INTERVIEW

10

access

INTERNATIONAL

NOVEMBER-DECEMBER 2013

is traction for this idea that more and more

companies in North America are looking at

rental versus capitalising equipment, so that

whole trend seems to be driving growth.”

Mr Boehler sees a number of avenues for

Skyjack to continue on its upward trend,

including opportunities in Japan, Korea, China

and Brazil.

International markets

Skyjack has a “huge” fleet of used equipment in

Korea, Mr Boehler says. “The used equipment

market in Korea has traditionally been big and

we know there’s a large number of Skyjack

units that live and work in that marketplace

today.”

Around Bauma 2013, Skyjack brought

on Simon Cracknell as its new director of

business development in Asia. Mr Cracknell

previously worked with JLG Industries, Inc.

as its senior director of sales and customer

support for Northern Europe, but also lived

in Singapore for a number of months on

assignment from JLG.

“We hired Simon there to help us in that

marketplace and help us understand if we

could and should be there,”Mr Boehler says.

“We’re looking to see whether or not we’re

going to open a company store there.”

Mr Boehler and his team want better

representation in Korea while considering

if they should sell new equipment into the

country. Korea is rich with ship building,

construction manufacturers, car manufacturers

and other global entities; there’s a large

manufacturing base established in the country.

Skyjack has had contract representation in

Korea for quite some time (Cracknell focuses

more on other regions), but the market’s

dominance with used equipment versus new

equipment might not justify having boots on

the ground.

“When you look at the used market, though,

we can funnel our equipment there and we

can capture a lot of parts sales,”Mr Boehler

says. “Those two things – parts and better

representation – mean we will do something in

Korea in the not-so-distant future.”

Also on the boiler for Skyjack is more

activity in China and Japan.

“China is a struggle,”Mr Boehler says. “It’s

all about figuring out who can sell what in

China.”

Skyjack is looking at potential plans for

its involvement in China, but they’re not on

the cusp of opening a manufacturing facility

there, despite synergies with parent company

Linamar.

“Linamar has a manufacturing facility there

today and they’re building another, which is

going to open soon,”Mr Boehler says. “We

have a foot in the door, meaning we have

technical people on the ground and we have

manufacturing on the ground. We are buying

things from certain vendors in China today

and I think as we continue that process, it’s a

matter of doing the right things.

“We ensure our suppliers are meeting

standards – supplying us with good products

on time.

“As we develop, and once we have a local

supply chain we can deepen there, that’s the

first step into the manufacturing environment.”

And that’s not the only place Skyjack wants

to put its toes; the company is also looking to

grow in Japan.

“We’re looking at new products, new

markets and looking to expand the customer

Brad Boehler

, president of

Skyjack talks to

Lindsey

Anderson

about the

different challenges faced

in markets around the

world, and the company’s

programme of expansion.

S

kyjack is ending 2013 with a bang.The

company reported strong growth and

an overall positive first half of 2013;

with revenues of US$320.3 million for the first

six months, up 10.5% over the same period last

year. Operating profits were US$39.3 million,

up a healthy 82.8% due to strong sales of

access equipment.The Canada-based company

also celebrated its first year anniversary in

Brazil; manufactured its 250000th machine;

started a quest to find the oldest Skyjack

working scissor lift; and opened two sales and

service centres in Scandinavia and Germany.

One would think Skyjack’s parent company,

Linamar, would be satisfied with its progress –

and it is – but it’s also anxiously awaiting 2014.

“The rental industry hasn’t backfilled all the

non-activity they had for two and a half years,

so there’s still aged fleet out there and there’s

still fleet replacement to be had, let alone

real growth,” says Brad Boehler, president,

Skyjack. “We will have growth next year.There

World view

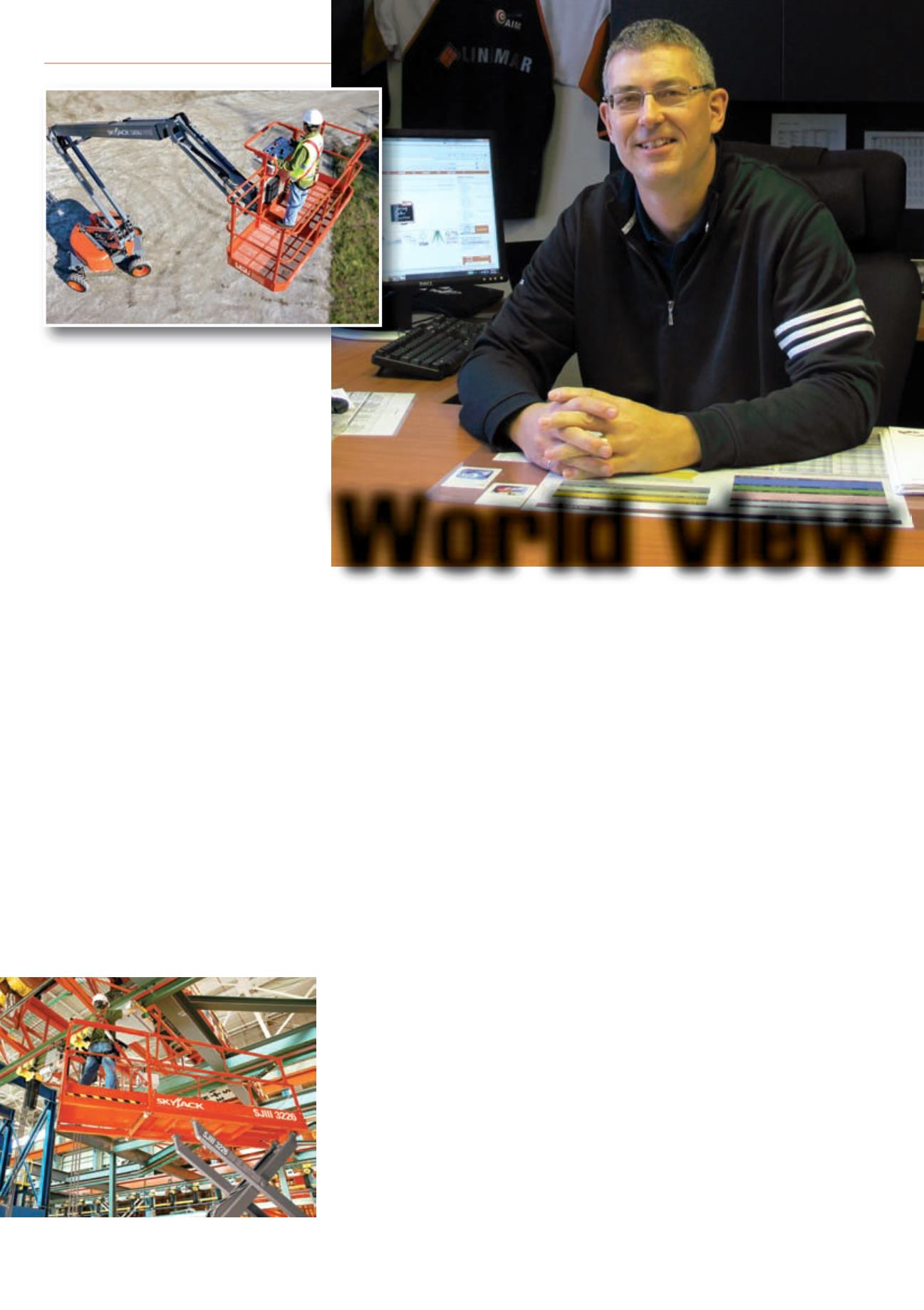

Brad Boehler,

president of Skyjack.

Skyjack SJ111 3226 scissor

in industrial setting

Skayjack SJ63AJ boom