The global top 200

international

construction

july-august 2013

NEWS REPORT

22

Country

No. of

New

Up

Down

Same

Total

% of Average Average

Average Average

companies

Sales

Total

Sales Operating

Headcount Sales/

(US$ mill.)

(US$ mill.) Profit

Margin

Employee

(US$ mill.)

(US$)

China

11

-

1

7

3

362880

23.7%

32989

1430

3.63%

125085 $285,677

Japan

32

2

27

2

1

228756

15.0%

7149

236

3.38%

8982

$846,649

US

30

3

15

9

3

183856

12.0%

6129

348

5.02%

20493

$314,174

France

7

-

2

2

3

125173

8.2%

17882

1492

7.41%

63419

$281,965

Spain

10

-

2

8

-

115138

7.5%

11514

347

2.62%

43981

$273,050

South Korea

11

2

7

2

-

66319

4.3%

6029

203

3.22%

7365

$870,485

UK

15

-

6

7

2

60975

4.0%

4065

184

4.52%

16567

$251,437

Germany

6

1

2

3

-

52797

3.5%

8800

240

1.95%

34149

$299,437

Sweden

4

-

1

3

-

36206

2.4%

9051

275

3.04%

25201

$359,171

Australia

3

-

2

1

-

35843

2.3%

11948

383

3.20%

29765

$401,406

Netherlands

9

-

1

7

1

34253

2.2%

3806

129

3.38%

6789

$575,798

Italy

6

-

2

4

-

30061

2.0%

5010

363

6.48%

15689

$357,655

Brazil

7

-

5

2

-

30026

2.0%

4289

785

12.14%

14750

$290,808

Austria

4

-

-

3

1

25644

1.7%

6411

41

0.57%

24426

$401,406

India

5

-

3

2

-

19992

1.3%

3998

452

11.30%

3908

$627,209

Canada

4

-

4

-

-

18897

1.2%

4724

299

5.42%

13743

$343,772

Norway

3

1

2

-

-

12399

0.8%

4133

207

5.01%

10428

$396,343

South Africa

3

-

2

-

1

11474

0.8%

3825

16

0.42%

17285

$221,278

Belgium

4

-

2

2

-

10837

0.7%

2709

181

6.69%

8697

$321,858

Russia

4

-

2

2

-

10689

0.7%

2672

190

7.15%

7306

$365,767

Finland

2

-

-

1

1

8963

0.6%

4481

174

3.88%

16119

$278,020

Turkey

2

-

2

-

-

8010

0.5%

4005

357

8.91%

7972

$502,440

Mexico

3

1

2

-

-

7331

0.5%

2444

427

17.47%

7432

$328,788

Egypt

2

-

-

2

-

6275

0.4%

3137

913

19.54%

12953

$242,220

Greece

1

1

-

-

-

1584

0.1%

1584

116

7.32%

12436

$127,408

Others

12

3

8

1

-

25417

1.7%

2118

-

-

-

-

ALL

200

14

100

70

16

1,529,795 100.0%

7649

357

4.30%

23,899

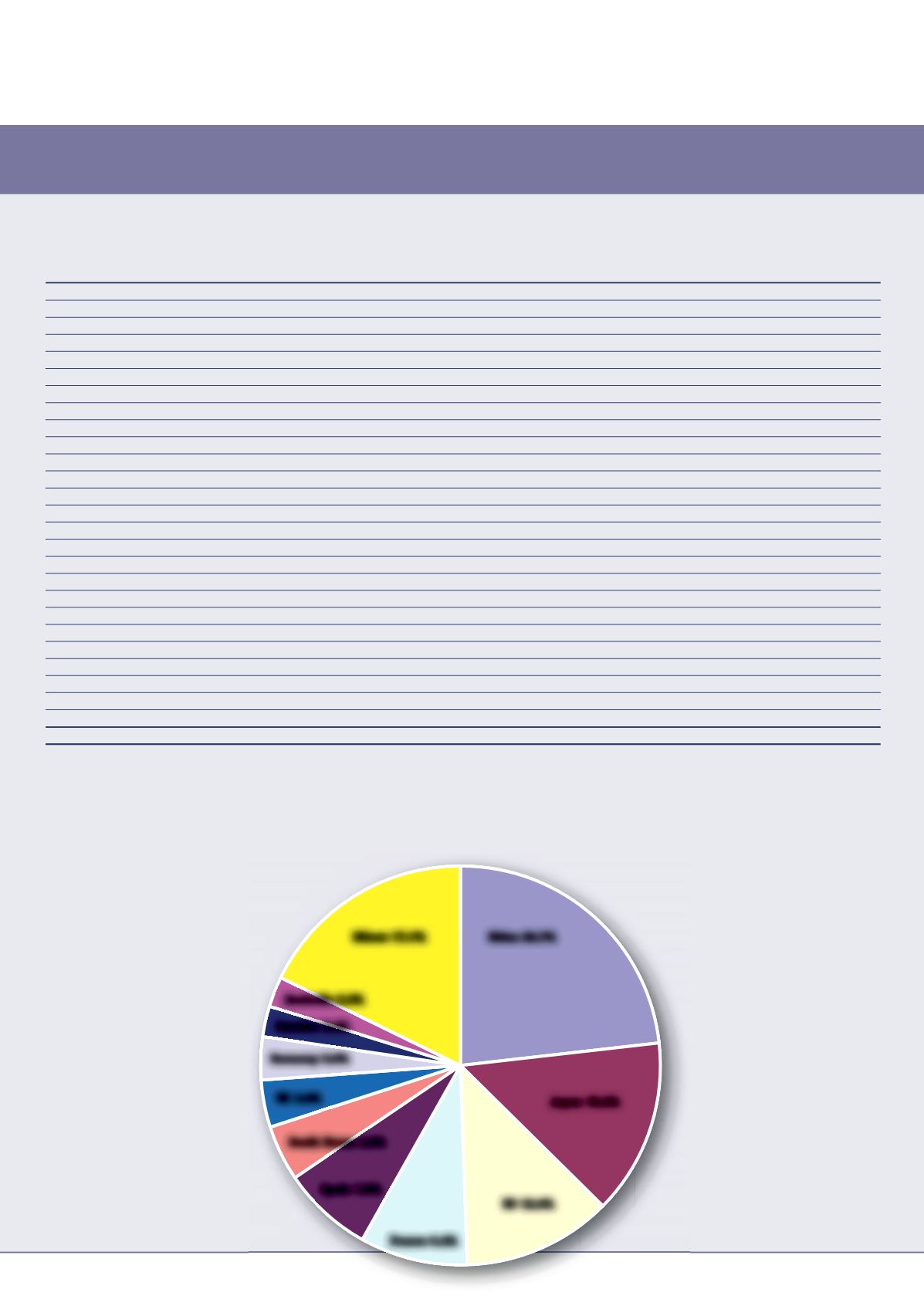

Analysis by country

Which country’s contractors are the biggest and most profitable?

D

espite falling revenues for many Chinese contractors last year,

robust growth by the three biggest players meant the country’s

construction companies claimed a slightly increased slice of

the top 200’s revenues last year – 23.7%, compared to 23.2% in the

2012 edition (based on 2011 figures).

Meanwhile a surge for Japanese contractors has seen their share

of the Top 200’s revenues move up from 14.2% in last year’s

study to 15.0% this year. US companies in the Top 200

meanwhile were almost unmoved with a 12.0% share

this year, compared to 12.1% last year.

Five years ago in the 2008 edition of the Top

200, US contractors enjoyed the biggest slice,

with a 19.9% share. They were followed by

the Japanese (15.5%) and French (9.9%).

Total revenues for China’s contractors

came to 9.7% of the total for the Top 200,

putting this national group in fourth place,

which emphasises how fast they have

grown as companies.

Global growth

Total revenues for the Top 200 came to

US$ 1,529 billion in this year’s study, a

+3.1% increase on last year’s total of

US$ 1,483 billion. This meant the average size

of a Top 200 company increased from US$ 7.41

billion to US$ 7.65 billion in revenue terms.

However, this was achieved without much of an

increase in headcount. Figures on employee numbers show that across

the Top 200, the average company now employs 23,899 staff – only a

+0.6% increase on the figure of 23,762 people per company from last

year’s analysis. This implies total employment among the top 200 of

about 4.78 million staff.

China’s contractors are the largest in revenue and employment terms,

but they are also among the least profitable in the Top 200, with an

operating margin of just 3.63%, compared to the average of

4.30%. Other under-performers in terms of profitability

include the Japanese, South Korean and Australian

national groups, along with most of the European

contractors.

The more successful national groups on

this basis are the US, Brazilian, Indian,

Mexican and Egyptian contractors, while

other emerging markets such as Turkey

and Russia also seem to deliver healthy

profits to their nation’s largest construction

companies.

About 75% of the companies listed in the

Top 200 are from developed markets and

they account for about 70% of the revenues.

Of the remaining 50 or so, 11 are Chinese,

leaving some 40 other emerging market

contractors. These tend to be the smaller

companies. They have total revenues of US$ 119

billion – just under US$ 3 billion each, compared to

the Top 200 average of US$ 7.65 billion.

Japan 15.0%

China 23.7%

France 8.2%

Spain 7.5%

UK 4.0%

Germany 3.5%

South Korea 4.3%

Sweden 2.4%

Australia 2.3%

Others 17.1%

US 12.0%

>