

make AfDB Africa’s largest multilateral financier.

To put it in perspective, the projected US$ 40

billion would compare to the US$ 19 billion

dispersed this year through the AfDB and World

Bank combined.

Assuming that the projects financed are well

chosen and executed capably and honestly, the

continent would receive a tremendous direct and

indirect economic boost, but it would still only

partially close the region’s huge infrastructure gap.

Indeed, Africa may need to invest over

US$ 50 billion in the next decade on additional

rail infrastructure alone. This would provide

4,000 km of rail to improve access to the

continent’s mineral resources.

While there are extensive coal, iron and

manganese deposits in West Africa and

Mozambique, they are expensive to reach and

develop due to lack of infrastructure. Mozambique

alone could see upwards of US$ 20 billion in rail

and port infrastructure as its coal reserves are

desired by the large and rapidly growing nearby

markets in Asia, especially India.

Roads are also an issue. Mozambique has

about 30,000 km of road, with the main arteries

surfaced. However, secondary roads tend to be

poorly maintained and can become impassable

in the rainy season. With Chinese funding, the

country has begun an infrastructure improvement

programme that will include the construction

of a ring road to connect critical highways in

Mozambique to South Africa by 2014/15.

Investment in roads is widespread and vitally

needed. Under its Vision 2030 programme,

Kenya has committing to building and upgrading

thousands of kilometres of roads. The initial

phase will see construction of the country’s first

eight-lane superhighway, a major link to the

great Trans-African highway from Cape Town to

Cairo and connecting Nairobi with Somalia and

Ethiopia.

Power shortages

Another critical infrastructure element is

power, with most countries throughout Africa

experiencing chronic shortages that disrupt

industrial and commercial operations. Plans are

being put in place to tackle this – Nigeria, for

instance, intends to put 1 GW into the national

electricity grid per year over the next decade,

increasing total capacity by 10 GW, or about a

+50% to +70% compared to the current reliable,

as opposed to nominal, level of capacity.

While few details have been released, the plan

is notable for two aspects. First, the focus will be

largely on renewable sources, principally solar.

Secondly, the investment is being made by a

South Korean conglomerate, HQMC, pledging

up to US$ 30 billion.

The HQMC venture is structured as a build-

operate-transfer contract, which would provide

Nigerians with both jobs and technical training

in early project phases, and eventually turn over

full ownership and control of the technology to

Nigerians.

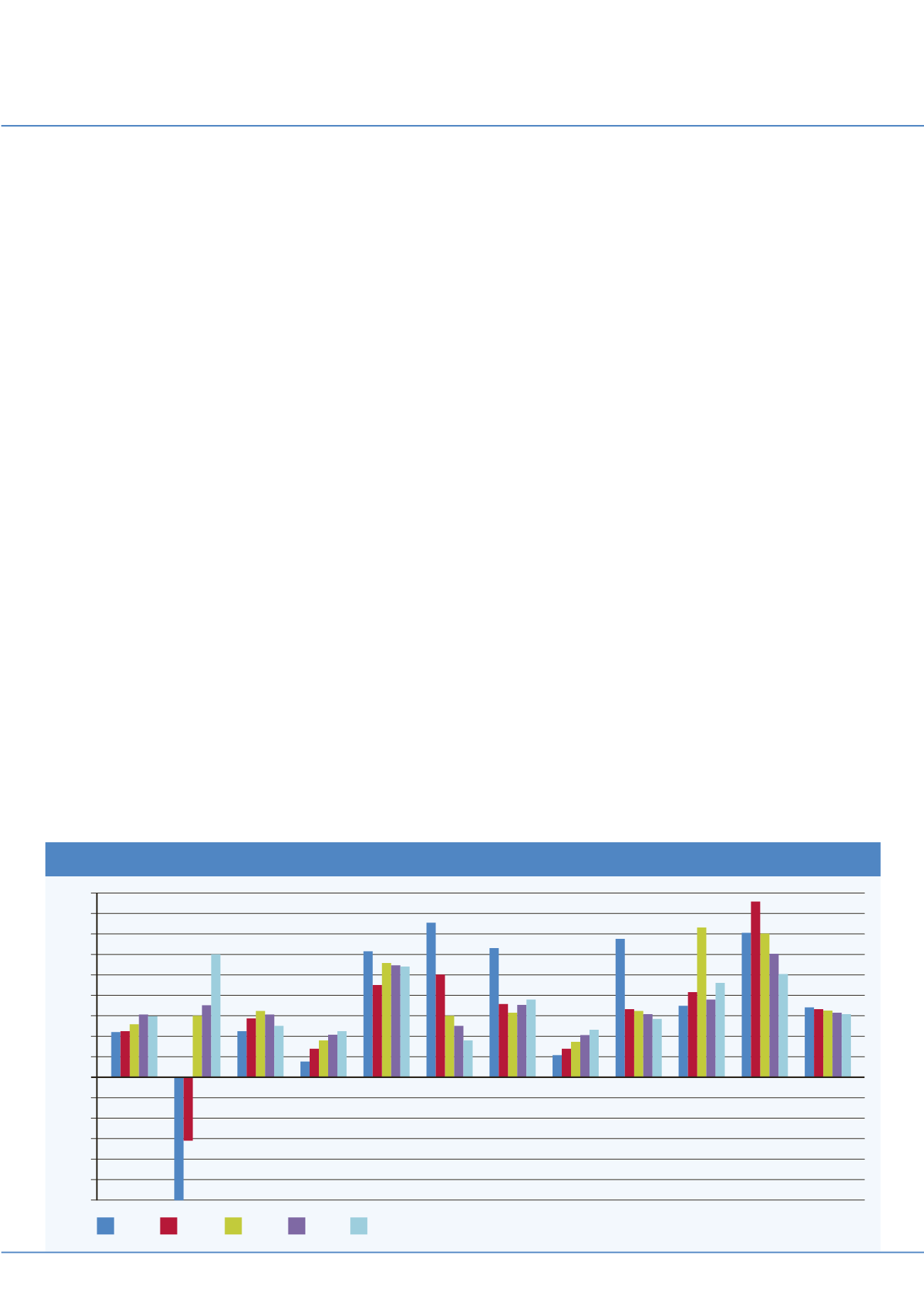

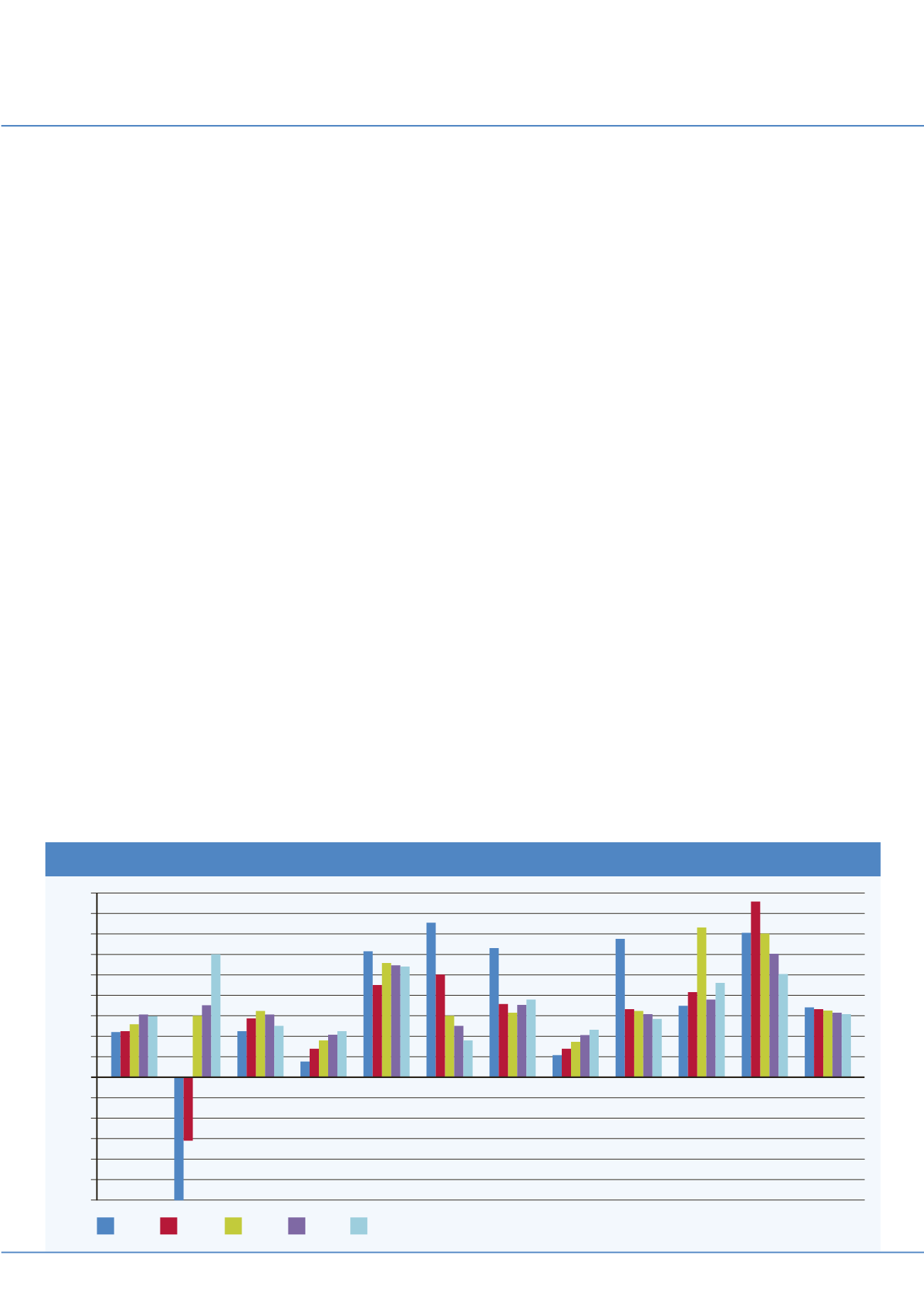

Growth in business fixed investment

Sub-

Saharan

Africa

South

Africa

Senegal

Nigeria

Namibia

Kenya

Guinea

Ghana

Republic

of Congo

Botswana

Angola

2011

2012

2013

2014

2015

18%

16%

14%

12%

10%

8%

6%

4%

2%

0%

-2%

-4%

-6%

-8%

-10%

-12%

Zimbabwe