IRNAPRIL-MAY 2015

20

ERA/

IRN

RENTALTRACKER

Lower

Same

Higher

Balanceof opinion

Q1-15

+30.5%

45.2%

40.2%

14.6%

Q1-15

+13.4%

35.4%

42.6%

22.0%

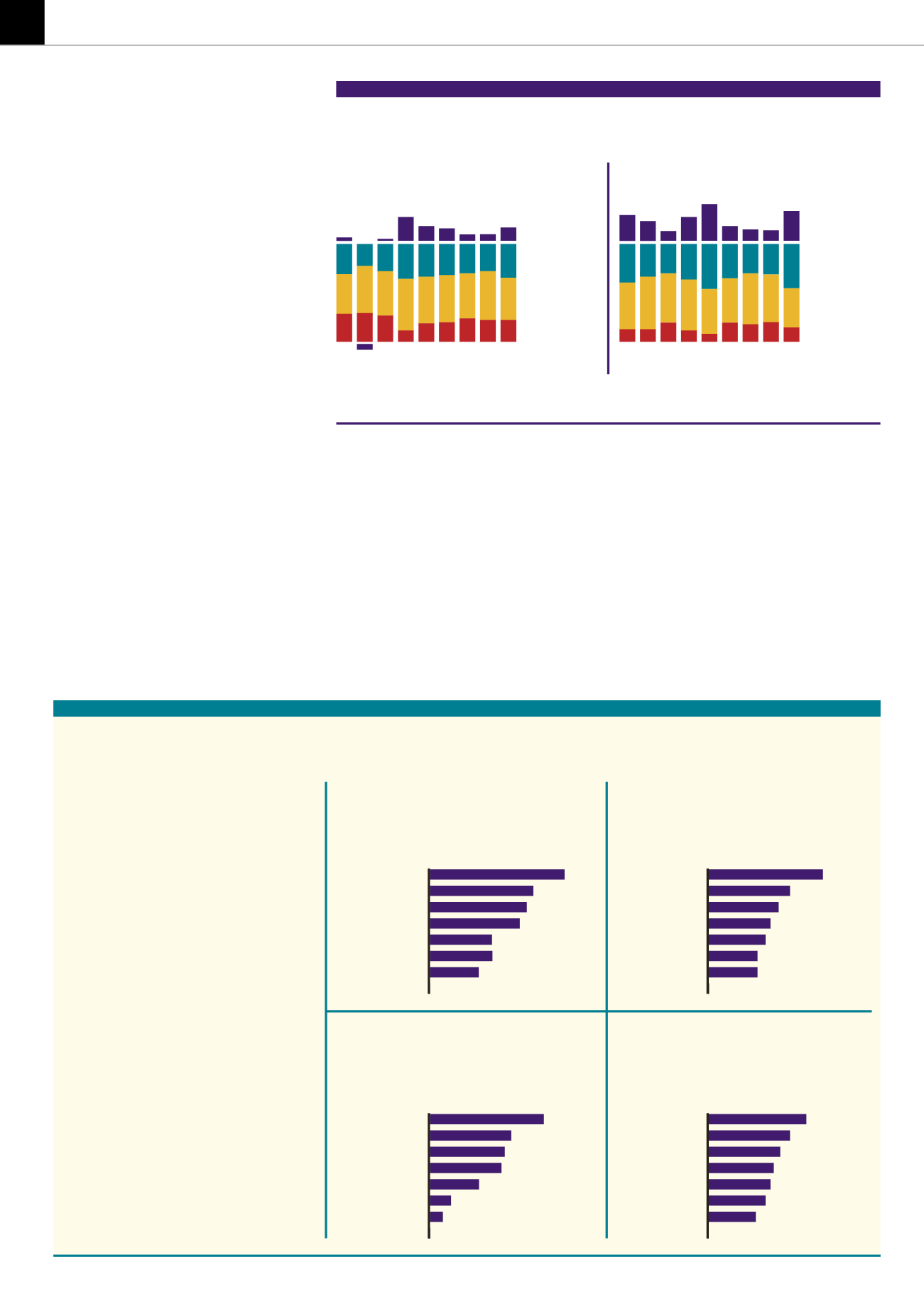

FIGURE 3

Europe: Fleet investment

THISYEAR

NEXTYEAR

Q1/13

Q1/13

Q1/14

Q1/14

Q3/13

Q3/13

Q2/13

Q2/13

Q3/14

Q3/14

Q1/15

Q1/15

Q4/14

Q4/14

Q2/14

Q2/14

Q4/13

Q4/13

in the June issue of

IRN

– said: “It’s a pleasure to

have the time to fill in these questionnaires now the

market haspickedup!”

In summary, these are the pan-European headline

numbers from the first quarter of 2015 (all figures

expressed as percentages, some totals may not

equal 100%due to rounding):

■

Business conditions now: better 35.9%, same

47.6%, worse 16.5%, balance 19.4% (Q42014: 8.4)

■

Compared to a year ago: 37.8, 39.8. 22.4, 15.3

(18.8)

■

Full year compared to previous year: 51.5, 35.1,

13.4, 38.1 (37.0)

■

Forecast, year fromnow: 60.2, 31.6, 8.2, 52.0 (29.5)

■

Timeutilisation: 34.6, 44.4, 21.0, 13.6 (21.6)

■

Fleet investment this year: 35.4, 42.7, 22.0, 13.4

(6.4)

■

Fleet investment next year: 45.1, 40.2, 14.6, 30.5

(10.6)

■

Employment intentions: 31.0, 59.8, 9.2, 21.8 (13.9)

If Europe’s rental market in 2014 was the tale

of a north-south divide, this is reflected in the

respondents’ views of current business conditions,

though lessmarkedly that onemight have imagined.

Confidence

By far themost optimisticwere theNordic countries.

Nearly three-quarters of respondents felt that

business conditions were improving and only 9%

believed theyweregettingworse.

The confidence inNordic economieswas borne out

by activity during the quarter that included a €40

million deal for Ramirent as part of a prestigious

construction contract in Stockholm, and the recent

acquisitionof Rent City inKarlstadbyStavdal.

Germany was similar, with more than 90% split

equally between “improving” and “stable”. The UK,

despite a quarter that concluded with the start of

General Election campaigning, was more cautious,

withonly30% saying conditionsweregettingbetter.

In fact, the UK - historically one of the strongest

performers both in terms of rental business and

completing the survey - was one of the countries

with fewer responses this quarter, which gives the

confidence shown elsewhere in Europe greater

significance still.

Further towards the equator, half of Spanish

companies saidbusinesswas gettingbetter, perhaps

an inevitable conclusion given the downturn in

recent years.

However, despite similar conditions, France was

themost pessimisticcountry in the survey, with50%

in the “deteriorating” campandonly6%prepared to

suggest the corner hadbeen turned.

Of Italian respondents, 40% said conditions were

improving. Italy was the only major country where

no one believed business was getting worse - a

distinction shared by multinational companies, who

wereequally split between “improving” and “stable”.

The only country with no respondents who felt

business conditions were improving was Russia,

thoughas in the final quarterof 2014 thiswasa small

sample sizeand shouldbe treatedwith caution.

It was probably not surprising in the light of the

above that theNordiccountrieshad thebestopening

quarter compared to 2014 aswell. Indeed, theNordic

countrieswere theonlygroupwithmore thanhalf of

DoesEurope’snorth-southdivide reallyexist?

TABLE 2

BALANCEOFOPINIONONBUSINESS

CONDITIONS (ENDQ1, 2015)

(previousquarter inbrackets)

Nordic

64%

(51%)

Multinational

50%

(-34%)

Italy

40%

(TBC)

Spain

38%

(20%)

Germany

36%

(-13%)

UK/Ireland

20%

(50%)

All Europe

19%

(8%)

France

-44%

(-62%)

NOTE: Balanceof opinion=proportion seeing

improvement – proportion seeingworsening

conditions.

0

0

20

20

40

40

60

60

80

80

100

100

PERCENTAGEREPORTINGQ1 2015

GROWTHVSQ1 2014

(previousquarter inbrackets)

Multinationals

83%

(8%)

Nordic

64%

(32%)

UK

60%

(77%)

Italy

56%

(29%)

Spain

38%

(40%)

All Europe

38%

(40%)

Germany

30%

(57%)

France

0%

(23%)

PERCENTAGEWHICHWILLEMPLOY

MORE INQ22015

(previousquarter inbrackets)

UK/Ireland

70%

(65%)

Nordic

50%

(20%)

Multinational

46%

(18%)

Germany

44%

(14%)

All Europe

31%

(31%)

Spain

13%

(24%)

France

8%

(23%)

Italy

0%

(14%)

PERCENTAGEWITH INCREASING

UTILISATION INQ1 2015

(previousquarter inbrackets)

Nordic

70%

(51%)

Spain

50%

(50%)

Italy

43%

(14%)

Germany

38%

(83%)

All Europe

35%

(41%)

Multinational

30%

(18%)

UK/Ireland

30%

(81%)

France

0%

(18%)

PERCENTAGEEXPECTTO INCREASE

INVESTMENTBY >10% IN2015

(previousquarter opinion inbrackets)

Nordic

60%

(80%)

Germany

50%

(29%)

Multinational

44%

(

20%)

UK/Ireland

40%

(48%)

Spain

38%

(25%)

All Europe

35%

(31%)

Italy

29%

(14%)

France

0%

(18%)

0

0

20

20

40

40

60

60

80

80

100

100

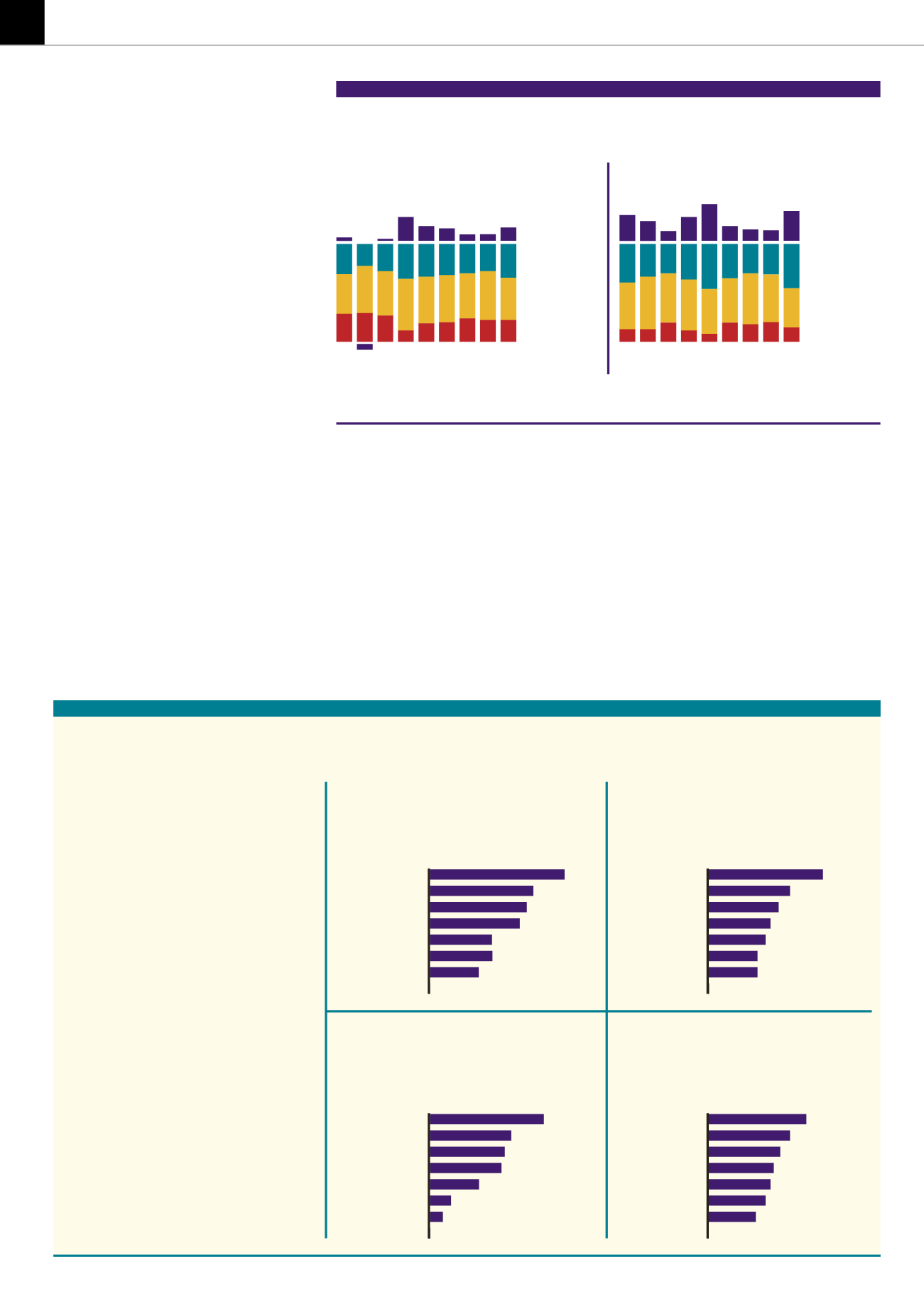

How countries differ on key

indicators in the survey (all

figures in percentages)