international

construction

september 2014

REGIONALREPORT

22

Light at the end of the tunnel

includes the high-speed rail link from Stockholm toLinkoping,

among others.

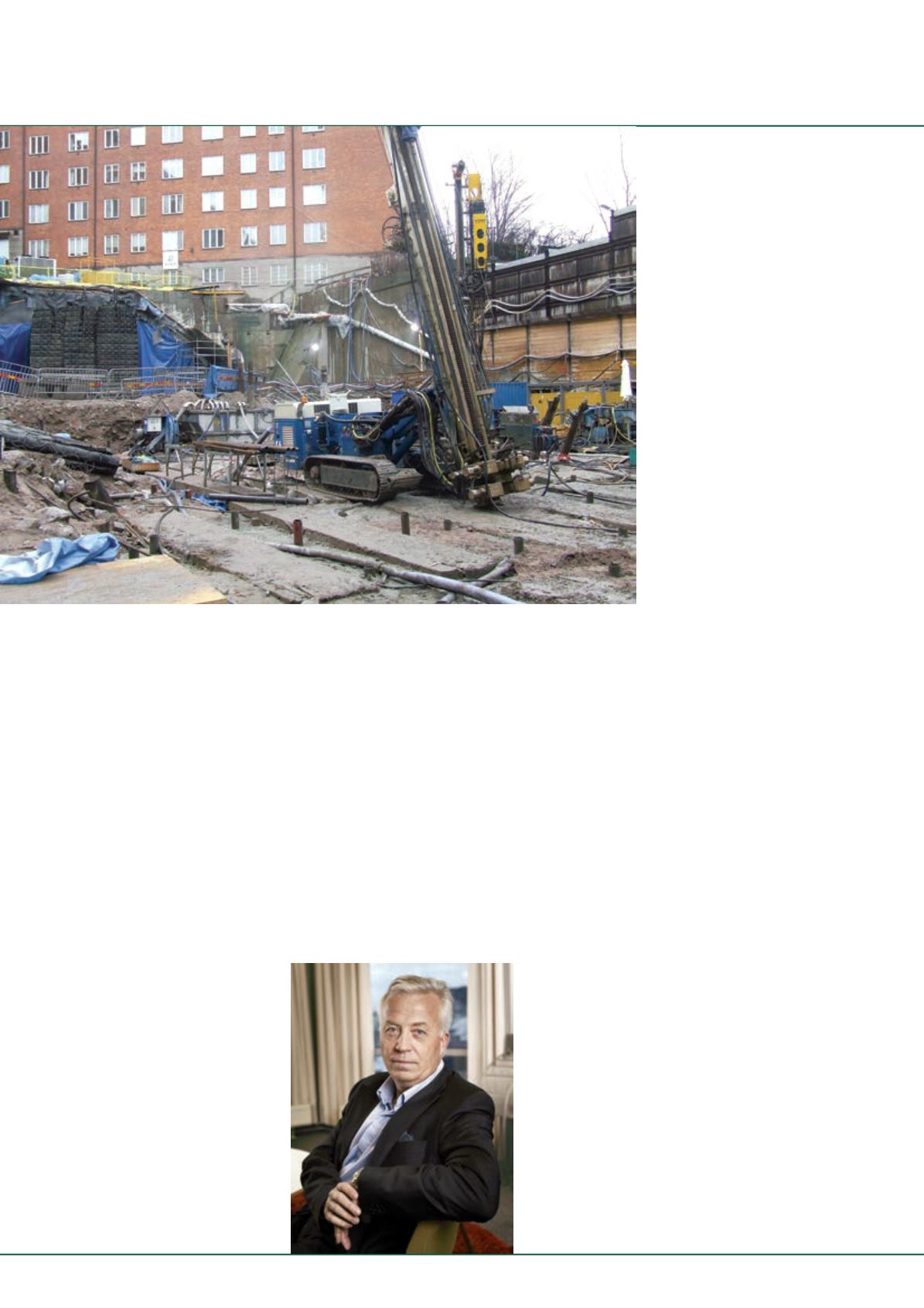

Inaddition,work isunderwayon theStockholmmetro.A6km

commuter rail tunnel is beingbuilt beneath central Stockholm–

the € 1.7 billion (US$ 2.3 billion) Citybanan project.

Weakness remains

In contrast to the strength in the UK, Sweden and Norway,

all of which are outside the Euro Zone, things start to look a

little weaker within the more core European countries, and

particularly towards the South of the region.

In mid-Europe, there are signs that construction growth in

Germany is slowing, even though Europe’s biggest market led

the way out of recession a few years ago and had one of the

region’s bolder national stimulus plans in the crisis years.

Things look even worse in France, where Euroconstruct

says a construction recession has returned, following some

encouraging signs in2011.The organisation says itwill be 2016

before the French construction sector grows again.

France’s economic stagnation provoked

a major schism in the government in

August, with prime minister Manuel

Valls firing almost his entire cabinet

for disagreeing with president François

Hollande’s austerity policies.

The theme of austerity in Europe,

championed by German chancellor

AngelaMerkel, is one that has alsodrawn

criticism from the construction industry.

FIEC vice president Jacques Huilllard

said, “There can be no growth without

investment.The policyof austeritywhich

has been in favour for the last few years

has done enormous damage both to

the real economy in general and to the

construction sector in particular.”

It is certainly true that austerity

measures have bitten into public

construction. FIEC’s figures show that

infrastructure construction was down

-3.7% in Europe last year, while the

value of construction in the public non-

residential segment fell -5.5%. It was

only amore buoyant housing sector that

limited thedecline inoverall construction

output last year to -2.3%.

Undoubtedly the countries that have

suffered the most since the crisis years

have been the Southern peripheral

economies such as Greece, Italy, Spain

andPortugal.

Spain was once considered one of

the ‘Big 5’ construction markets along

with France, Germany, Italy and the

UK. However, six years of double digit

declines have seen construction output

fall to € 65 billion (US$ 86 billion)

last year, according to Euroconstruct,

compared to a pre-crisis high of almost

€ 220 billion (US$ 290 billion) – the

country’s construction market is worth

just 30% of what it was seven years ago.

Having said that, Spain seems to have reached the bottom,

and is showing signs of recovery, and that is stimulating

business. For example, Valero Serentill, regional sales manager

for equipment auction company Ritchie Bros said, “When you

open a newspaper or read the news online, you see signs of

recovery in Spain. The banks report fewer bad loans, GDP is

expected to grow slightly, the tourism industry is still expanding

and government stimulus-packages are rolled out to boost the

industry.”

He said another reason for hope was the changes beingmade

to businessmodels in construction companies.

He added, “Before you can look to the future, youhave to look

closer at thepresent.An important and real change is thatpeople

are getting a grip on the reality of themarket. Step by step you

seebig and small constructionbusinesses all over Spain adapting

their businessmodel to the new needs and opportunities of the

market.”

Figures from Euroconstruct forecast a return to moderate

growth for the Spanish construction market in 2015, with a

similar improvement expected for Italy andPortugal.

But forecasting is of course a dangerous business, and the

circumstances that can change construction’s outlook are

sometimes unexpected and can come around more frequently

than the annual cycle of industry updates.

The European Commission’s statistical service, Eurostat

providesmonthly data, and since the secondquarter of the year,

there has been some suggestion that European construction

growth could be reversing, or even stagnating. Worsening

relations with Russia, insurgency in theMiddle East and other

global concerns are all having an impact on Europe’s weak

economic growth.

As construction output tends to go up and down with the

general economic cycle, there is a concern that even though

these factors are well-removed from the industry itself, they

could be enough to delay the recovery.

iC

Stockholm’s Citibanan project.

Veidekke and

FIEC’s Kjetil

Tonning says of

Norway, “You

knowwhat you

can expect even

if you change the

government.”