15

SEPTEMBER 2013

ACT

BUSINESS NEWS

AUTHOR:

CHRIS SLEIGHT

is one of

the world’s most internationally

renowned construction

business writers, with

specialist expertise in financial

markets and stock market

analysis. He is editor of KHL’s

market-leading

International

Construction

and is a regular

contributor to

ACT’

s

sister publication,

International Cranes

and Specialized

Transport

.

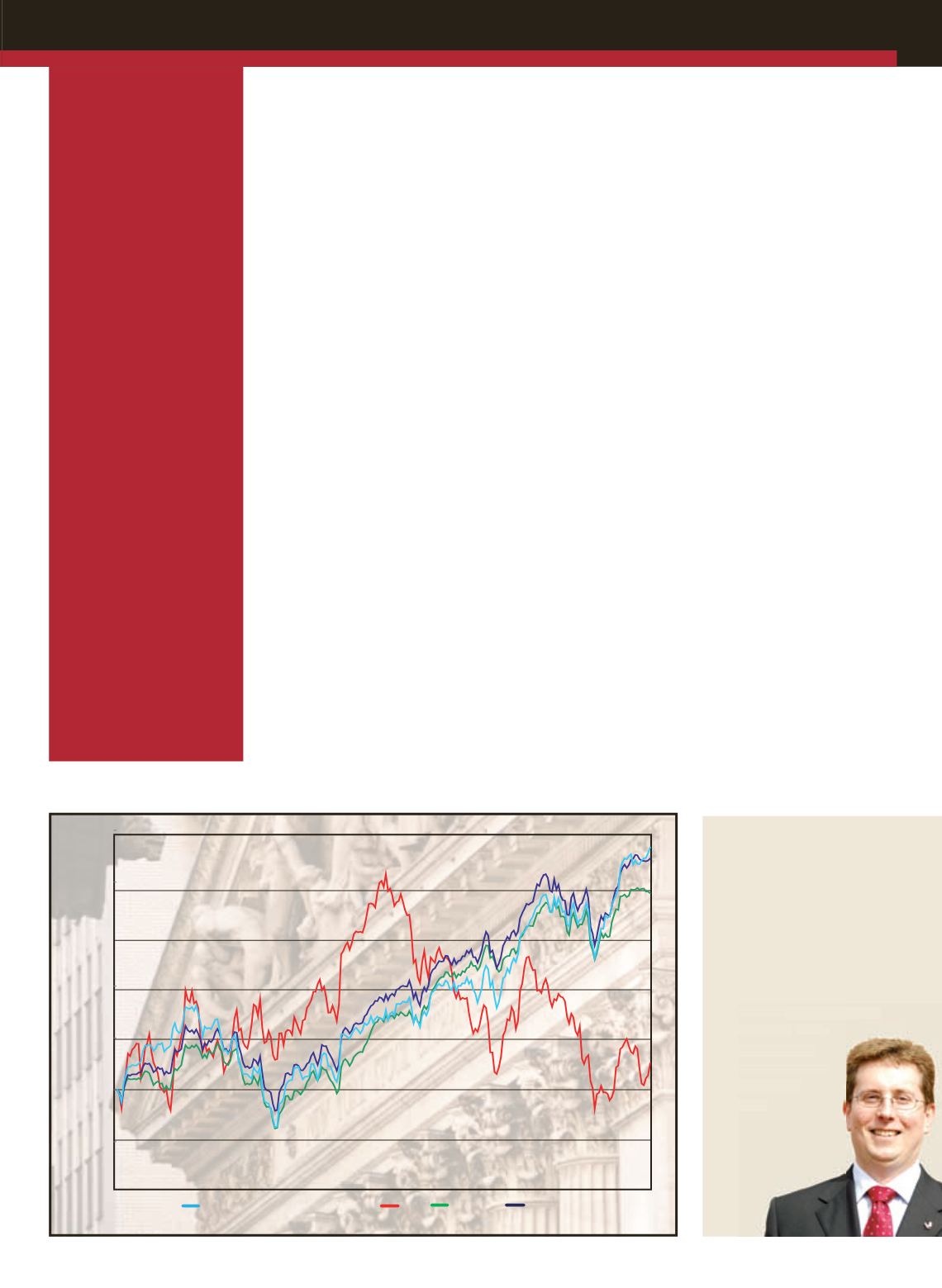

The mainstream

market indices

continued to fly

high through

the mid-summer

period, while the

heavy equipment

sector continued

to weaken.

Chris

Sleight

reports

T

he Dow continued

to set record highs

throughout July

and August, and remained

well above the unprecedented

15,000-point mark for much

of the mid-summer period. Its

new found growth, and that

of other benchmarks like the

NASDAQ and S&P 500, came

as investors shrugged off any

fears about the tapering off of

quantitative easing – the Fed’s

policy of ‘printing money’ to

boost the economy.

No net gains

In contrast to the gains of

20 percent or more seen by

these indicators over the last

12 months, the

ACT

Heavy

Equipment Index (HEI)

continued to fall over the

summer. By late August it was

back to where it was a year

ago, with no net gains and no

clear trajectory.

This separation of fortunes

dates back to around the

start of 2013, and reflects the

different drivers for blue-

chip stocks and benchmark

indicators, compared to the

equipment industry.

As impressive as the Dow’s

growth has been, it does not

seem to be warranted by the

current economic picture.

Although the recovery has

taken root, it looks a little

tepid – GDP growth will be

about 2 percent this year,

and unemployment is taking

time to fall. Hardly the

conditions you would expect

to herald record stock market

valuations.

The most likely explanation

is that the Dow and other

well-known indicators

have become the new safe

haven for investors. The

price of gold is in decline,

and the low interest rate

environment means bonds

are not particularly attractive.

Although equities offer more

risk, blue-chips are seen as

relatively safe, and offer a

steady return on investment

through dividends.

In contrast, the heavy

equipment sector’s

performance reflects the

ACT Heavy Equipment Index (HEI)

DOW

NASDAQ

S&P 500

25%

20%

15%

10%

5%

0%

-5%

-10%

% change

52 weeks to August 2013

challenging year being

experienced on global

equipment markets. The

buoyancy has gone out of

many emerging countries

– most notably China–

and economic growth in

developed parts of the world

is not yet strong enough to fill

the void.

Global reflections

As a result, sales and profits

for the industry this year have

been lackluster, and most

manufacturers are looking

to late 2013 or into 2014 for

the situation to improve. The

performance of the ACT HEI

is a reflection of this.

So while it looks like the

ACT

HEI is somehow missing

out on the wider stock market

rally, it is arguably the case

that this index is a fairer

reflection of global conditions

in the industry. The rally is

due more to investors’ need

for a safe haven for their

funds at a time when the more

traditional destinations are

not looking attractive.

■

ACT’

s Heavy Equipment Index

(HEI) tracks the performance

of eight of America’s most

significant, publicly-traded

construction equipment

manufacturers – Astec

Industries, Caterpillar, CNH,

Deere & Company, Joy Global,

Manitowoc and Terex.

Rally retreats