BUSINESSHIGHLIGHTS

US

Aecom goes buying

ConsultantmakesUS$4billion offer for URS and

also snaps upHunt ConstructionGroup

E

ngineering design company Aecom has agreed to acquire fellowUS

consultant engineer URS Corporation for US$ 4 billion in cash and

shares.Aecomwill alsoassumeURS’sdebt, taking the total transaction

value to someUS$6billion.

Under the terms of the deal, Aecom will pay US$ 56.31 per URS share,

which represents a 19% premium on the 30-day average share price leading

up to the merger announcement on July 11. This will be made up of

US$33.00 in cash and0.734Aecom shares.However,URS shareholders can

elect to receive all cashor all shares for their existing stock. Aecom said itwas

aiming for anoverallmix of 59% cash and41% shares in the transaction.

In a separate deal, Aecom has acquired the US$ 1.2 billion per year

constructionmanager Hunt ConstructionGroup.The value of the deal for

the privately-held companywas not disclosed.

Hunt is best known as a builder of stadiums and other sports facilities.

However, it is also active in the health care, aviation, commercial and tall

buildings sectors.

The addition of both companies to Aecomwill give it annual revenues in

the regionofUS$20billion, with95,000 employees in150 countries.

UK

Stalledmerger

Balfour Beatty has rebuffed three

takeover offers from UK rival

Carillion. Although talks were

initially

constructive,

Balfour

Beatty’s proposed sale of itsUS arm,

Parsons Brinckerhoff, emerged as a

deal-breaker. Carillion’s final offer

valued Balfour Beatty at just over

UK£2billion (US$3.3billion).

Balfour Beatty is the UK’s

largest contractor. It was ranked

no. 9 in

Construction Europe’s

CE

-

100 ranking of Europe’s largest

contractors and no. 26 in (

iC’s

)

ranking of the world’s top 200

construction companies. Carillion

was no. 25 in this year’s

CE

-100 and

no. 70 in the

iC

Top200.

Brazil

Cement sales

Holcim and Lafarge have proposed

selling three integrated cement

plants, two grinding stations and a

ready-mixed concrete plant inBrazil

to help win regulatory approval for

their plannedmerger.

The proposal has been put to

Conselho Administrativo de Defesa

Econômica (CADE) as part of pre-

merger negotiations and will now

be subject to review and further

discussion.

In a separate development Lafarge

has agreed to sell its controlling

stake in Lafarge Pakistan Cement

to Bestway Cement for US$ 329

million. Lafarge Pakistan Cement

is quoted on the Karachi, Lahore

and Islamabad stock exchanges, and

Lafarge is selling its 75.86% stake in

the business.

US

Mining impact

Caterpillar had revenues of US$

14.2 billion for the second quarter

of the year, a -3% decline on the

same period last year. Although

the company’s sales of construction

equipmentwereup+11%compared

to a year ago, it was a weak quarter

for theResources Industriesdivision,

which is focussed on the mining

sector.The company’s net profit for

thequarterwas up+4%on the same

period last year atUS$999million.

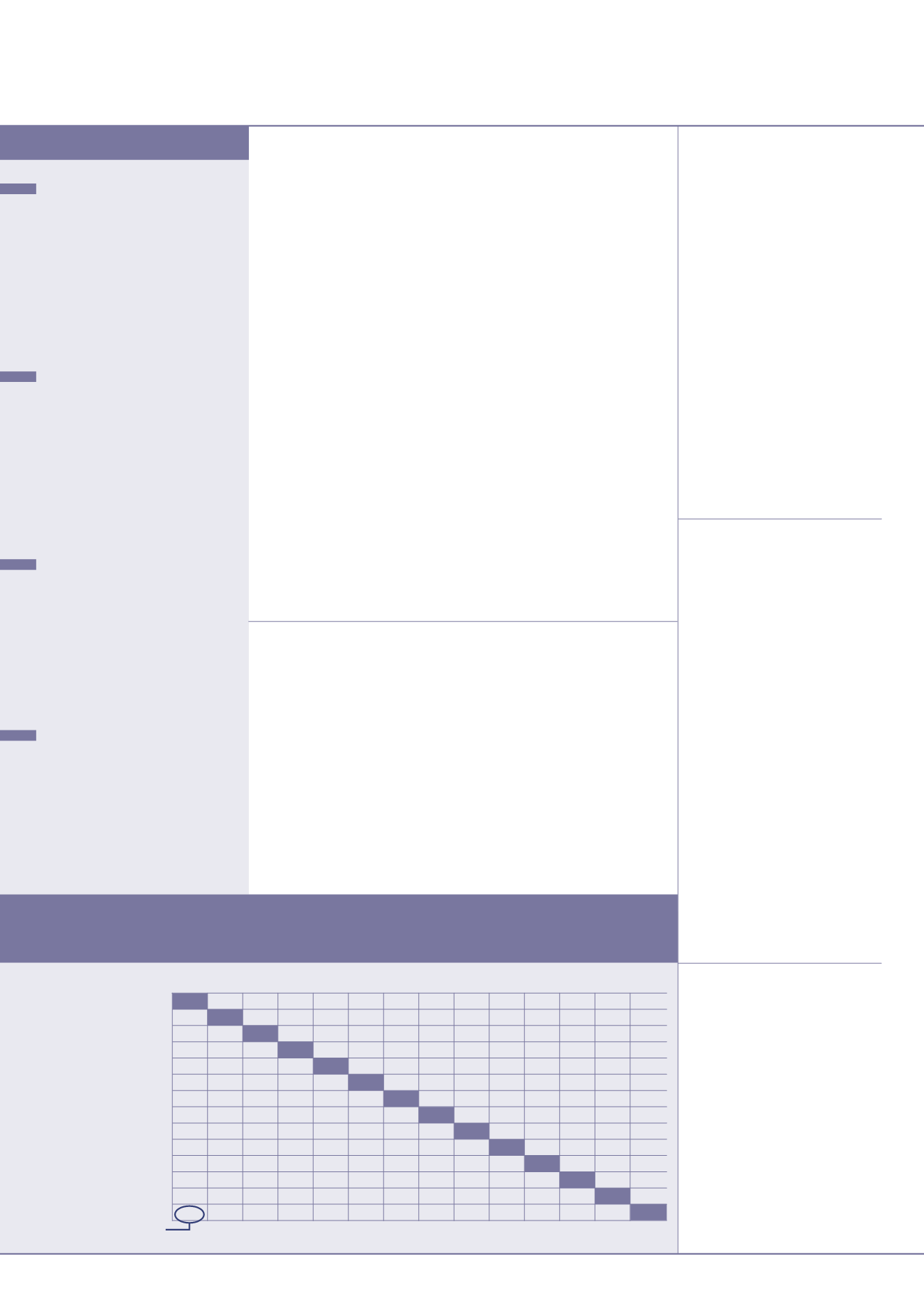

VALUEOF 1:

SYMBOL AU$

BRL

UK£ CNY

€

INR

YEN MXN RUR SAR

ZAR KRW CHF

US$

AustralianDollar

AU$

0.47 0.564 5.75 0.708 56.4

97

12.26 33.8

3.50

9.99

950 0.857 0.935

BrazilianReal

BRL

2.12

0.266 2.71 0.334 26.6

45.8

5.77

15.9

1.65

4.71

447 0.404 0.440

BritishPound

UK£

1.77

3.76

10.2

1.26 100.1 172

21.7

59.9

6.21

17.7

1684 1.52

1.66

Chinese Yuan

CNY

0.174 0.369 0.098

0.123 9.81

16.9

2.13

5.87 0.609 1.737

165 0.149 0.162

Euro

€

1.41

3.00

0.80

8.12

79.7

137

17.3

47.7

4.95 14.10 1341 1.21

1.32

IndianRupee

INR

0.018 0.038 0.010 0.102 0.013

1.7

0.217 0.598 0.0621 0.177 16.8 0.0152 0.0166

Japanese Yen

YEN

0.010 0.022 0.006 0.059 0.007 0.580

0.1260 0.347 0.0360 0.1027 9.8 0.0088 0.0096

MexicanPeso

MXN

0.082 0.173 0.046 0.469 0.058 4.60

7.93

2.75 0.286 0.815

77

0.070 0.0762

RussianRuble

RUR

0.030 0.063 0.017 0.170 0.021 1.67

2.88 0.363

0.104 0.296 28.1 0.0254 0.0277

Saudi Riyal

SAR

0.285 0.606 0.161 1.641 0.202 16.107 27.760 3.499 9.635

2.85

271 0.245 0.267

SouthAfricanRand ZAR

0.100 0.213 0.056 0.576 0.071 5.650 9.738 1.227 3.380 0.351

95

0.086 0.094

SouthKoreanWon KRW

0.0011 0.0022 0.0006 0.0061 0.0007 0.0594 0.1024 0.0129 0.0356 0.0037 0.0105

0.00090 0.0010

Swiss Franc

CHF

1.17

2.48

0.66

6.71

0.83 65.87 113.52 14.31 39.40 4.09 11.66 1108

1.091

USDollar

US$

1.07 2.272 0.604 6.155 0.758 60.4 104.1 13.12 36.13 3.75 10.69 1016.12 0.917

For exampleUS$ 1=AU$ 1.07

Exchange rates: August 2014

UK

Miller Group has agreed to sell its

UK£ 409million (US$680million) per

year construction division to domestic

rival Galliford Try for UK£16.6million

(US$ 27.7million). The deal will

include the business’s cash balance

of UK£ 23million (US$38.3million),

meaningMiller is effectively paying

Galliford Try to take this loss-making

division off its hands.

GERMANY

Road building equipment

manufacturerWirtgen has bought

a 70% stake inBenninghoven, a

privately-owned, Germany-based

maker of asphaltmixing plants.

Wirtgen–which also owns the Vögele,

Hamm andKleemann construction

equipment brands – said adding

Benninghoven complimented its

existing portfolio.

RUSSIA

Rasperia Trading, a

subsidiary of Russian businessman

OlegDeripaska conglomerateBasic

Element has increased its shareholding

inStrabag from 19.4% to 25% plus

one share. The

€

123million (US$ 164

million) deal takes Basic Element’s

interest inStrabag back to the level it

was at in early 2009.

PORTUGAL

ContractorMota-Engil

has suspended the initial public

offering (IPO) of shares in its subsidiary

Mota-Engil Africa due toweakening

stockmarket conditions. The London,

UK floatation could have netted it

UK£405million (US$700million) had

all the shares been subscribed at the

top of the price range.

international

construction

september 2014

BUSINESSNEWS

10

UK

Arcadis beatsNipponKoei to get Hyder

Arcadis has agreed tobuyUK-based

engineer Hyder Consulting for

UK£ 288 million (US$ 489

million). The Dutch company had

to increase its initial offer followinga

rival bid from Japan’s NipponKoei.

Hyder’s Board has recommended

the increasedoffer to shareholders.

The end of July saw Arcadis offer

UK£6.50 (US$11.00) per share for

Hyder, valuing it UK£ 256 million

(US$435million).Thiswas topped

just over a week later whenNippon

Koei came in with a UK£ 6.80

(US$ 11.56) per share offer. Arcadis

has now come back to the table

with a UK£ 7.30 (US$ 12.41) per

share offer, which values Hyder at

UK£ 288 million (US$ 489

million), amore than+12% increase

on its original bid, or an additional

UK£32million (US$54million).