CONFIDENCE SURVEY

2.6% last year, and 7% predict more than 10%

declines, compared to nearly 3% the previous

year.

These figures may represent a slightly more

realistic view of the market compared to last

year, and a sense that in emerging markets,

for example, like Brazil and China, there is

great opportunity but still many challenges

hindering sustained growth.

It’s also worth remembering that the

confidence level of 65.4%, mentioned in the

first paragraph, is based on prospects for the

next five years, while the other tables in this

survey concentrate on the next 12 months.

Regionally, the comments made by

participants reflect the same mixed view.

Even in North America, where the story has

been unequivocally positive over the last 18

months, comments from the continent about

the year ahead range from; “Expectations

are that aerial platforms will continue to

have growth opportunities for several years.

Increases in our fleet should remain consistent

into 2014,” to, “Cost pressures will increase,”

and, “it will remain static.”

Let’s not be too pessimistic however; the

regional figures promising strong growth

in North America are much higher than

those suggesting the opposite. Nevertheless,

participants expecting a 1% – 10% decline

represent 9% of those taking part, compared to

2% last year. It is possible, of course, that this

slight drop in confidence simply represents

a strong market, where those taking part are

starting from a higher base than last year.

Regional variations

In Europe the comments are also mixed in

tone, but the overall mood is improving. We

all know that market conditions are radically

different when comparing countries in

the south of Europe to those in the north,

generally speaking. In light of this, it is not

as easy to make a sweeping statement about

Europe as it is for North America.

“It is clear that the crisis has passed in

Europe. Business (construction and industrial)

is growing and this growth will be very fast in

2014-2015 and reasonable in 2015-2017,” says

one participant – it’s a sentiment shared by a

good number of others.

On the side of the coin: “Still suicidal

bidding going on in spite of plenty of work

available for all,” and, “It will remain at 2013

levels, no growth.”

The figures bear this out. Confidence is

about the same as last year among those who

operate in Europe. Expectations for more than

10% growth are up a smidgen at 17.6%, while

those predicting 1% – 10% growth are down

marginally at 35%.Those looking at no growth

number the same as last year at 28%, and

overall those looking at declines are basically

the same too.The message is; growth is on

the horizon, but it certainly won’t happen

in all parts of Europe and the market is still

wavering in others.

In Australia and New Zealand those

expecting growth next year are significantly

16

access

INTERNATIONAL

NOVEMBER-DECEMBER 2013

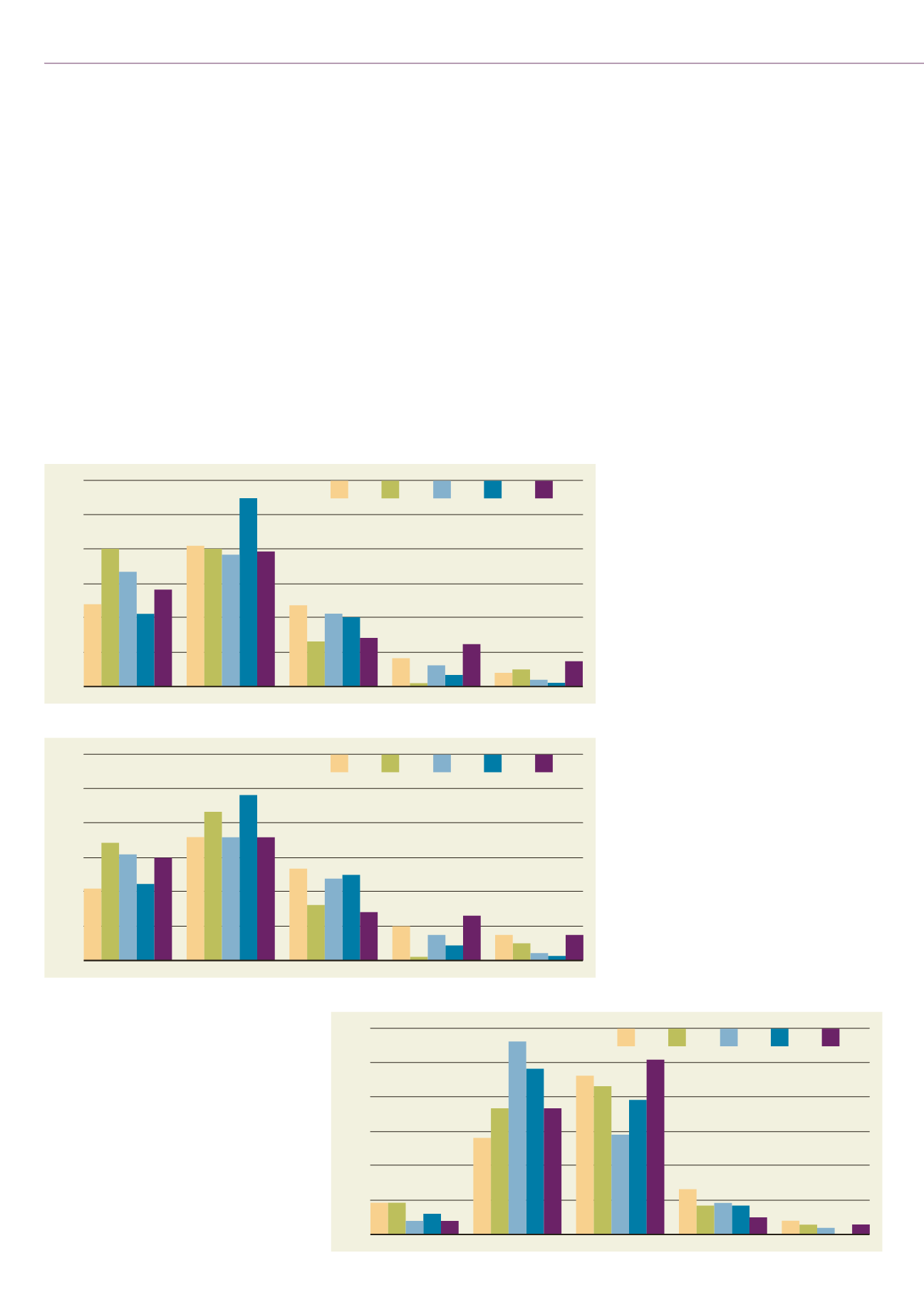

2014 SALES PREDICTIONS

2014 PRODUCTION LEVELS

2014 PRICE CHANGES

60%

50%

40%

30%

20%

10%

0%

>10% growth 0-10% growth No growth 0-10% decline >10% decline

40

33

21

28

23

13

21 20

24

14

55

38

41

39

1

60%

50%

40%

30%

20%

10%

0%

>10% growth 0-10% growth No growth 0-10% decline >10% decline

34

31

22

16

25

14

24

26

43

36 36 36

60%

50%

40%

30%

20%

10%

0%

>10% growth 0-10% growth No growth 0-10% decline >10% decline

9 9

4 46

29

39

51

46

43

37

37

56

48

30

21

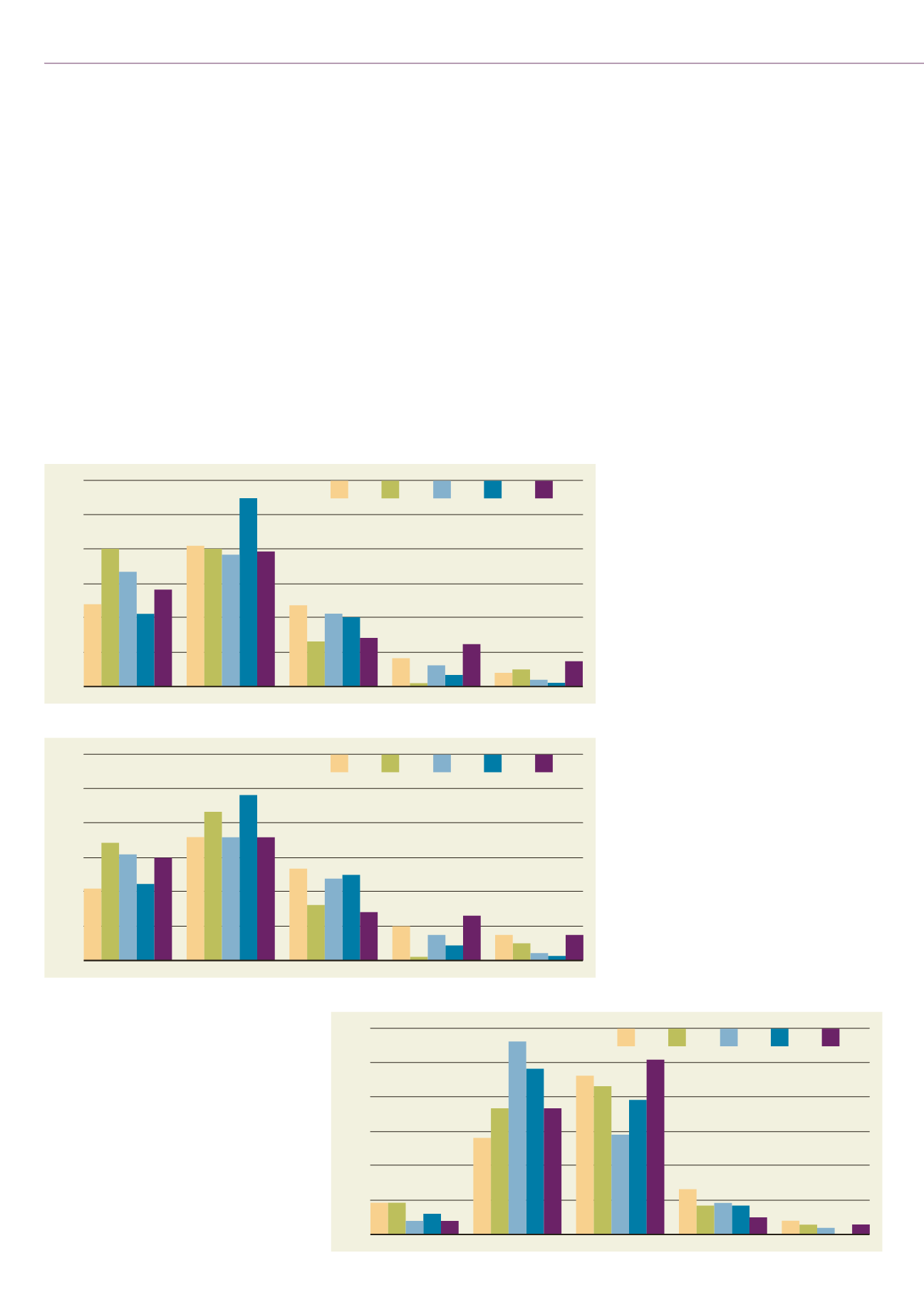

WHAT DO SUPPLIERS THINK?

48

4

13

10

1

7

89

28

40

12

3

5

8

12

7

4

7

7

12

8

4 5

13

2010 2011 2012 2013 2014

2010 2011 2012 2013 2014

2010 2011 2012 2013 2014

6

5

3

3 2