14

MAY-JUNE 2015

d

&

ri

100

and again it is thosedown the

peckingorder that seem tohave

undergone this experience.

Despite the above, the

turnover of the company in

100thplace in the list has actually

fractionally increased against last

year’sUS$13.70million, with the

UK'sHughes&Salvidgeholding

that positionon a reported

turnover ofUS13.88million.

ON THE UP

In this year’s listing, as indicated

above, aminority (39) of

contractors saw growthduring

2014. Inmany cases, thiswas

relatively small, but one star did

emerge inBrazilian contractor

FabioBruno, who saw revenue

increaseby247% toUS$50.71

andwhomade thebiggest leapup

the table fromposition73 to29.

Taken together, the growth

seenby thesewell-performing

contractors has beenunable to

counteract thenegative effects

of the results from their less

fortunate fellows, and results in

the

d

&

ri

100

showing amajor

fall that has been exacerbatedby

our repositioningof the listing.

Nevertheless, the fact remains

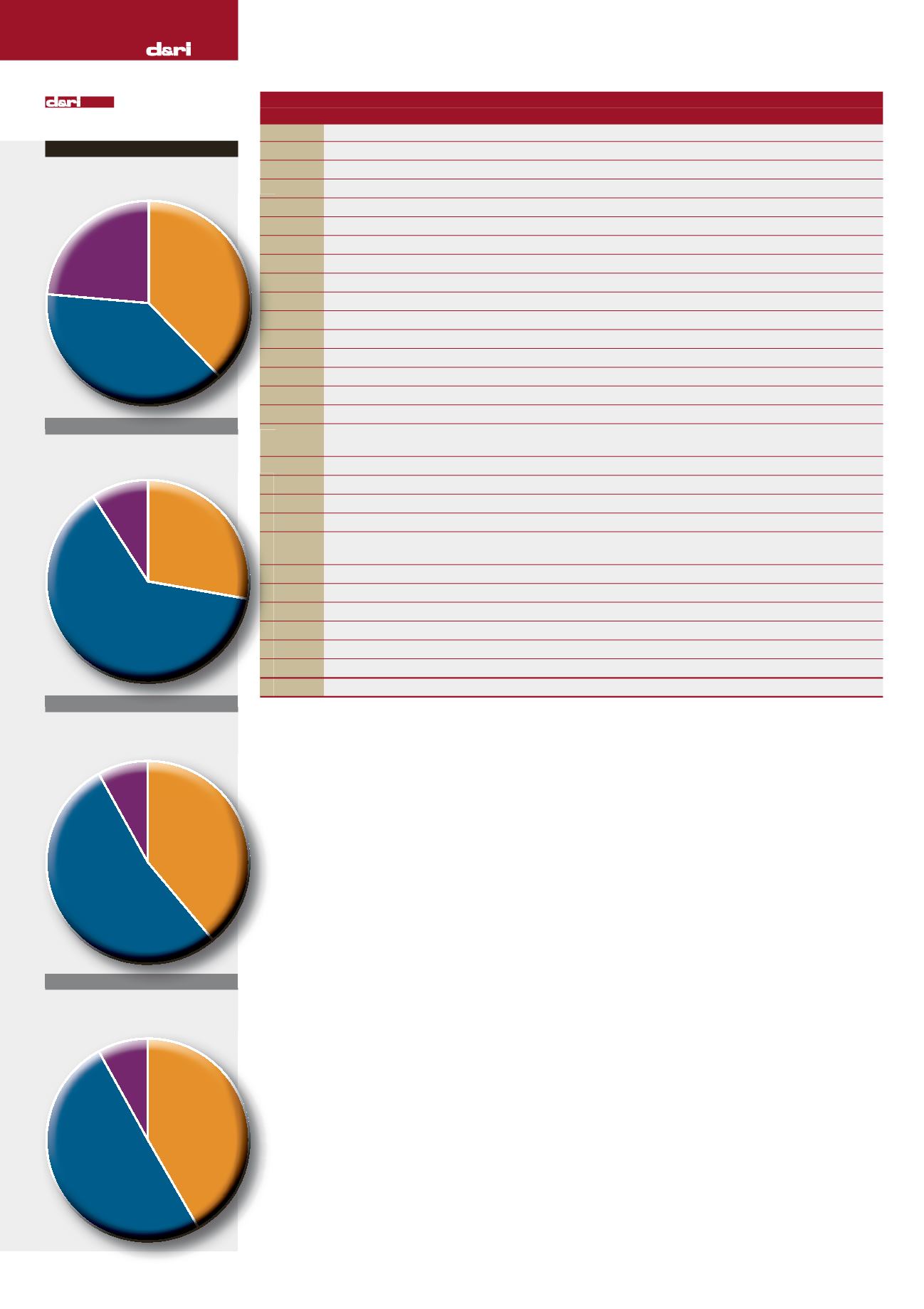

REGIONAL

BREAKDOWN

2013

2014

2015

Total Revenue

US$5,117.9

Total Revenue

US$6,007.30

Total Revenue

US$5,328.89

2012

Total Revenue

US$4,693.5

2

RoW

8%

North

America

39%

Europe

53%0

North

America

42%

RoW

8%

Anumber of theothers return

as part of another initiative

undertaken this year.Wehave

always been aware that the

Japanesedemolition industry

has beenunder-reported in

recent years. Language issues

and thedifficulty inobtaining

thenecessary figureswere the

cause of this. This year, we

weredetermined that amajor

effort bemade to correct this

situation, and the result of these

efforts sees a total of seven

Japanese contractors return to

themain list, with a further three

appearing just outside.

Thishas alsohad thenatural

effect of substantially increasing

the share that ‘Rest of the

World’ contractors’ occupyof

the

d

&

ri

100

‘pie’ to23.5%

from last year’s somewhat paltry

8.5%. Indeed, for the first time

in the listing’shistory, the ‘Rest

of theWorld’ total comfortably

passes theUS$1billionmark.

I am confident that thismore

accurately reflects the scaleof the

industryoutside theAmericas

andEurope, and effortswill be

maintained to ensure that this

remains the case in futureyears.

■

that the

d

&

ri

100

total still

exceeds thehighpoint in2008

before the effects of the credit

crunch fullykicked in and

caused the global financial crisis

that had such an impact of the

world’s construction industry.

Only theEuropean industry

appears tohave fallenbelow this

benchmark, with2008 seeing a

total revenueofUS$2.4billion

for those listed in these region,

someUS$300millionmore than

the corresponding figure for this

year.

NEW PLAYERS

A total of 21names arenew to

the list this year or have returned

after varying length absences.

Topof thepile is of course

NorthStarGroup, which is the

result of themerger of LVI and

NCMGroup reportedon in a

past issue.

At that time,

D&Ri

did suggest

that the combined reported

turnovers of the two companies

would likelymake it theworld’s

largest singledemolition and

remediation contractor, and the

numbers this year do appear to

bear this out.

100

2

RoW

9%

North

America

28%

Europe

63%

North

America

37%

RoW

23%

Europe

38%

>

16

73

(77)

▲

Marto Fils SA

MitryMory

FRANCE

19.40

20.62

74

(-)

Uchimura Kogyo KK

Tokyo

JAPAN

20.53

75

(71)

▼

Cantillon

London

UK

22.00

19.90

76

(80)

▲

Break Thru Enterprises Inc

Lombard

USA

18.10

19.20

77

(-)

WMDickson Co

USA

19.10

78

(-)

Nagaisangyou Co Ltd

Tokyo

JAPAN

18.54

79

(78)

▼

Armac Group

Coventry Road UK

18.40

18.34

80

(-)

MGL Demolition

Durham

UK

18.25

81

(95)

▲

777Demolition Ltd

Worcester

UK

15.30

18.08

82

(83)

▲

Boverhoff Sloopwerken BV

Heerde

NETHERLANDS

17.80

18.07

83

(74)

▼

Central Demolition Ltd

Bonnybridge

UK

20.30

17.62

84

(90)

▲

A&SBetondemontage

Lehrte

GERMANY

16.80

17.58

85

(66)

▼

Enterprise Ferrari

Wittlesheim

FRANCE

23.00

17.53

86

(62)

▼

Vlasman Betonbewerkings

AlpenaandenRijnNETHERLANDS

25.10

17.53

87

(-)

Bond Demolition

Caerphilly

UK

17.01

87

(77)

▼

Robinson &Birdsell Ltd

Wetherby

UK

18.90

17.01

89

(99)

▲

Johannes Landwehr

Clarholz

GERMANY

14.60

16.97

Abbruchunternehmen GmbH

90

(100)

▲

National Wrecking Co.

Chicago

USA

13.70

16.80

90

(55)

▼

Potts &Callahan Inc

Baltimore

USA

28.00

16.80

92

(-)

GBMDemolition

Louth

UK

16.71

93

(92)

▼

Durr Heavy Equipment Inc

Harahan

USA

16.70

16.50

94

(-)

WilliamMunro Construction

Alness

UK

16.25

(Highland) Ltd

95

(94)

▲

M&MContracting Inc

San Antonio

USA

15.70

16.10

96

(-)

▲

Plannerer GmbH&Co Kg

Pullenreuth

GERMANY

7.20

15.80

97

(72)

▼

Mrózek a.s

Bystrice

CZECHREPUBLIC

21.20

15.59

98

(93)

Rivners AB

Skogas

SWEDEN

16.20

15.00

99

(96)

▼

Dore &Associates Contracting Inc

Bay City

USA

15.20

14.32

100

(31)

▼

Hughes & Salvidge Ltd

Portsmouth

UK

60.50

13.98

5,328.89

POSITION

TURNOVER (US$)

15

(14)

COMPANY NAME

LOCATION

2013

2014