CONFIDENCE SURVEY

15

NOVEMBER-DECEMBER 2013

access

INTERNATIONAL

optimism in the 2013 Confidence Survey, and

a belief that overall things are moving, at least

steadily, in the right direction. Although, there

is no doubt that those operating in Southern

Europe may answer the ‘how confident?’

question in a very different way to others

based in Northern Europe; then it would

be different again for companies in North

America, South America, Asia Pacific and

so on.

Growth prospects

While confidence is up overall, there is also

a distinct feeling of cautiousness reflected in

this year’s survey, perhaps even more so than

in the results from last year. Looking at the

overall growth prospects for manufacturers/

distributors, rental companies and end users

combined, the figures are remarkably similar

to last year’s survey results. Slightly more

participants are expecting growth in 2014 than

>

80%

70%

60%

50%

40%

30%

20%

10%

0%

80%

70%

60%

50%

40%

30%

20%

10%

0%

80%

70%

60%

50%

40%

30%

20%

10%

0%

80%

70%

60%

50%

40%

30%

20%

10%

0%

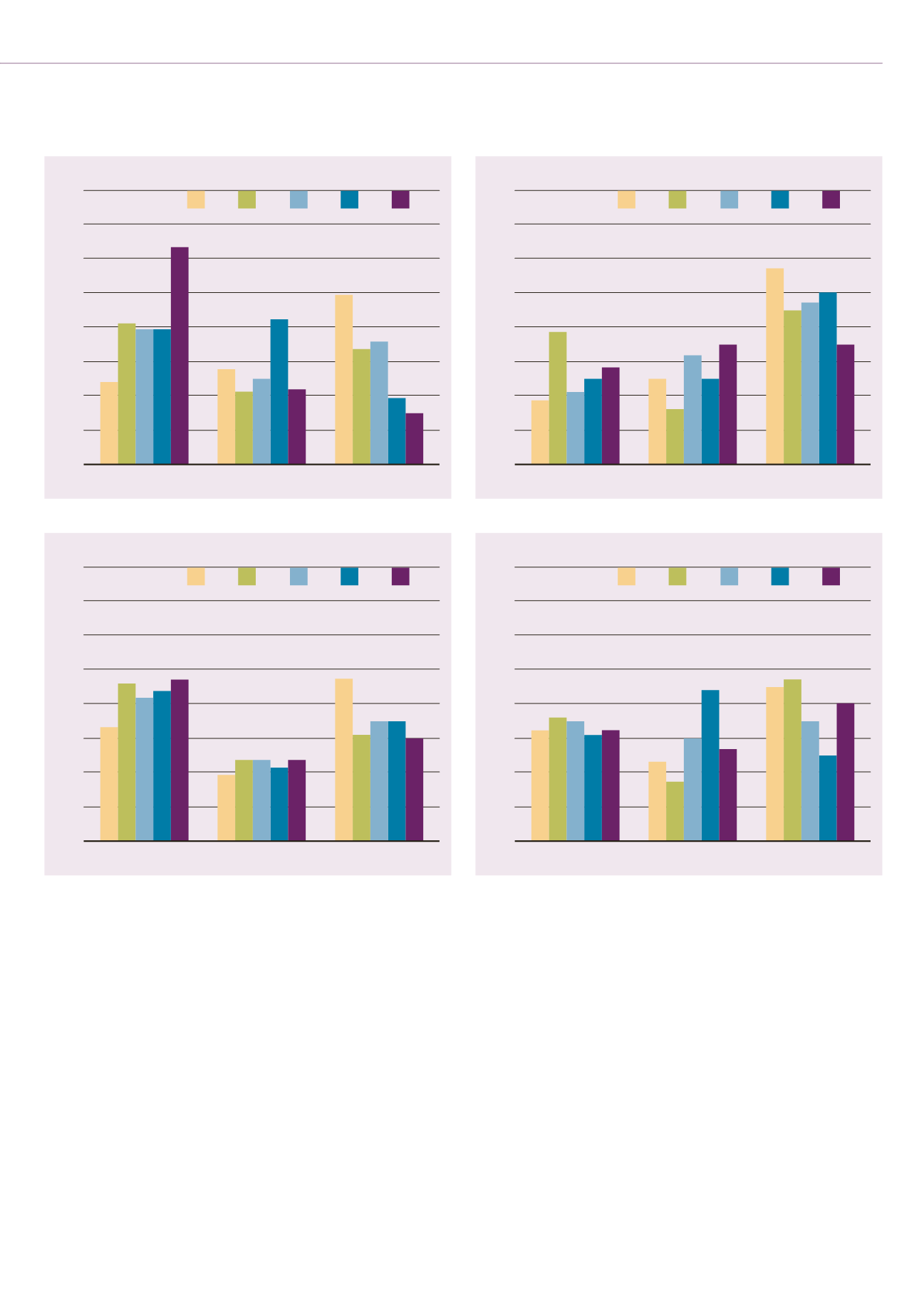

Will grow

fleet

Replacement

only

No purchasing

plans

46

42 44

47

33

31

35 35

30

47

23 23

23

21

19

RENTAL COMPANIES

USED MACHINES

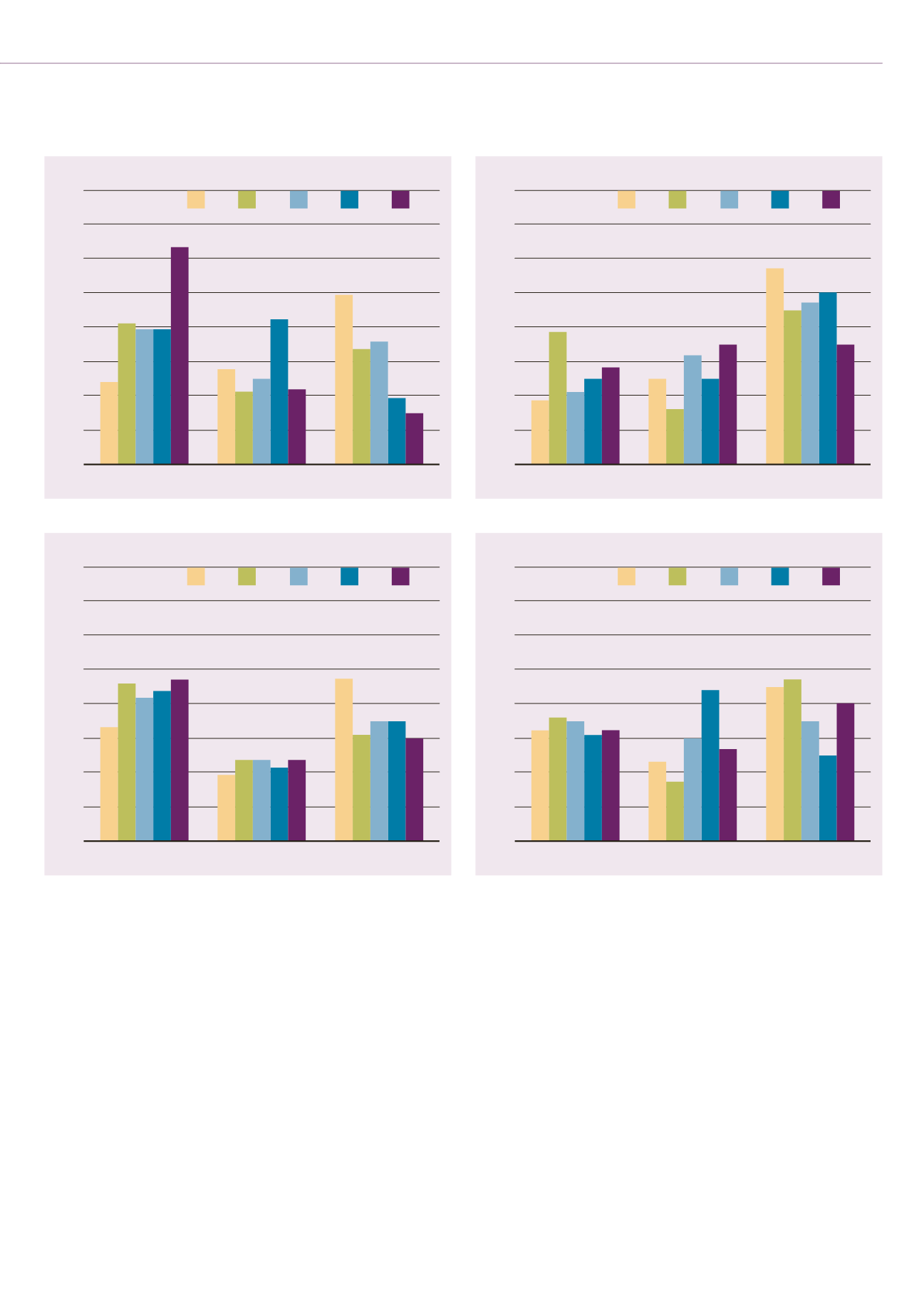

Will grow

fleet

Replacement

only

No purchasing

plans

36 35

31 33

32

47

35

25

40

45

17

30

44

27

END-USERS

USED MACHINES

Will grow

fleet

Replacement

only

No purchasing

plans

41 39

63

39

33 36

19

24

15

49

21

25

42

22

27

RENTAL COMPANIES

NEW MACHINES

Will grow

fleet

Replacement

only

No purchasing

plans

38

21

25

28

18

45

47

35

50

57

16

32

35

25

END-USERS

NEW MACHINES

2014 INVESTMENT PLANS

23

25

2010 2011 2012 2013 2014

2010 2011 2012 2013 2014

2010 2011 2012 2013 2014

2010 2011 2012 2013 2014

>

in 2013, while some 4% less are forecasting no

growth; those pointing to a decline number

about the same as last year.

Breaking down those results for the

manufacturers, rental companies and end

users individually there is an increased level

of positivity when it comes to purchasing

plans or sales expectations. For example, 63%

of rental companies worldwide say they will

grow their fleet, compared to 39% in last year’s

survey. Just 15%, down from 19%, are planning

replacement only compared to last year.

The overall positive numbers are brought

down somewhat by the manufacturers/

distributors, who are are expecting a mixed

year ahead.Those predicting more than 10%

sales growth are markedly up by 7%, but

there is a significant drop in those forecasting

1 – 10% growth from 55% last year to 39%

this year. Working along that table, 12.3%

are looking at 0 – 10% declines, compared to