32

Branching out

REGIONAL REPORT: SOUTH AFRICA

international

construction

july-august 2013

electricity utility, Eskom.

The government will also spend ZAR 430 billion (US$ 43

billion) to build schools, hospitals, clinics, dams, water and

sanitation projects. The funds will also go towards expanding

electricity networks and supplying electricity to over a million

new homes, building more courtrooms and prisons and construct

better bus, commuter rail and road links, according to Finance

Minister Pravin Gordhan. These projects will mostly be carried

out through municipalities and provincial authorities

The state utilities also have ambitious projects ahead. Transnet,

for instance, wants to turn the old Durban airport on the

country’s east coast into a new container facility, at a projected

cost of ZAR 100 billion (US$ 10 billion).

Exploratory drilling on the site by Transnet is already underway,

and the first phase is expected to be completed by 2019. By 2036,

it will have a 16-berth container terminal that can handle 9.6

million standard twenty-foot equivalent units (TEUs).

A project of this size and complexity will put South African

companies to the test, which will offer opportunities for

international companies, says Andrew Robinson, head of the

Admiralty and Shipping department at Norton Rose Fulbright

South Africa.

“There are not many people here with experience in this sort

of thing,” said Mr Robinson. “It will require special skills, such

as understanding how concrete and sea-water react to each other

over long term. It will also involve a huge amount of excavation.

So a lot of overseas companies are watching with interest, and

some have already begun setting up offices here.”

He added that foreign entrants to the

South African market will have a steep

learning curve. By law, all government

contracts require the winning bidder to

include black equity partners. While local

companies have adapted their operating

models to include black participants, first

time entrants to the market will have to

figure their way through the process – a

daunting prospect for many.

Another hurdle is the glacial pace at

which these projects get signed off. “We

hear a lot of talk but as yet these projects

are not coming to fruition,” Ms Dlamini

noted.

Funding is the biggest fence to be

cleared, but private sector asset managers

C

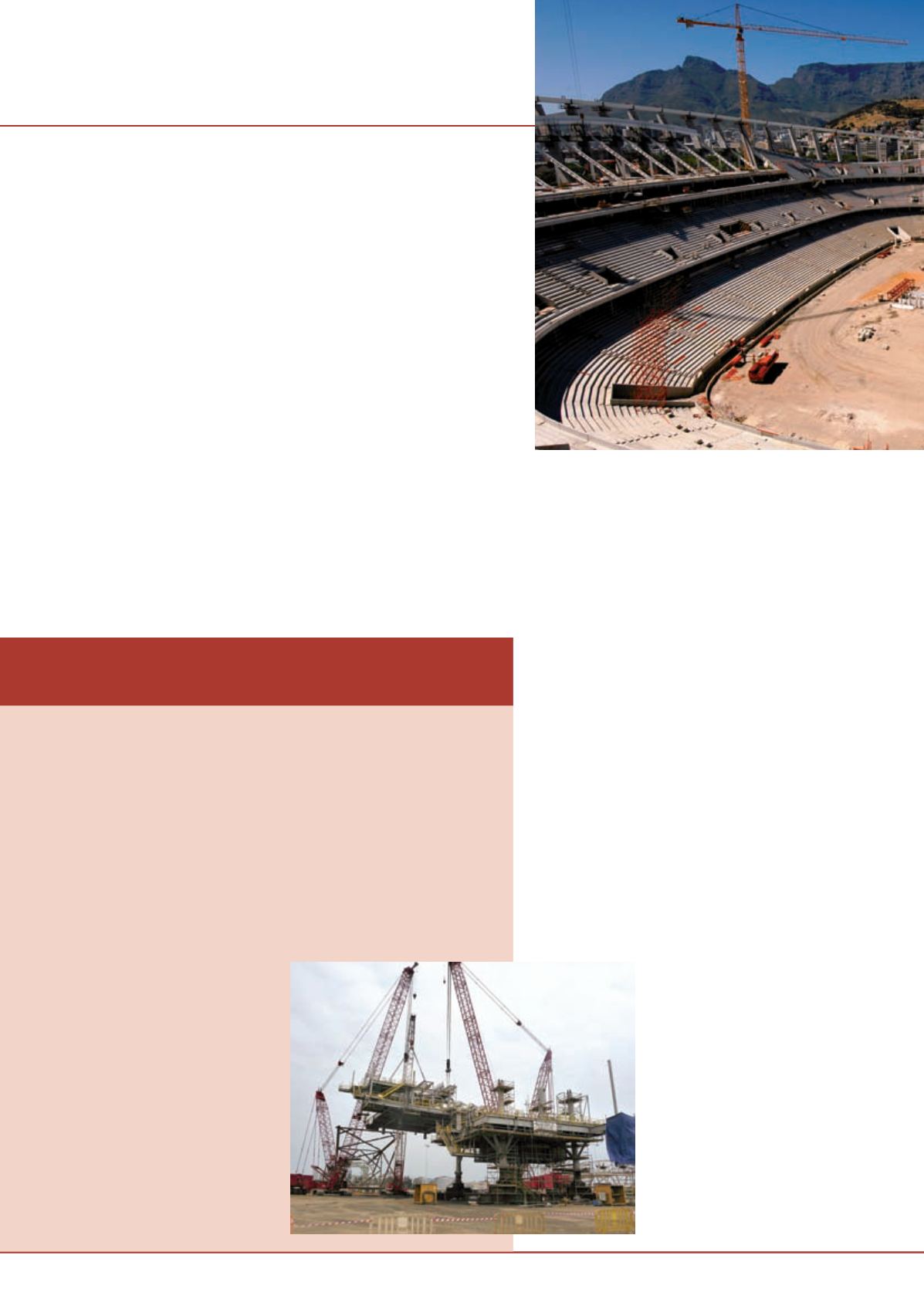

ontractor Sonamet owns a fleet of 13 Manitowoc crawler cranes that are

challenged to work round the clock in Lobito, on the coast of Angola. The oldest

model – the 4000 WV – dates back to 1967, and works alongside the newest

18000 from 2011.

Sonamet is a joint venture between Subsea 7, a seabed-to-surface engineering,

construction and services contractor to the off-shore energy industry, and Sonangol, an

Angolan hydrocarbon company,

The cranes lift loads of up to 550 tonnes for the assembly of oil platforms and other

underwater/ offshore infrastructure. Conditions are tough, with the coastal location

increasing the potential for rust build-up and the entire 80 ha site is almost completely

covered in sand. On-site engineers, who were trained by Manitowoc Crane Care, perform

routine maintenance and regular checks to ensure the sustained performance and

longevity of the cranes.

Alexander Arsie, operations, yards and

assets manager at Subsea 7, said, “We

fabricate a lot of different and very large

structures so we need adaptable machines

that can be set up quickly and perform

effectively. The cranes adapt well to the

work. The older machines are put through

their paces and manage to keep up with

their younger, more modern colleagues.”

The 18000 is fitted with the MAX-ER

capacity-enhancing attachment that

increases its capacity to 750 tonnes, making

it the most powerful crane on site. The

smallest crawler is a 5500, which offers a

55 tonne capacity. Sonamet regularly uses

the cranes in tandem or in combinations of

up to four to carry out the largest lifts.

Old and new in Angola

A fleet of 13 cranes are put through their paces 24/7 in Lobito

There are however signs of improvement. First National Bank

(FNB) and the Bureau for Economic Research said that their

latest construction confidence index had jumped from 36 index

points in the last quarter of 2012 to 51 points in the first quarter

of 2013. This was the highest reading of the index in four years.

Sizwe Nxedlana, chief economist at FNB, said the surge was a

result of restored profitability in the construction sector.

“Construction firms have been able to restore profitability

following a prolonged period of intense margin pressure,”

Mr Nxedlana said. “However, this could be constrained if

construction activity growth continues at the slow pace seen in

the first quarter of 2013.”

Ms Dlamini added that the numbers appear to reflect the mood

on the ground, “We have not seen this kind of growth for a while

now. We hope this will continue.”

Large projects

Much of the hope is pinned on large state-funded projects. The

ruling African National Congress is under pressure to improve

economic growth and, especially, to create jobs – a quarter of the

country’s working-age population are unemployed.

Last year, it announced an almost ZAR 4 trillion (US$ 400

billion) infrastructure programme to be rolled out over the next

two decades, with almost ZAR 850 billion (US$ 85 billion) to

be spent within the next three years. The projects will be split

between various government departments and state-owned

enterprises, such as logistics company Transnet and national

CREDIT CITY OF CAPE TOWN