IRNAPRIL-MAY 2015

21

ERA/

IRN

RENTALTRACKER

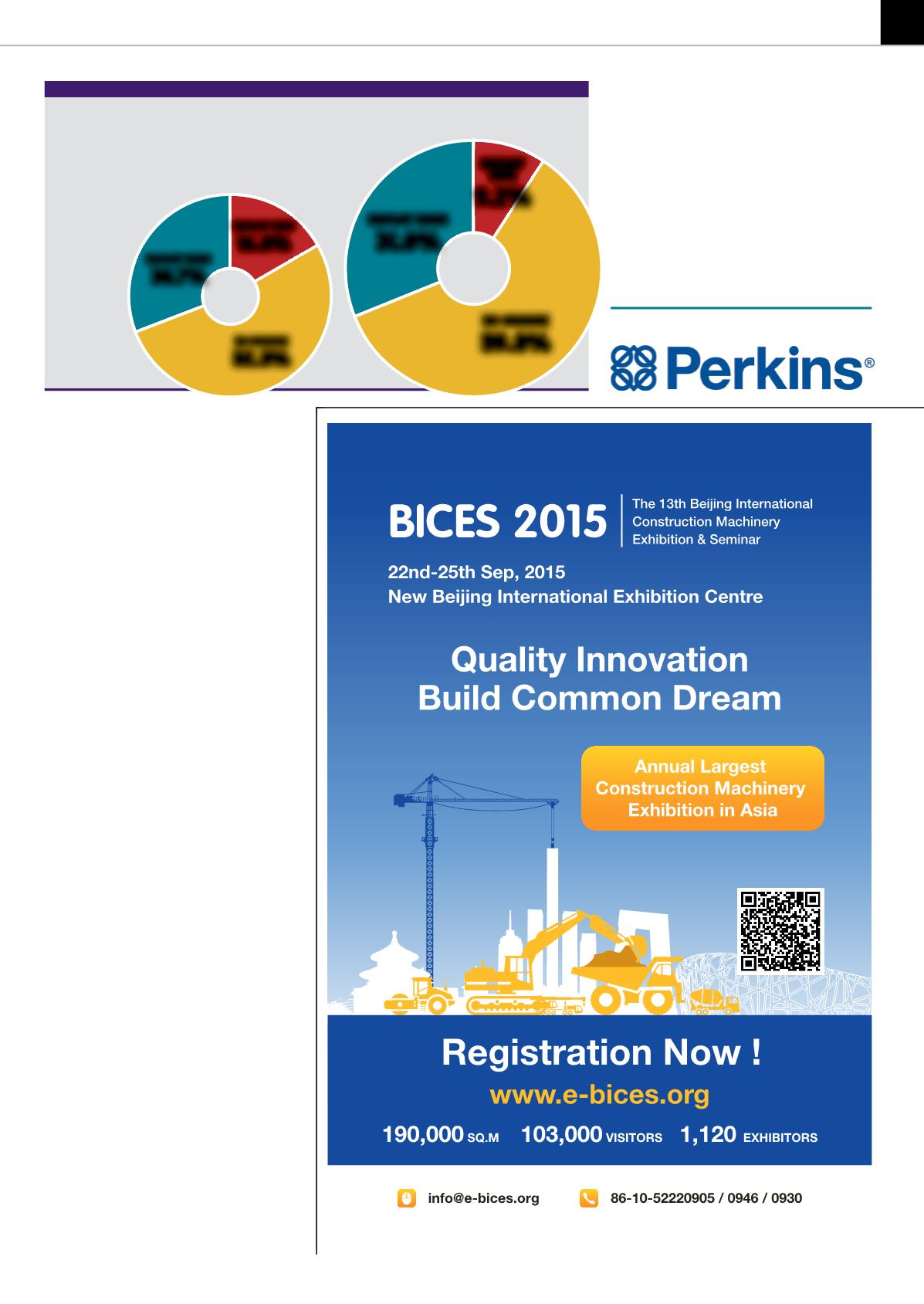

Europe: Employment

intentions fornext

quarter

FIGURE4

Asked end of

Q

1 2015

Asked

end of

Q

4 2014

respondents reporting an improvement in business

activityofmore than 10%.

Taking minimum growth of 5% as the benchmark,

Italy had the second best result. Perhaps fittingly

in a year when it will host the European Rental

Association Convention and Awards, more than 60%

of Italian companies who took part in the survey

reported this level of improvement. The UK was

third, though most of its companies’ growth was

between5and 10%, highlightingacautiousapproach

influenced by economic fluctuations in the country

in recent years. Francewas the only countrywith no

respondentsclaiminganynetgrowthat all compared

to theprevious year.

Expectations

In terms of individual countries, Germany showed

the biggest difference between its experience in the

openingquarter and itsexpectations for the full year

of 2015. Whereas less than a third of companies felt

they were currently doing more business than last

year – a smaller percentage than anywhere except

France or Russia - more than half said this would be

the caseat theyear end.

The Nordic countries also showed increased

confidence, from 64% reporting current growth of

at least 5% to 82% expecting it further down the

line. In absolute terms, the UK’s return was exactly

the same for both questions, but the year end total

was three timesashigh in thecategory for growthof

10%or greater.

In possibly the most reliable indicator, more than

70% of multinationals expected increased growth

later in the year, and none of the multinational

respondents thought business would be any worse

than “stable”.

This was repeated in the question on business

levels as a whole in 12months time, withmore than

four out of every five respondents saying itwouldbe

at least 5% higher. All German, Italian and Spanish

respondents believed growth would be at least

stable, though no Spanish companies felt confident

enough topredict growthofmore than 10%.

Taking time utilisation as the yardstick, companies

in most countries expect it to remain as it is now,

give or take 5%, despite their increasing confidence

about business levels.

“Stable” accounted for the biggest single level of

response from all countries except theNordic region

and Spain, and more than half the total responses

from the UK and multinational companies. Perhaps

with this in mind, intentions with regard to fleet

investment appear relatively low key for the rest

of this year before a surge in 2016 when 70% of UK

companies, half of Nordic companies and almost as

manyGermansandmultinationalsexpect to increase

fleet investment by more than 25%, and even the

vast majority of companies in the troubled French

and Spanish markets will be looking to make fleet

investment invaryingdegrees.

For the rest of 2015, however, the trend looks to

be towards a calmer approach. Maybe the rental

industry needs another quarter or two like the one

just gone before it can finally start to believe that

themarket’s recovery is a reality.

IRN

Sponsored by:

EMPLOYMORE

30.7%

EMPLOY LESS

16.8%

NOCHANGE

52.5%

EMPLOYMORE

31.0%

EMPLOY

LESS

9.2%

NOCHANGE

59.8%