15

ECONOMICOUTLOOK

Slow recovery

september 2014

international

construction

>

Slow recovery

The construction outlook for Europe is brightening, but there is a contrast between strongermarkets

in the north and theweakness still present in southern countries.

Scott Hazelton

reports.

T

he Euro zone’s economic recovery will

remain gradual, with tensions in Ukraine

and theMiddle East adding uncertainty to

an already difficult economic environment. Real

GDP looks to be growing at only lacklustre rates

this year.

Although there has been an improvement for

Spain, there is weakness in Belgium and Italy.

Even Germany is now showing only marginal

gains, despite a strong first quarter. On the plus

side,Eurozoneunemploymenthasdipped slightly

and employment and real wages are rising a little.

The Purchasing Managers’ Index (PMI) for

manufacturing suggests that output growth has

slowed and new order growth has stabilised.

IHS Global Insight expects further depreciation

of the Euro, which will improve manufacturing

competitiveness.

On the other hand, the services PMI has

climbed, reinforcing hopes that economic growth

is gaining traction. Since European economies

are typically more dependent upon services than

manufacturing, this is goodnews for construction

on balance. Low inflation suggests that the

European Central Bank (ECB) can sit tight and

wait for interest rate cuts and liquidity measures

to take effect, although further easing is unlikely.

On balance Euro zone real GDP is expected

to increase +1.0% in 2014, improving to +1.5%

in 2015 and +1.6% in 2016 with better than

expected prospects for Spain being offset by

weaker prospects for Italy andFrance.

By contrast, the UK economy is performing

well, with consumer spending and business

fixed investment driving growth. While the

manufacturing PMI confirmed a loss of

momentum, the PMI for the dominant services

sector showed buoyant growth for output,

incomingnewbusiness and employment.

Importantly for construction, the business

investment outlook is favourable, supported by

companies’ healthy cash positions, improved

profitability and easing credit conditions.

Businesses are currently investing to improve

productivity and develop new markets and

products. Over time, there will be an increasing

need to add capacity.

With this strength, the Bank of England is

likely to raise interest rates in the comingmonths.

Increases will be gradual, however, as the central

bank gauges the impact of rising rates in an

environment of high debt burdens and a strong

currency. IHSGlobal Insight’s UKGDP outlook

is for +3.1% growth this year, +2.8% in 2015

and +2.7% in 2016 – nearly twice the Euro zone

performance.

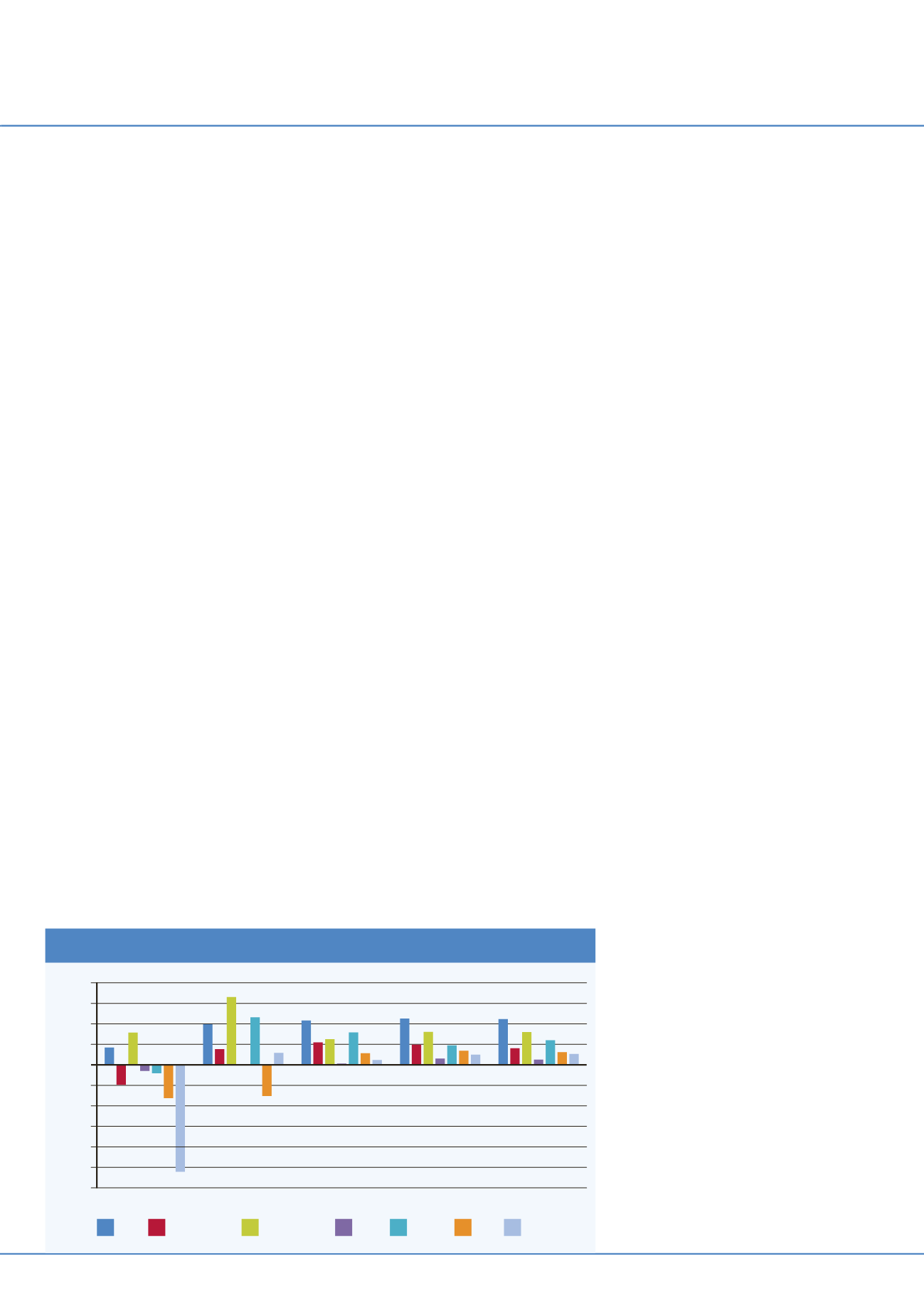

Constructiongrowth

Given thiseconomicoutlook, theview forWestern

Europe construction is one of improvement, but

with anaemic growth. After years of contraction,

total construction spending will expand +1.5%

in 2014 and offer about +2.2% growth over the

following three years.

Infrastructure spending provides most of the

impetus, as theneed for fiscal austeritydiminishes

and countries need to catch up on deferred

projects. Turkey, Germany and the UK lead

growth in this segment, but their growth rates are

not much higher than in recent years. The real

turnaround in infrastructuregrowth for the region

is a return tomarginal growth (or at least smaller

declines) in Greece, Ireland, Portugal and Spain

after the collapse seen in the crisis years.

While uninspiring in the early years of this

forecast, the non-residential structures segment

will goon to see the strongest growthwith average

annual increasesof+2.3%, over thenextfiveyears.

Over the same period, residential construction

will grow at only +1.8%.

Germany (+3.9%)offers thebestnon-residential

structures outlook in the near and medium

terms, withmost of its strength coming from the

manufacturing sector, although Germany will

also leadEuropean growth in the commercial and

institutional segments.

The UK (+3.8%) offers the second largest

growth innon-residential structures andoffers the

strongest growth inEurope in the office sector. A

further indication of the turnaround inEurope is

Ireland, with the fifth highest growth (+3.0%),

behindSweden (+3.4%) andTurkey (+3.3%).

Turkeyhasbecomeoneofthemoredisappointing

economies in Europe as political dysfunction has

increased risk and decreased interest in capital

expenditures, particularly from foreign investors.

Residential outlook

At +4.8%, the UK will be the leader as far as

residential construction growth is concerned,

followed by Turkey (+4.7%). Part of the UK

growth is a price effect, but the country is also

benefitting from housing policy decisions and

sustained economic growth that encourages

residential investment.WhileTurkey has become

less attractive as an investment economy, it still

offers Europe’s most attractive demographic

profiles and improving personal incomes.

On the other hand, residential overhang

remains in Spain, while fiscal policy and a lack of

consumer confidence is dragging on residential

construction inGreece andPortugal.All threewill

continue to contract in the near term, and even

five years from now will have smaller residential

construction sectors than they do today. While

Ireland is improving innon-residential structures,

it will take time for that to filter through to

consumers, and it will also see further residential

sector contraction.

Scandinavia will enjoy moderate growth in the

+2% to +2.5% range, although Norway will be

Total construction growth forecasts

2013

2014

2015

Average2013-2018 Average2018-2023

World WesternEurope

UnitedKingdom France

Germany

Spain Italy

8%

6%

4%

2%

0%

-2%

-4%

-6%

-8%

-10%

-12%