7

NEWS

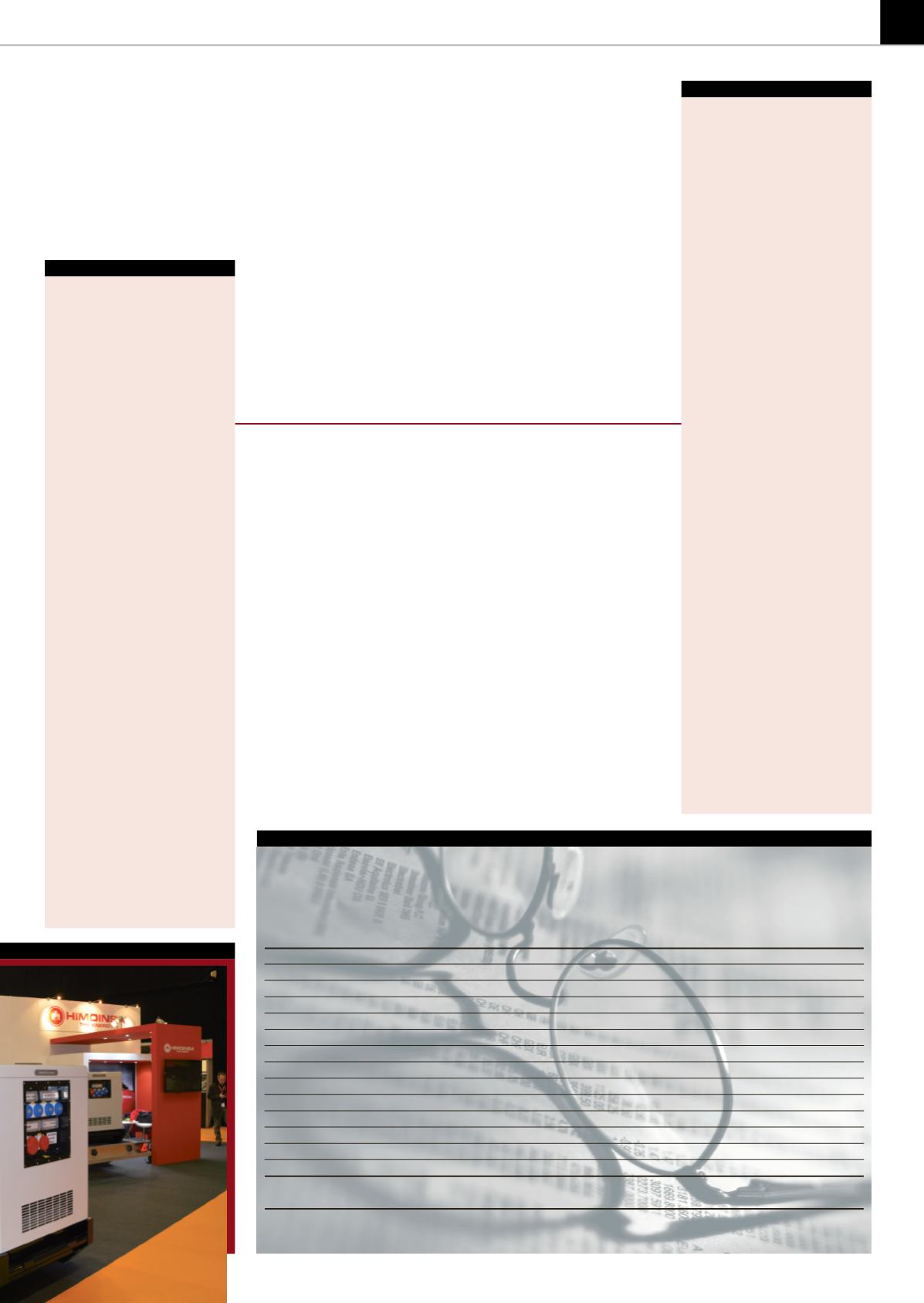

SHARE PRICES

Start date Previousmth

Currentmth

% change

COMPANY

11/1/06

18/02/15

30/04/15

Acces Industrie (France)

€

0.47

2.96

2.36

-20.3%

Aggreko (UK)

£

2.75

16.79

16.48

-1.9%

Ashtead Group (UK/US)

UK£

1.83

11.11

11.21

+1.0%

Boom Logistics (Australia)

A$

3.70

0.13

0.11

0%

Cramo (Fin)

€

13.0

14.50

16.65

+14.8%

GAM SA (Spain)

€

8.00

0.34

0.37

0%

GL events (France)

€

29.96

17.74

19.40

+9.3%

H&E Equipment

US$

–

23.63

24.72

+4.6%

Kanamoto

Yen

–

3020

3515

+16.4%

Lavendon (UK)

UK£

2.20

1.64

1.74

+0.6%

MobileMini (US)

US$

46.2

41.65

38.54

-7.5%

Ramirent (Finland)

€

23.43

7.13

6.87

-3.6%

SpeedyHire (UK)

UK£

8.32

0.69

0.73

+5.8%

United Rentals (US)

US$

24.9

95.03

96.58

+1.6%

IRN

INDEX

100.0 322.2

328.92

+2.7%

Note: The index is basedonaggregate changes inmarket values of the companies in the list.

The initial index valueof 100 is basedon values on 11 January 2006.

IRN

Rental Share Index

IRNAPRIL-MAY 2015

Kiloutou in

Spainpurchase

France’s Kiloutou group has

entered the Spanish market for

the first time with the acquisition

of theRentecnikaequipment rental

business.

The move by the €450 million

turnover rental company follows

an acquisition in Poland last year

that took its network of agents

past the400mark.

Founded in 1994, Rentecnika

operates out of Barcelona and

Madrid with a rental fleet of

around 5,000. Its customers range

from large building companies

through small and medium-sized

businesses toprivate individuals.

Kiloutou chief executive officer

Xavier du Boys said the company’s

aim was to become one of the

major players inSpain.

“This acquisition is an important

step in our development and

confirms our ambitions abroad.

Rentecnika’s positioning in terms

of products and agency format is

perfect for the changing Spanish

market.”

Santiago del Solar, chairman

of Rentecnika, added: “This will

enable us to accelerate our

development and be able to grasp

many business opportunities as

theSpanishmarket recovers.”

■

Netherlands-based telehandler

and access rental specialist Riwal

has signed a five-year framework

agreement for long term rentalwith

Prangl, a renter of mobile cranes

and aerial work platforms across

Austria and eastern Europe. Prangl

head of business development

Markus Reitermayer said: “We

consider rental as an interesting

alternative to purchasing

equipment and we have made a

well informed decision choosing

Riwal.” Part of the agreement is a

three-year rental deal for 79 JLG

aerial work platforms comprising

electric and diesel scissor lifts,

electric booms and telehandlers.

Prangl will rent the machines to

customer is Hungary, Romania,

Bulgaria, Slovakia and the Czech

Republic.

■

Spanish rental company GAM

has signed an agreement with 11

financial institutions to restructure

its debt. A statement said the deal

reduced its debt to €120 million.

The financial institutions involved

accounted for 92% of GAM’s total

liabilities. The statement continued:

“The company has, through this

agreement, strengthened its

balance and remarkably improved

the situation of its assets. This

will allow it face the future with

confidence and to develop its

business in a more efficient way.”

The business had been adversely

affected by conditions in its

domestic construction market,

which contributed to a 14% fall in

revenues in2014 to€104million.

HIGHLIGHTS

Loxam entersSouthAmerica

with investment inDegraus

France’s Loxam has acquired an

initial 25% share of Brazilian rental

companyDegraus, which isoneof the

top five rental companies in Brazil

with 20 locations and450 employees.

The deal entails a capital increase at

Degraus, allowing it to strengthen its

position in Brazil’s rental market.

Degraus, founded in 1987, is a

general equipment rental company

with a strong presence in the state

of Sao Paulo, as well as the states of

Rio de Janeiro, Recife, Salvador and

PortoAlegre.

This will be Loxam’s first venture

intomarketsoutsideof Europe,where

it already operates in 13 countries. Its

business is still dominated by France,

which generated 80% of total group

sales in 2014.

Izaac Costa, founder or Degraus

as well as its majority shareholder,

chairman and CEO, will remain as

general manager of the company.

Loxammanaging director Stéphane

Henon talks about the move

into Brazil, as well as last year's

acquisitions in Europe, in a special

IRN interview on page 15.

Danish equity fund forms

‘largest rental company’

The private equity fund CataCap,

togetherwithpension fundDanicaand

French Access Capital Partners, has

acquiredandmerged twoofDenmark’s

leading equipment rental companies,

GSV Materieludlejning and Pitzner

Materiel.

Together thecompanies forma “one-

stop shop” and account for nearly

one-fifth of the DKK 3 billion (€402

million) rental market for construction

equipment inDenmark.

CataCap will become the majority

shareholder in the combined company,

which continues under the name

GSV Materieludlejning. GSV senior

managementwill step inas co-owners.

”We’ve had our eyes set on the

very fragmented equipment rental

market in Denmark for a long time,”

said CataCap partner Vilhelm Hahn-

Petersen.

“While GSV has delivered strong

topline growth and earnings through

a sharp focus on customers and

products, Pitzner has optimized

earnings by implementing one of

the industry’s most advanced fleet

management systemsduring the same

period,”headded.

Pitzner said the new companywould

have a market share of 18%, taking it

above the 11%currentlyheldbyFrench

company Loxam.