The global top 200

Although Chinese contractors dominate the

top 10 of our league table, the downturn in

their domestic market has had an impact

on standings throughout the Top 200.

Chris Sleight

reports.

The

global

top 200

W

ith five Chinese contractors within the top 10 of

iC’s

league table of the world’s largest construction

companies, it is fair to say that they continue to

dominate the very top end of the industry. The big three – China

State Construction & Engineering (CSCEC), China Railway

Construction and China Railway Group are unchanged in their

positions from last year, while there is quite a gap to fourth –

placed Vinci from France, once itself the clear world no. 1.

Elsewhere in the top 10, ACS and its partially-owned subsidiary

Hochtief have improved their standings, as has Bechtel of the US,

and these have come at the expense of China Communications

Construction and China Metallurgical Group (MCC).

This in itself is unusual. Over recent years Chinese construction

companies have seemed to march relentlessly up the league table,

but the 2013 ranking, based on revenues in 2012, has seen a

definite change of fortunes.

Of the 11 Chinese companies listed in the Top 200, only

one, Guangsha Construction Group, has improved its position

compared to last year. Of the remainder, seven have lost ground,

while the three largest are unmoved from 2012.

This illustrates what appears to be a growing divide between the

big three Chinese contractors and the country’s other players. The

group of CSCEC and the two railway specialists saw their total

revenues increase some US$ 27.7 billion last year for an above

average increase of +13%. Their total US$ 237 billion revenues

accounted for almost two thirds of sales for all Chinese companies

in the Top 200.

In contrast, the remaining eight Chinese contractors in the Top

200 saw their revenues decline by an average of -6% year-on-year,

with the impact on their standings in the league table that has

already been noted.

Where there are fallers in the league table, there of course also

have to be gainers, and there are several key groups of companies

that have improved their standings since last year.

international

construction

july-august 2013

NEWS REPORT

18

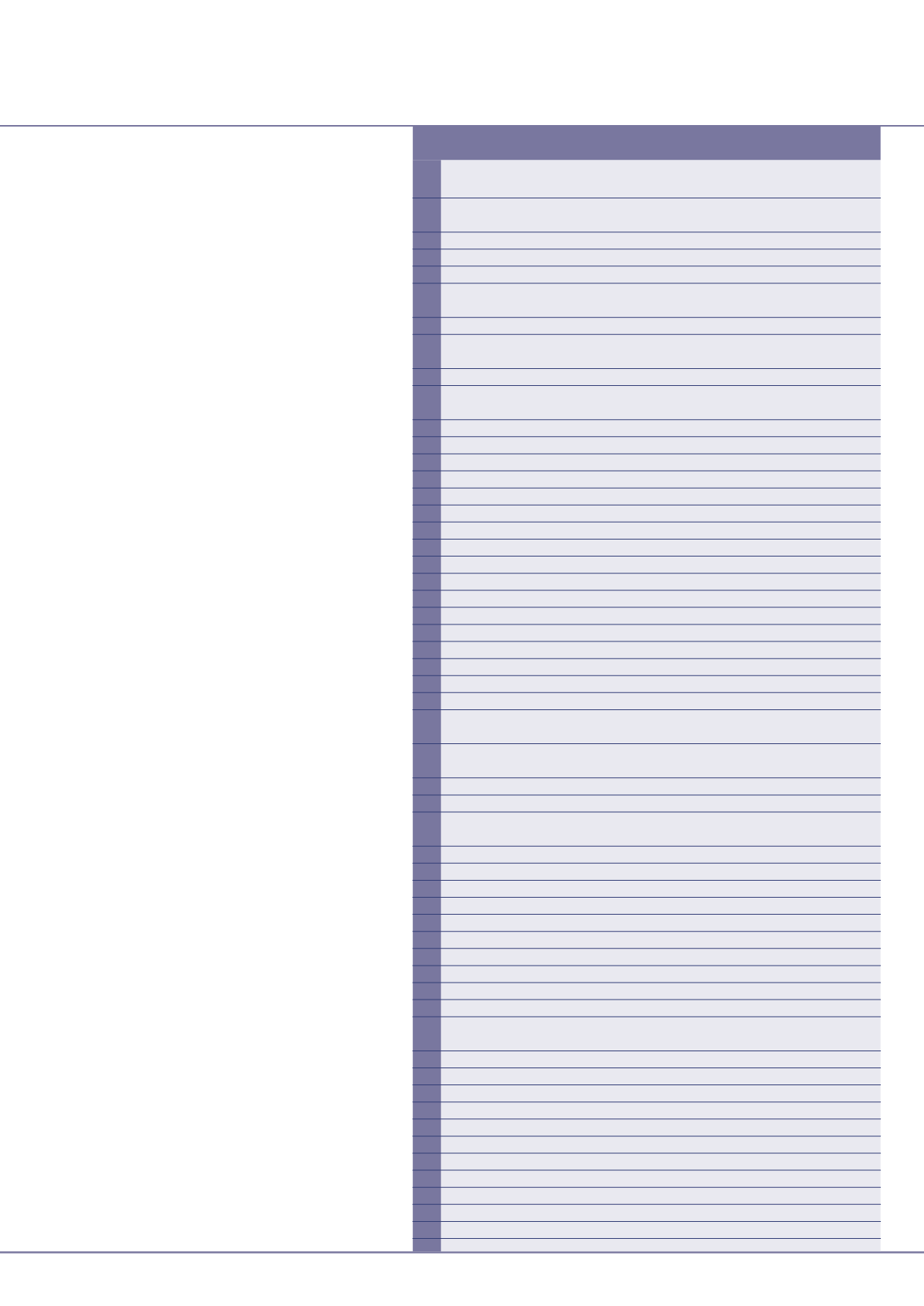

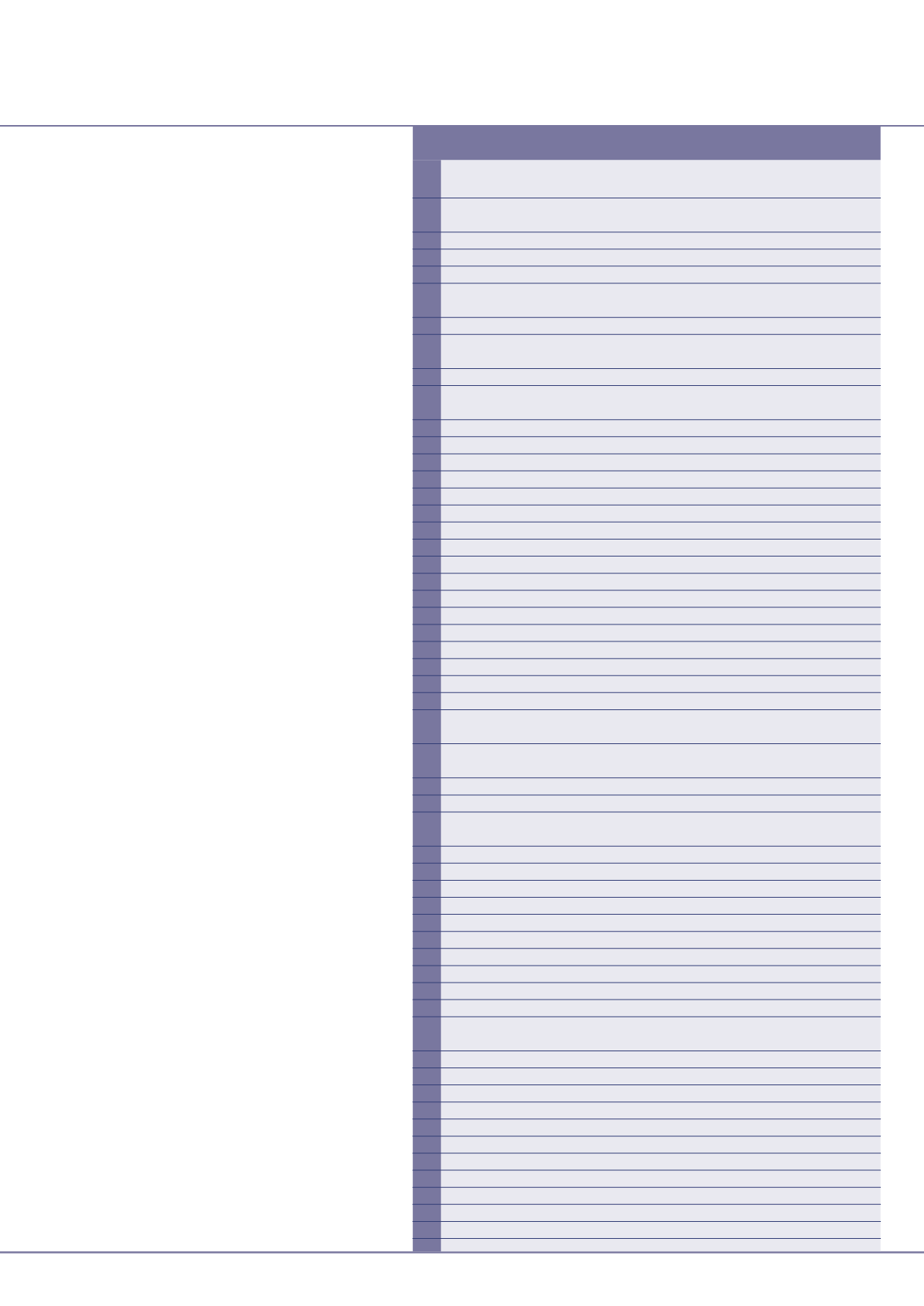

Sales Company

Country 2012 Change

Website

(US$ million)

1

88107

China State Construction

China

1

& Engineering (CSCEC)

*

2

74787

China Railway Construction

China

2

Corporation

3

74646

China Railway Group

China

3

4

49653

Vinci

France

4

5

49347

ACS

Spain

6

1

6

45875

China Communications

China

5

1

Construction

7

37900

Bechtel

US

9

2

8

33508

Bouygues’ Construction

France

8

Divisions

9

32809

Hochtief

Germany

10

1

10

28506

China Metallurgical

China

7

3

Group (MCC)

11

27577

Fluor

US

11

12

25146

Daiwa House

Japan

12

13

20210

Sekisui House

Japan

15

2

14

19562

Leighton Holdings

Australia

13

1

15

19045

Skanska

Sweden

17

2

16

18597

Kajima Corporation

Japan

18

2

17

18137

Obayashi

Japan

24

7

18

18029

Eiffage

France

14

4

19

17739

Taisei Corporation

Japan

22

3

20

17733

Shimizu Corporation

Japan

21

1

21

17182

Saipem

Italy

20

1

22

16686

Strabag

Austria

16

6

23

16051

Sinohydro

China

19

4

24

14333

FCC

Spain

23

1

25

13814

Balfour Beatty

UK

25

26

12498

Takenaka Corporation

Japan

27

1

27

12036

Lend Lease

Australia

37

10

28

11833

Hyundai Engineering &

South Korea 29

1

Construction

29

11804

Shanghai Construction

China

26

3

Group

30

10973

URS Corporation

US

35

5

31

10936

Bilfinger

Germany

28

3

32

10904

Construtora Norberto

Brazil

39

7

Odebrecht

*

33

10894

Jacobs Engineering

US

31

2

34

10544

Technip

France

36

2

35

10381

Peter Kiewit*

US

33

2

36

10187

Larsen & Toubro E&C

India

45

9

37

10160

Samsung Engineering

South Korea 42

5

38

10003

Abengoa

Spain

34

4

39

9878

Ferrovial

Spain

32

7

40

9516

Bam Group

Netherlands 30

10

41

9106

Daelim

South Korea 49

8

42

9017

Acciona

Spain

38

4

43

8549

Doosan Heavy Industries

South Korea 47

4

& Construction

44

8436

China Railway Erju

China

41

3

45

8426

NCC Group

Sweden

44

1

46

8250

GS E&C

South Korea 43

3

47

8093

SNC-Lavalin

Canada

48

1

48

7921

KBR

US

40

8

49

7822

JGC

Japan

51

2

50

7458

Aker Solutions

Norway

56

6

51

7303

Daewoo E&C

South Korea 58

7

52

7056

Isolux Corsan

*

Spain

82

30

53

6999

Haseko

Japan

59

6

54

6897

Peab

Sweden

53

1