9

d

&

ri

MAY-JUNE 2015

100

D&Ri’s

annual ranking

of theworld’s largest

demolition contractors

contains a few

surprises this year.

Lindsay Gale

reports

on the only global

listing covering the

demolition sector

A

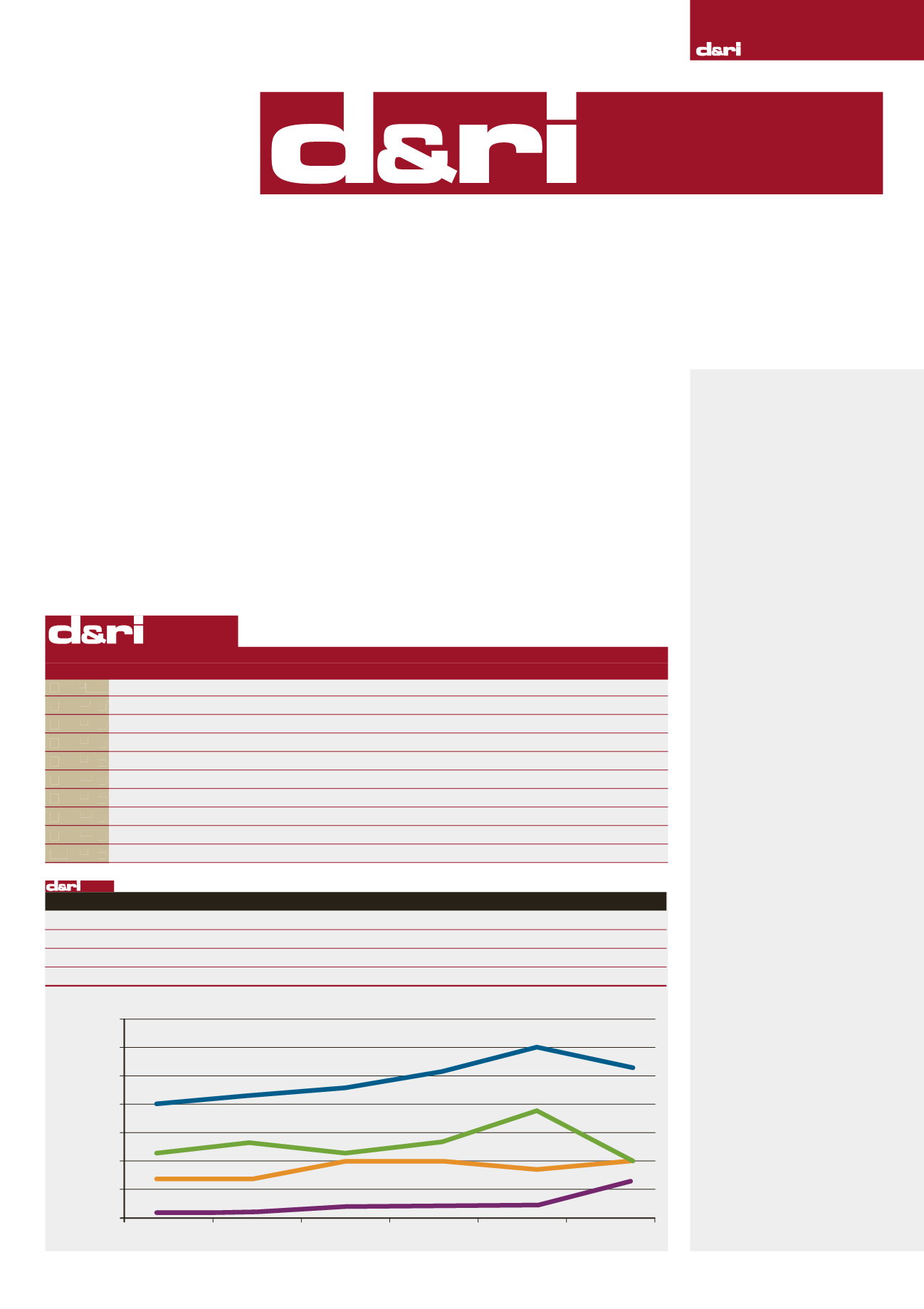

t first glance, the lines

of the graphbelow that

display theperformance

of thedemolition industry

during2014might lead you to

believe that times havebeen very

tough for the sector globally,

with the overall total of the 2015

d

&

ri

100

fallingby11.7%, at

just overUS$5.3billion, from

the corresponding figureof just

in excess ofUS$6billion last

year. Thedatawould also suggest

that it isEuropean contractors

Corrective

action

100

100

100

whohaveborne thebrunt of the

downturn, with this region’s total

fallingby almost 45% toUS$2.06

billion fromUS$3.77billion as

published last year.

Readersmight recall that in

last year’s report on the table,

I perhaps over-confidently

predicted that theUS$6billion

barrierwould againbemore than

comfortablypassed this year –

such is thedanger of committing

oneself inprint!

However, one reasonbehind

Sourcing

the data

As was the case last year,

considerable resources

were devoted to encourage

contractors around the

world to supply basic

financial data concerning

their activities during 2014.

Where we were unable to

obtain information from

companies themselves,

independent financial

reporting services were

consulted to obtain the

necessary data. D&Ri

never makes use of even

informed estimates of annual

revenues in the compilation

of the

d

&

ri

100

.

We have endeavoured to

ensure the accuracy of the

figures used in the creation

of the

d

&

ri

100

ranking

of the world’s top demolition

companies but KHL can

accept no liability for any

errors or inaccuracies

relating to the individual

turnover figures contained in

this report.

D&Ri

would like to

encourage all companies

that receive future requests

for data for inclusion in the

d

&

ri

100

to consider

responding, as the greater

the level of participation

from contractors around the

world, themore accurate

and comprehensive future

listings will be.

Currency

conversion

Data that was supplied to

D&Ri

in currencies other

than in US$were converted

using the relevant exchange

rates as of 6thMay 2015.

YEARONYEAR

2010

2011

2012

2013

2014

2015

d

&

ri

100

4,069.40

4,337.90

4,680.40

5,106.10

6,033.30

5,328.89

Americas

1,439.00

1,454.80

1,938.10

1,991.40

1,732.40

2,023.56

Europe

2,391.30

2,627.70

2,371.40

2,707.60

3,772.00

2,060.54

RoW

228.90

255.40

366.30

407.10

528.60

1,244.79

7,000.00

6,000.00

5,000.00

4,000.00

3,000.00

2,000.00

1,000.00

0

US$M

2010

2011

2012

2013

2014

2015

1

(-)

NorthStar

New York

USA

479.70

2

(6)

▲

Keltbray Ltd

Esher

UK

236.50

239.96

3

(4)

▲

Brandenburg Industrial Services Co

Chicago

USA

189.80

215.10

4

(3)

▲

Penhall

Anaheim

USA

136.50

202.58

5

(7)

▼

Wanty SA

Binche

BELGIUM

184.40

168.30

6

(17)

▲

DHGriffinWrecking Co Inc

Greensboro

USA

109.40

153.00

7

(8)

▼

Eurovia Beton GmbH

Magdeburg

GERMANY

168.00

149.51

8

(13)

▲

Erith Group

Erith

UK

124.40

145.01

9

(21)

▲

Cherry Demolition

Houston

USA

95.00

127.50

10

(9)

▼

McGee Group Ltd

London

UK

156.90

123.14

POSITION

TURNOVER (US$)

15

(14)

COMPANY NAME

LOCATION

2013

2014